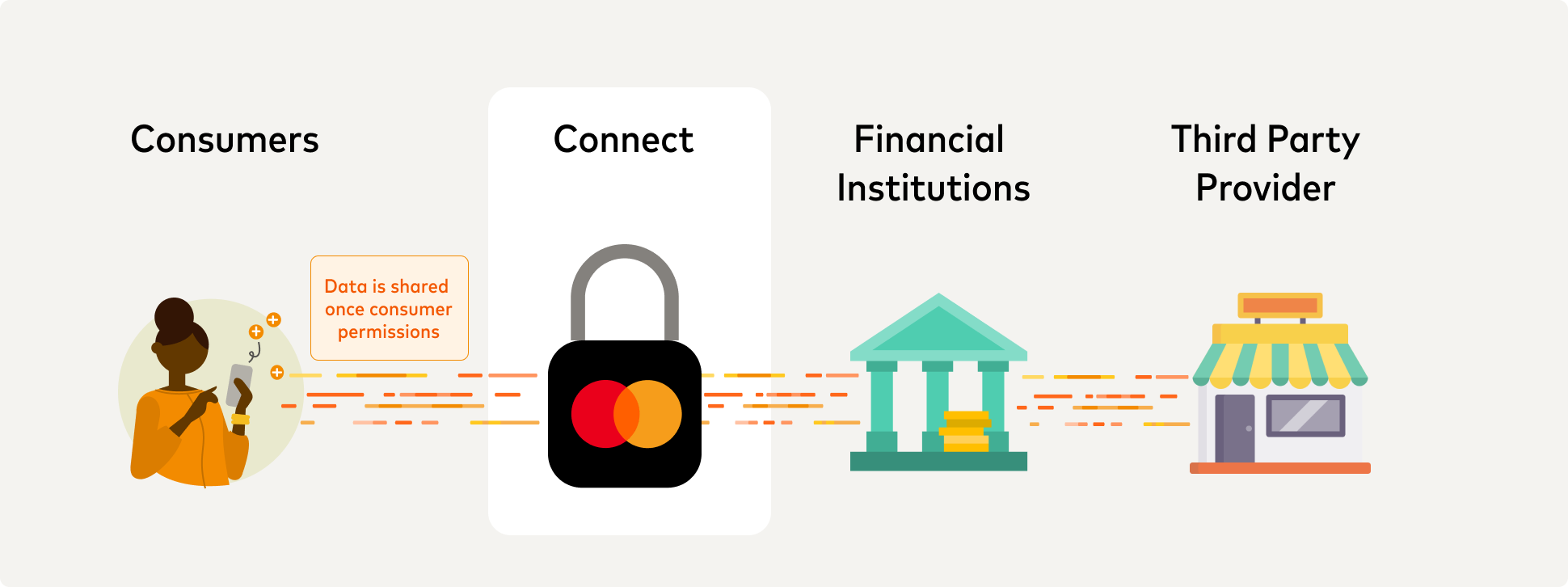

Mastercard has unveiled Connect Plus, a groundbreaking “data command center” that promises to put consumers firmly in control of their financial information. This innovative tool, announced on Friday, October 18, represents a significant step forward in addressing growing concerns about data privacy and security in the increasingly interconnected world of digital finance.

The Power of Choice: Connect Plus Explained

Connect Plus is designed to be a user-friendly interface that allows consumers to manage the sharing of their financial data with unprecedented granularity. Key features of the platform include:

- Account Linking: Users can search for and connect their various bank accounts within the platform.

- Permission Management: Consumers can view which third-party entities have access to their account data.

- Real-Time Control: The ability to grant or revoke data access permissions instantaneously.

- Notification System: Alerts users when third-party permissions are expiring or require attention.

Jess Turner, global head of open banking and API at Mastercard, emphasized the importance of this development: “Transparency is the key ingredient to instilling trust in the digital economy. When individuals and small businesses have agency over their financial data — who has it, where it’s going and how it’s being used — they can make informed decisions, access better opportunities and have more confidence that their financial data is just that — theirs.

The Timing: Responding to a Growing Need

The launch of Connect Plus comes at a crucial juncture in the evolution of open banking. A recent survey conducted by Mastercard revealed that 76% of their consumers already connect their financial accounts across various platforms. More tellingly, an overwhelming 93% of respondents stated that having control over how their financial data is used is of “paramount importance.”

These statistics underscore a growing awareness among consumers about the value and vulnerability of their financial data. As open banking initiatives expand globally, tools like Connect Plus are becoming increasingly necessary to maintain consumer trust and engagement.

Pilot Program and Future Rollout

Mastercard is taking a measured approach to the implementation of Connect Plus. The company has announced a pilot program set to run through the remainder of 2024, with plans for full availability across the United States in 2025. This phased rollout allows Mastercard to refine the platform based on real-world usage and feedback, ensuring that Connect Plus meets the evolving needs of consumers and financial institutions alike.

The Open Banking Landscape: Opportunities and Challenges

Connect Plus enters a complex and rapidly evolving open banking ecosystem. While open banking promises enhanced financial services through the secure sharing of data via APIs, it also faces significant hurdles, particularly in the realm of consumer trust.

A recent Thechipblog Intelligence report, “Can Open Banking Win Trust to Drive Real-Time Payments?”, highlighted that many American consumers still place their primary trust in traditional financial institutions when it comes to protecting their financial data. This presents both a challenge and an opportunity for innovations like Connect Plus.

The skepticism surrounding open banking is not limited to the United States. In the United Kingdom, where open banking initiatives are more advanced, 84% of consumers express mistrust in its safety. Furthermore, 72% believe that open banking primarily benefits third-party providers rather than consumers themselves.

Bridging the Trust Gap

Mastercard’s Connect Plus appears strategically positioned to address these trust issues. By providing consumers with a transparent and user-friendly interface to manage their data permissions, Mastercard is taking a proactive step towards demystifying open banking processes.

Dr. Emily Chen, a fintech analyst at Global Financial Insights, comments on the potential impact: “Tools like Connect Plus are crucial in building consumer confidence in open banking. By giving users direct control over their data, Mastercard is not just offering a service; they’re educating consumers about the realities of data sharing in modern finance.

The Broader Implications for the Financial Industry

The introduction of Connect Plus could have far-reaching effects on the financial services industry:

- Competitive Pressure: Other financial institutions and tech companies may feel compelled to develop similar tools, potentially accelerating innovation in the space.

- Regulatory Influence: The platform’s emphasis on user control and transparency could influence future regulations around data privacy and open banking.

- Consumer Expectations: As users become accustomed to the level of control offered by Connect Plus, they may demand similar capabilities from other financial service providers.

- Data Ecosystem Dynamics: The ability for consumers to easily revoke access could lead to more dynamic and competitive relationships between financial institutions and fintech companies.

Challenges and Considerations

While Connect Plus represents a significant step forward, several challenges remain:

- User Education: Ensuring that consumers understand how to effectively use the platform to protect their interests will be crucial.

- Integration Complexities: The success of Connect Plus will depend on seamless integration with a wide array of financial institutions and third-party services.

- Security Concerns: As a centralized platform for managing sensitive permissions, Connect Plus itself could become a target for cybercriminals.

- Balancing Control and Convenience: There’s a risk that too much granular control could lead to “permission fatigue,” potentially discouraging users from taking full advantage of open banking services.

Implications for Consumers and the Industry

As Mastercard moves forward with the pilot program for Connect Plus, the financial industry will be watching closely. The success or failure of this initiative could significantly influence the trajectory of open banking adoption in the United States and beyond.

For consumers, Connect Plus represents a potential turning point in their relationship with financial data. It offers the promise of greater control and transparency, but also requires a more active engagement with the intricacies of data sharing.

Mark Thompson, a consumer rights advocate, sees both opportunity and responsibility in this development: “Connect Plus is a powerful tool, but it also places a burden on consumers to actively manage their data. It’s crucial that Mastercard and other financial institutions provide robust education and support to ensure users can make informed decisions.”

Mastercard’s Connect Plus stands as a bold attempt to address one of the most pressing issues in modern finance: the tension between data sharing and privacy. By putting control directly in the hands of consumers, Mastercard is not just launching a new product; they’re potentially reshaping the entire conversation around open banking.

As the pilot program unfolds and Connect Plus moves towards full deployment in 2025, its impact will extend far beyond Mastercard’s immediate user base. It sets a new standard for transparency and user control in financial data management, one that could become the benchmark for the industry.

The success of Connect Plus could mark a turning point in the adoption of open banking, bridging the trust gap that has thus far limited its potential. However, its true test will come in real-world application, as consumers grapple with the power and responsibility of managing their financial data in an increasingly complex digital ecosystem.

For now, Connect Plus represents a promising step towards a future where financial data is not just a commodity to be traded, but a personal asset to be carefully managed and protected. As this future unfolds, the financial industry and consumers alike will be watching closely, ready to adapt to the new realities of banking in the digital age.

Add Comment