If you’ve decided it’s time to part ways with your Kotak 811 savings account, you’ve come to the right place. This in-depth guide covers everything you need to know to successfully close your account, from the reasons you may want to do so to the step-by-step process of shutting it down for good. We’ll also address some frequently asked questions and provide alternative solutions to closing your account entirely.

Reasons You May Want to Close Your Kotak 811 Account

There are several scenarios that could lead you to consider bidding farewell to your Kotak 811 account:

- You found a better deal elsewhere. Perhaps another bank is offering a higher interest rate or features that are a better fit for your financial goals and needs.

- You want to simplify your finances. Maintaining multiple bank accounts can get complicated. Consolidating into fewer accounts can make managing your money easier.

- You’re embracing minimalism. If you’re on a mission to declutter various aspects of your life, you may decide to stick with a single primary bank account and close extraneous ones.

- You’re moving abroad. Relocating to another country often means closing bank accounts in your home country.

Whatever your reason, it’s crucial to make sure your account has a zero balance and no pending transactions before initiating the closure process. Having a negative balance or outstanding fees can complicate and delay your account closure.

Can You Close a Kotak 811 Account Online?

While many banking tasks can be completed online these days, unfortunately, closing a Kotak 811 account is not one of them. Currently, Kotak Mahindra Bank requires customers to visit a physical branch location in order to close an 811 account.

Steps to Take Before Your Branch Visit

To ensure your account closure goes smoothly, take these preparatory measures beforehand:

- Compile necessary documents. Bring your Kotak 811 account number and customer ID, government-issued photo ID like a PAN card or Aadhaar card, and your debit card if you have one.

- Verify a zero account balance. Check that you’ve paid any fees and that all transactions have cleared. You should not have any pending dues when requesting account closure.

- Transfer remaining funds. If your account still has money in it, transfer the balance to a different account before your appointment. You can also opt to initiate the transfer at the branch.

- Update linked services. If any recurring payments or subscriptions are tied to your Kotak 811 account, be sure to change the payment information on file to another account.

Visiting the Branch to Close Your Account

Once you’ve completed the prep work, use Kotak’s online branch locator to find your nearest branch office. Upon arrival, inform the customer service representative that you need to close your account and take a token to wait your turn.

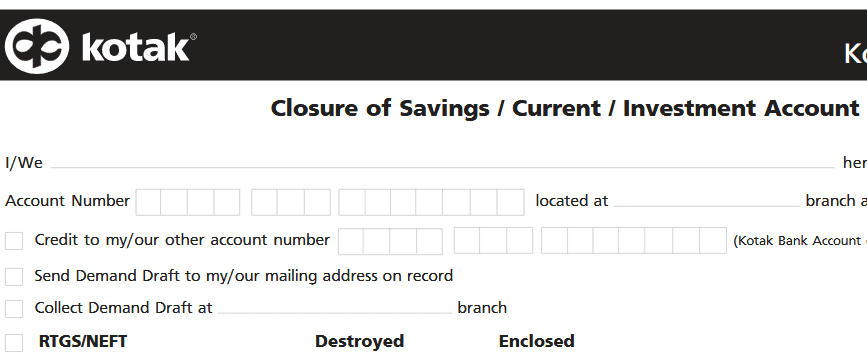

When called to the counter, explain to the representative that you wish to close your 811 account. They will give you an account closure form to fill out. Be prepared to provide:

- Your reason for closing the account (this is usually optional)

- How you want to receive any remaining account balance (electronic transfer to another account or demand draft)?

You’ll also need to surrender your debit card and any unused checks for the representative to destroy.

The agent will process your closure request after you confirm all the details. They should give you some form of acknowledgment, like a reference number, to document the transaction. Before you leave, inquire about any account closure fees so you’re not caught off guard.

What to Expect After Closing Your Account

In most cases, it takes between 7 and 10 business days for Kotak Mahindra Bank to finalize your account closure after you submit the request. You should receive a confirmation by email or SMS when the process is complete.

At that point,

- Your remaining balance will be disbursed to you by your chosen method (transfer or demand draft), with any closure charges deducted

- Your Kotak 811 account will be completely inaccessible, with your debit card and other features deactivated

Frequently Asked Questions

How long does closing a Kotak 811 account take?

Once you initiate the process by submitting an account closure request at a branch, it generally takes 7–10 business days to be finalized.

What do I need to bring to the bank to close my account?

Bring your Kotak 811 account details (account number and customer ID), a valid photo ID, your debit card, and your checkbook if you have one.

Does Kotak charge a fee to close an 811 account?

Kotak may charge an account closure fee. The representative can tell you the exact cost when you go in to close your account.

How will I get my money after I close my 811 account?

You have two choices:

- Provide another account number to have the funds electronically transferred

- Request a demand draft be mailed to your address on file

How will I know for sure that my account is closed?

Kotak will send you a confirmation message by email or SMS when they have completed the closure process.

I can’t find my 811 account number. How can I get it?

You can log into Kotak’s online banking portal if you have access. If not, you’ll need to contact customer service for assistance retrieving your account details.

My account is closed but I see a new transaction. What do I do?

Contact any billers or subscription services that were drawing automatic payments from your Kotak 811 account. It’s likely you forgot to update your payment information with them. Providing an alternate account number will prevent them from trying to debit your closed account in the future.

Alternatives to Closing Your Kotak 811 Account

If you’re not totally sure you want to close your Kotak 811 account, consider these options:

- Downgrade to a basic savings account. Switching to Kotak’s no-frills account can lower fees if you plan to keep the account mostly dormant.

- Let your account remain idle. If you can maintain any minimum balance requirements, you may be able to let your account sit unused without incurring inactivity fees. Just make sure to disable automatic billing to avoid unwanted charges.

Wrapping Up

Closing a Kotak 811 savings account is a relatively straightforward process once you know what to expect. By following the guidelines in this article and coming prepared with the proper documentation for your branch visit, you’ll be ready to seamlessly close this chapter of your banking life.

While closing an account may feel like a hassle, remember that managing your finances actively and mindfully is the cornerstone of a healthy financial life. And if you decide closing your Kotak 811 account is the right choice for you, you’ll come away from the process with one less financial loose end to monitor.

Add Comment