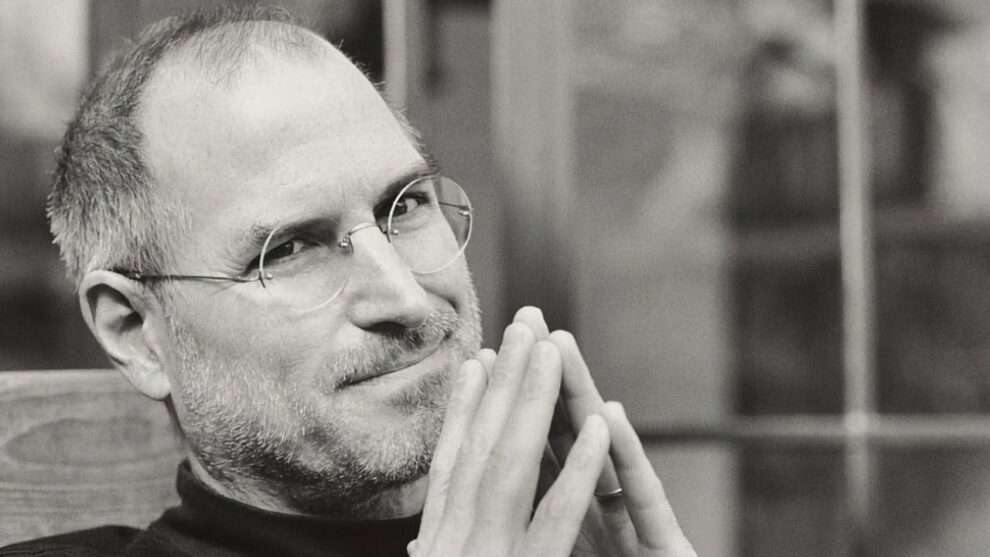

Steve Jobs, the visionary co-founder of Apple, would have turned 70 this year. His legacy as one of the most influential leaders in tech history is undeniable, having transformed Apple into one of the world’s most valuable companies. Yet, even the most iconic leaders seek advice from their peers. In a fascinating revelation, Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, shared a story about a conversation he had with Jobs regarding what to do with Apple’s massive cash reserves. While Buffett suggested stock buybacks, Jobs famously chose to keep the cash—a decision that reflects his unique approach to leadership and business strategy.

The Conversation Between Two Legends

In a 2012 interview with CNBC, Buffett recounted a phone call he received from Jobs a couple of years prior. At the time, Apple was sitting on a mountain of cash, and Jobs was unsure how to deploy it. “He said, ‘We’ve got all this cash, Warren. What should we do with it?’” Buffett recalled. The two discussed four primary options: stock buybacks, dividends, acquisitions, and simply holding onto the cash.

Buffett, known for his pragmatic investment philosophy, suggested that Jobs consider stock buybacks if he believed Apple’s shares were undervalued. At the time, Apple’s stock was trading at around 7.40pershare(adjustedforsplits,today’sequivalentwouldberoughly245). Jobs agreed that the stock was undervalued but ultimately chose not to act on Buffett’s advice.

“He just liked having the cash,” Buffett said. “It was very interesting to me because I later learned that he said that I agreed with him to do nothing with the cash. But he just didn’t want to repurchase stocks, although he absolutely thought his stock was significantly underpriced.”

Jobs’ Leadership Philosophy

Jobs’ decision to ignore Buffett’s advice is emblematic of his leadership style. He was known for forging his own path, often disregarding conventional wisdom in favor of his instincts. Former Gap CEO Mickey Drexler, who served on Apple’s board during Jobs’ tenure, described him as a “unique, once-in-a-lifetime” leader who was “difficult, mercurial, and incredibly creative.”

Jobs’ meticulous attention to detail—famously insisting that even the screws on Apple products be perfectly aligned—extended to his financial decisions. He preferred to maintain control over Apple’s resources, ensuring the company had the liquidity to pursue ambitious projects without relying on external funding. This approach allowed Apple to invest heavily in research and development, leading to groundbreaking products like the iPhone, iPad, and MacBook.

The Case for Stock Buybacks

Buffett’s suggestion to Jobs was rooted in sound financial logic. Stock buybacks, which involve a company repurchasing its own shares from the market, can be an effective way to return value to shareholders. By reducing the number of outstanding shares, buybacks increase the value of remaining shares and can boost earnings per share (EPS). Additionally, buybacks are often more tax-efficient than dividends, making them an attractive option for companies with excess cash.

However, buybacks are not without controversy. Critics argue that they can starve companies of funds needed for innovation, research, and development. Harvard Business Review has noted that buybacks can also reduce a company’s liquidity, leaving it vulnerable during economic downturns. Despite these concerns, Buffett has long been a proponent of buybacks when executed under the right conditions.

Buffett’s Own Buyback Strategy

Interestingly, Buffett hasn’t always followed his own advice. In Berkshire Hathaway’s 2000 annual report, the company announced its intention to buy back stock, a move Buffett described as ethical only if shareholders fully understood the rationale behind it. “We want to be sure if we’re buying it back from our partners at a discount from what it’s worth, that they understand what it’s worth and why we’re doing it,” he said.

Buffett has often cited IBM as a success story for stock buybacks. Between 2009 and 2018, IBM repurchased nearly $83 billion worth of stock, significantly boosting shareholder value. However, in 2024, Buffett announced that Berkshire Hathaway would halt its six-year streak of buybacks, citing high market valuations. This decision underscores Buffett’s belief that buybacks should only occur when shares are undervalued.

Jobs’ Legacy and the Power of Cash

Jobs’ decision to hold onto Apple’s cash reserves ultimately paid off. By maintaining a strong balance sheet, Apple was able to weather economic uncertainties and invest in transformative technologies. Today, Apple is one of the most profitable companies in history, with a market capitalization exceeding $2 trillion.

Jobs’ approach to leadership and decision-making serves as a reminder that there is no one-size-fits-all strategy in business. While Buffett’s advice was grounded in financial theory, Jobs’ instincts were driven by a vision for innovation and long-term growth. Both leaders achieved extraordinary success, but their paths were shaped by fundamentally different philosophies.

Lessons for Today’s Leaders

The story of Jobs and Buffett’s conversation offers valuable lessons for today’s business leaders. First, it highlights the importance of seeking diverse perspectives. Even a visionary like Jobs recognized the value of consulting with someone as experienced as Buffett.

Second, it underscores the need for leaders to trust their instincts. Jobs’ decision to hold onto Apple’s cash was unconventional, but it aligned with his vision for the company’s future.

Finally, the story reminds us that there is no single “right” way to manage a company. Whether through buybacks, dividends, or strategic investments, the best approach depends on a company’s unique circumstances and goals.

As we reflect on Steve Jobs’ legacy, his conversation with Warren Buffett serves as a testament to the power of bold leadership and the enduring impact of staying true to one’s vision. While their strategies differed, both men left an indelible mark on the business world—and their stories continue to inspire leaders today.

Add Comment