The once-heralded millimeter wave (mmWave) spectrum market is experiencing a dramatic downturn, with major telecommunications companies facing significant losses on their multi-billion dollar investments in what was previously touted as the future of 5G technology. This shift marks a stark contrast from the early days of 5G deployment when companies like Verizon championed mmWave as “wireless fiber” and engaged in fierce bidding wars for spectrum licenses.

The decline in mmWave’s perceived value is most clearly illustrated by recent industry moves. UScellular has slashed the valuation of its unsold mmWave spectrum licenses by half, recording a substantial $136 million impairment that reduced their value from $300 million to $161 million. In an even more telling development, T-Mobile has completely surrendered 520 mmWave spectrum licenses where it couldn’t meet FCC coverage requirements, while seeking to restructure coverage obligations for its remaining 865 licenses.

The current situation stands in stark contrast to the spectrum gold rush of just four years ago, when industry giants including Verizon, T-Mobile, EchoStar, and AT&T collectively invested nearly $10 billion across three FCC auctions to secure mmWave holdings. Verizon’s $3.1 billion acquisition of Straight Path Communications for its spectrum licenses exemplified the aggressive pursuit of mmWave assets during this period.

According to Frank Rayal of Xona Partners, the initial high valuations of mmWave spectrum in the United States were driven by a unique set of circumstances. American operators, facing a scarcity of available spectrum options for 5G deployment between 2017 and 2020, viewed mmWave as a viable solution for mobile applications. This perspective changed dramatically with the FCC’s introduction of midband C-band spectrum auctions in 2021, prompting Verizon to pivot its strategy with a massive $53 billion investment in these more practical frequency bands.

The international context further highlights the overvaluation of mmWave spectrum in the U.S. market. Outside the United States, mmWave spectrum auctions have seen minimal interest, with licenses either going unsold or selling at minimum bid prices. This global skepticism is reflected in Apple’s product strategy, which limits mmWave 5G capability to U.S. iPhone models only.

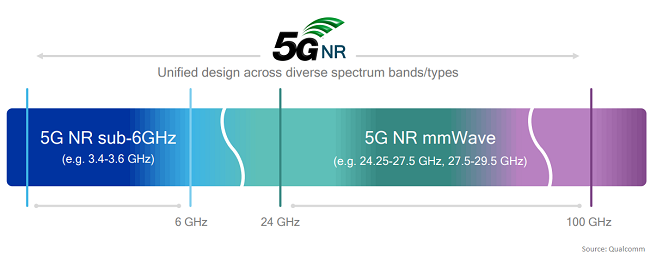

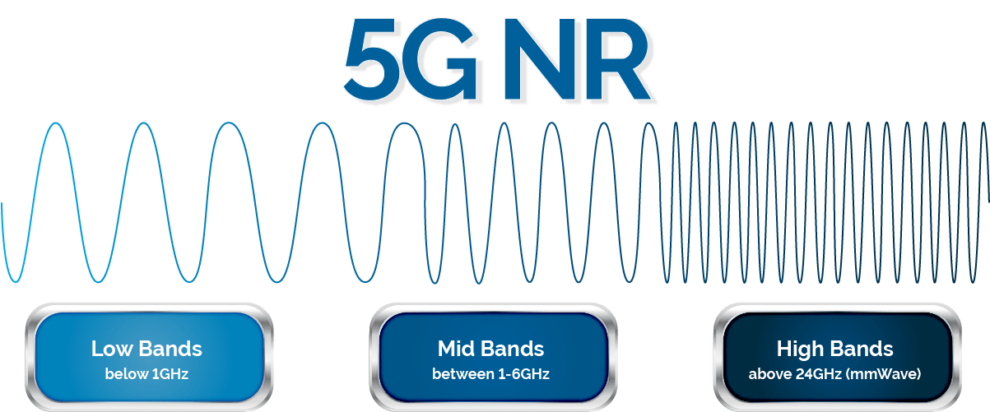

The technical limitations of mmWave technology have proven to be significant obstacles to widespread deployment. Signals in highband mmWave spectrum suffer from limited range and poor penetration through buildings and other objects. A 2019 Google study for the Pentagon’s Defense Innovation Board revealed the staggering infrastructure requirements for meaningful mmWave coverage: approximately 13 million transmitters and $400 billion in investment would be needed to provide 100 Mbit/s service to 72% of the U.S. population.

Despite these challenges, industry experts like Earl Lum of EJL Wireless Research suggest that mmWave spectrum retains some value for specific applications. The technology can effectively boost speeds in concentrated areas like stadiums and airports, and may prove useful for outdoor fixed wireless access, particularly in multi-dwelling units. However, these limited use cases fall far short of the transformational impact originally promised by industry leaders.

The shifting valuation of spectrum resources has created a notable contrast in the market, with lowband and midband spectrum seeing increasing value while mmWave continues to decline. This trend reflects a growing industry consensus about the practical limitations and optimal applications of different spectrum types in 5G networks.

This reality check in the mmWave market serves as a cautionary tale about the risks of early technology adoption and the importance of realistic assessment of new telecommunications technologies. The experience has demonstrated that while mmWave spectrum can play a role in the 5G ecosystem, its value proposition is far more limited than initially predicted.

For telecommunications companies, the declining value of mmWave holdings represents a significant shift in strategic planning and resource allocation. The focus has clearly moved toward more practical and cost-effective spectrum solutions, particularly in the midband range, which offers a better balance of coverage and capacity for most applications.

The industry’s experience with mmWave spectrum may influence future technology adoption strategies and spectrum valuations, particularly as telecommunications companies continue to evolve their 5G networks and begin planning for future generations of wireless technology. The lesson learned appears to be that while cutting-edge technology may promise revolutionary changes, practical considerations of deployment costs and technical limitations ultimately determine real-world value.

Add Comment