The Rise of Buy Now, Pay Later: A Paradigm Shift in Consumer Finance

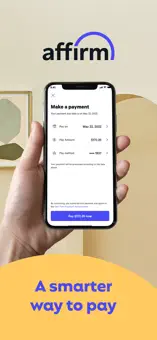

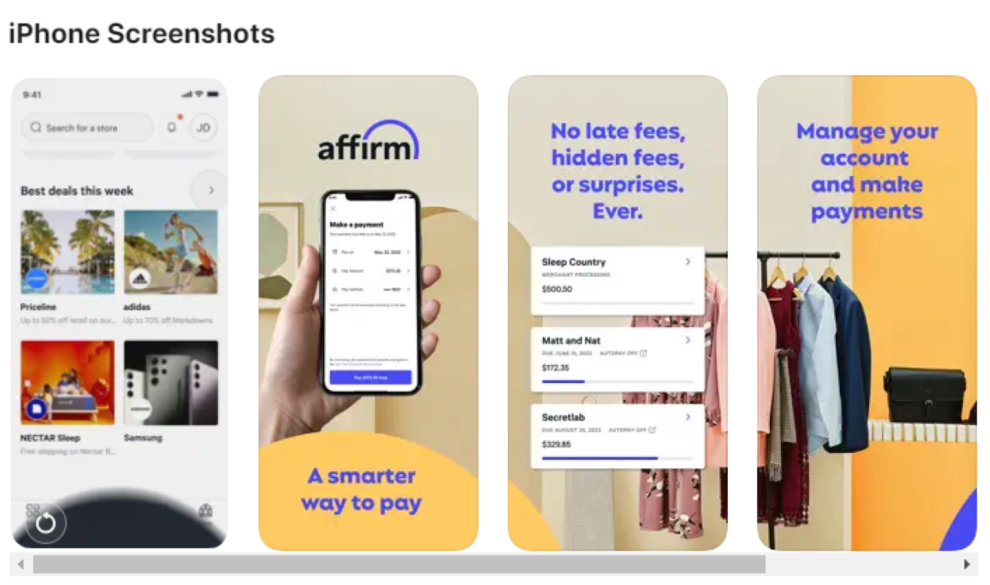

The BNPL market has witnessed explosive growth in recent years. Platforms like Affirm and Klarna have revolutionized how consumers approach online purchases, allowing them to spread the cost of their purchases over several installments without incurring interest charges. This flexibility, coupled with a user-friendly experience, has attracted millions of users, particularly millennials and Gen Z, who value convenience and control over their finances.

Affirm and Apple: A Match Made in Fintech Heaven

The integration of Affirm into Apple Pay offers several advantages for both companies and consumers:

- Enhanced Convenience for Users: apple Pay users can now access Affirm’s BNPL options directly within the Apple Pay interface, eliminating the need to visit a separate website or app to apply for financing. This streamlined experience makes splitting purchases easier than ever before.

- Expanded Reach for Affirm: Partnering with Apple, a tech giant with a massive user base, provides Affirm with a significant platform to reach new customers and expand its market share in the competitive BNPL landscape.

- A Boost for Apple Pay: By offering a wider range of financing options, Apple Pay becomes a more attractive option for consumers, potentially increasing its adoption rate and further solidifying its position as a dominant force in mobile payments.

Beyond Convenience: Potential Implications and Considerations

While the partnership offers undeniable convenience, some potential implications require consideration:

- Impact on Budgeting: Ease of access to BNPL options might lead to impulsive spending and over-extension of credit, particularly for vulnerable consumers. Responsible budgeting practices remain crucial.

- Regulatory Scrutiny: The BNPL industry is still evolving, and regulations are playing catch-up. The integration with a major player like Apple might attract greater scrutiny from regulators, ensuring fair lending practices and consumer protection.

- Competition and Innovation: The marriage of Apple Pay and Affirm is likely to spark further innovation in the BNPL space. Other players might introduce new features and competitive rates to attract customers, ultimately benefiting consumers.

The Future of Payments: A Blend of Convenience and Choice

The integration of Affirm with Apple Pay foreshadows a future where the act of buying seamlessly blends with financing options. This trend has significant implications for both consumers and retailers.

- Consumer Choice and Control: Consumers will have greater flexibility and choice when making purchases, deciding between traditional payment methods, credit cards, or BNPL options based on their needs and financial situation.

- Evolution of Retail Strategies: Retailers will need to adapt to this evolving landscape, potentially offering targeted promotions and loyalty programs tailored to users who prefer BNPL options.

A Look Ahead: What Does This Mean for You?

This partnership marks a significant milestone in the world of online payments. While it’s still early days, the implications are clear:

- Convenience at Your Fingertips: Apple Pay users will have a powerful tool to manage their finances and spread the cost of purchases over time.

- The Power of Choice: Consumers will have more control over their spending habits, deciding between different payment options based on their individual needs.

- A Call for Responsible Use: Despite the convenience, responsible budgeting practices remain paramount to avoid potential financial pitfalls.

The integration of Affirm into Apple Pay is a harbinger of a future where the shopping experience becomes increasingly intertwined with financing options. Whether this future empowers consumers or leads to overspending, remains to be seen. However, one thing is certain: the way we pay for things is undergoing a fundamental transformation, and this partnership between Apple and Affirm is a significant step in that direction.

Add Comment