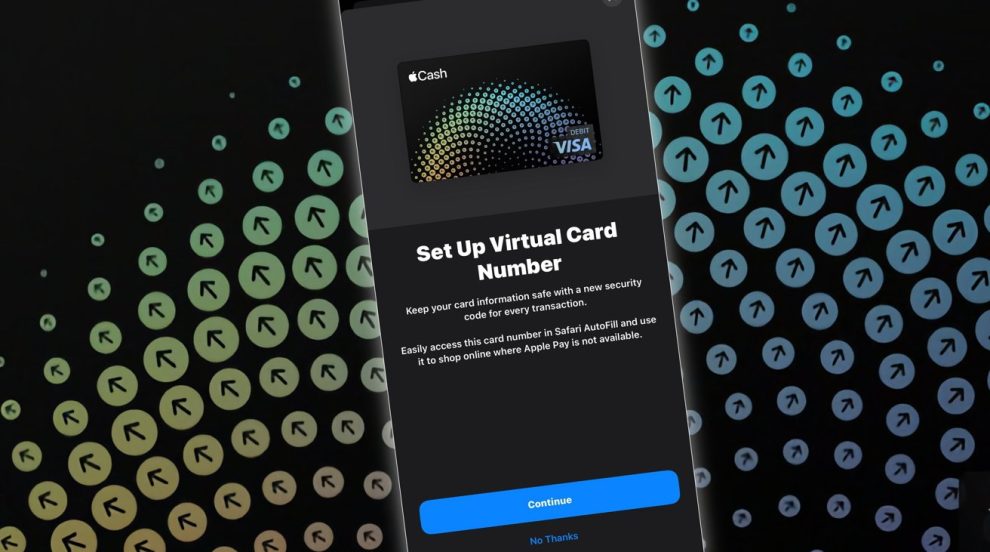

Apple Cash has just taken a significant leap forward. With the release of iOS 17.4, Apple’s built-in digital wallet now supports virtual card numbers, a feature that promises to revolutionize the way we shop online. This innovative addition not only enhances security but also expands the scope of Apple Cash, making it a more versatile and attractive option for managing your finances.

Apple Cash: The Journey So Far

Launched in 2014, Apple Cash has been a convenient tool for iPhone users to send and receive money. Integrated seamlessly into the Messages app and the Wallet app, it allows quick and easy peer-to-peer transactions. Whether you’re splitting a restaurant bill with friends, paying back a colleague for coffee, or receiving birthday money from grandma, Apple Cash has made the process as simple as a few taps on your iPhone.

However, despite its convenience for person-to-person payments, Apple Cash has had some limitations when it comes to online shopping. While it has worked well for in-app purchases and websites that accept Apple Pay, many online retailers have remained out of reach. This has meant that users often had to fall back on traditional debit or credit cards, which can come with their own security risks.

The Power of Virtual Card Numbers

iOS 17.4 aims to change all that with the introduction of virtual card numbers for Apple Cash. These unique, temporary numbers function like a regular debit card number when making online purchases, but with a crucial difference – they are not directly linked to your physical debit card or your main Apple Cash balance.

Here’s how it works: when you request a virtual card number through the Wallet app, Apple generates a unique number, complete with expiration date and CVV code. You use this virtual number to make your online purchase, just as you would with a regular debit card. The key difference is that the merchant never sees your real debit card number or has direct access to your Apple Cash balance.

This separation provides a significant security boost. In the event that the merchant experiences a data breach or security compromise, your actual financial information remains safe. The virtual card number acts as a disposable shield, protecting your real account details.

The Benefits for Apple Cash Users

The arrival of virtual card numbers is a game-changer for Apple Cash users, offering several significant benefits:

- Enhanced Security: The added layer of protection provided by virtual numbers significantly reduces the risk of fraud and unauthorized transactions. Even if a virtual number is compromised, your main Apple Cash balance remains secure.

- Expanded Shopping Options: With virtual numbers, Apple Cash can now be used at virtually any online retailer, not just those that accept Apple Pay. This greatly expands the utility and flexibility of your Apple Cash balance.

- Budgeting and Tracking: Virtual numbers can be a handy tool for budgeting and expense tracking. You can request a new number for each online purchase, making it easier to monitor your spending and stick to your budget.

These advantages position Apple Cash as a more comprehensive and competitive player in the digital payment landscape. With its focus on security and expanding functionality, it’s an increasingly attractive option for managing your day-to-day financial transactions.

How to Use Virtual Card Numbers with Apple Cash

Using virtual card numbers with Apple Cash is designed to be straightforward and user-friendly. Here’s a step-by-step guide:

- Open the Wallet app on your iPhone (you must be running iOS 17.4 or later).

- Tap on your Apple Cash card.

- Look for the “Request Virtual Card Number” option. This may be in a menu or directly on the screen.

- Tap this option and follow the prompts. You may need to authenticate with Face ID or Touch ID.

- Apple will generate a unique virtual card number for you, along with an expiration date and CVV code. This information will be displayed in the Wallet app.

- When you’re ready to make your online purchase, simply enter the virtual card number and related details at checkout, just as you would with a regular debit card.

- Once your purchase is complete, the virtual number will be automatically deactivated, adding an extra layer of security.

It’s important to note that each virtual number can only be used once. For each new online purchase, you’ll need to request a new virtual number. While this may seem like an extra step, it’s a crucial part of the enhanced security model.

Things to Keep in Mind

While virtual card numbers offer significant benefits, there are a few things to be aware of:

- Transaction Limits: Apple Cash has transaction limits, and these apply to virtual card number purchases as well. Be sure to check your limits in the Wallet app.

- Not for Recurring Payments: Because virtual numbers are single-use and automatically deactivated, they’re not suitable for recurring subscriptions or any service that requires you to keep a card on file.

- U.S. Only (For Now): At launch, virtual card numbers for Apple Cash are only available for transactions within the United States. International support may come in future updates.

Despite these limitations, the introduction of virtual card numbers is a significant step forward for Apple Cash, addressing a major pain point and broadening its usefulness for secure online shopping.

The Future of Apple Cash

As digital wallets continue to evolve and grow in popularity, Apple Cash is well-positioned to be a leader in this space. The addition of virtual card numbers demonstrates Apple’s commitment to enhancing security and expanding the capabilities of its digital payment platform.

Looking ahead, there are many exciting possibilities for Apple Cash. Some potential future developments could include:

- Integration with budgeting and financial planning tools

- Expanded international support for virtual card numbers

- Partnerships with major retailers for exclusive discounts and promotions

- Incorporation of loyalty programs and rewards directly into the Apple Cash ecosystem

As Apple continues to innovate and refine Apple Cash, it’s likely that we’ll see it become an even more comprehensive and compelling solution for digital payments and financial management.

Conclusion

The introduction of virtual card numbers for Apple Cash in iOS 17.4 is a significant milestone. It addresses a major limitation of the platform, enhances security for online shopping, and positions Apple Cash as a more versatile and competitive digital payment option.

As more and more of our financial lives move digital, tools like Apple Cash with virtual card numbers will become increasingly essential. They offer a balance of convenience and security, empowering users to shop online with confidence and manage their money more effectively.

If you’re an iPhone user, it’s worth taking the time to explore this new feature. Request a virtual card number for your next online purchase and see for yourself how Apple Cash is evolving to meet the needs of the modern, digital-first consumer. Welcome to the future of secure online shopping with Apple Cash.

Add Comment