Unlocking the Power of Credit Card Perks

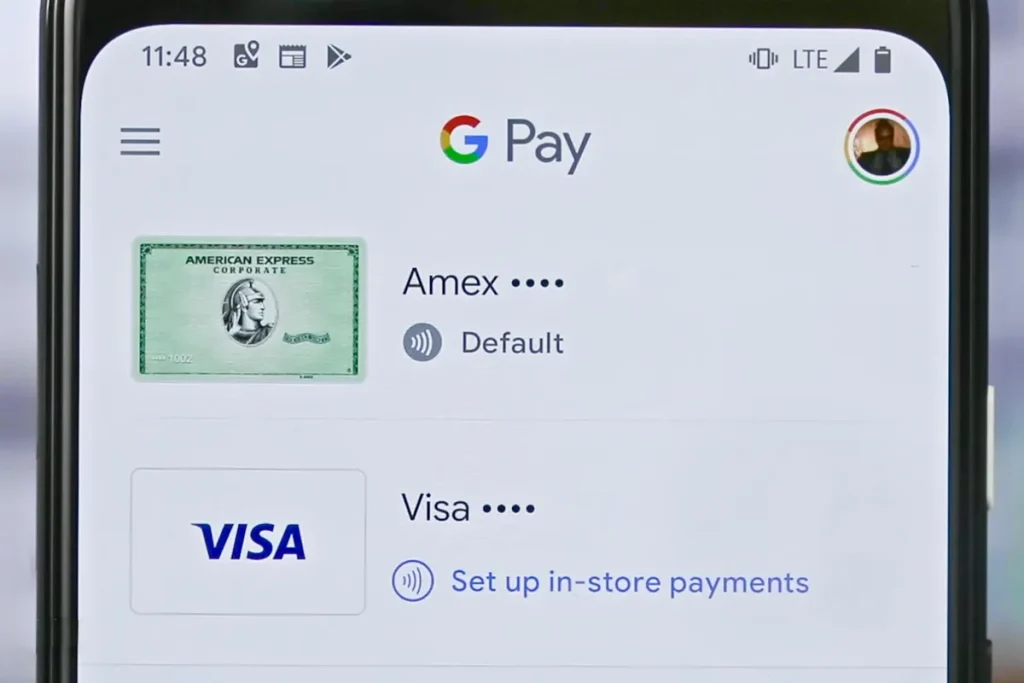

Picture this scenario: you’re at your favorite retailer, ready to make a purchase. As you prepare to pay with Google Pay, a notification appears on your screen, outlining the specific rewards and benefits you’ll earn by using your linked credit card for this transaction. This is the essence of Google Pay’s innovative new feature.

By partnering with credit card issuers, Google Pay will now have the ability to analyze your card’s benefits program and present relevant information at the point of sale. Whether it’s cashback offers, loyalty points, extended warranties, or purchase protection, you’ll have instant access to the perks your credit card provides.

How the Feature Works: A Seamless Integration

The process is remarkably simple and intuitive. When you’re at a participating merchant and ready to make a purchase, Google Pay will work behind the scenes, communicating with your credit card issuer to identify applicable benefits. This information will then be displayed on your screen, allowing you to make an informed decision about which card to use for maximum rewards.

Google assures users that privacy and security remain top priorities. The information displayed will be limited to relevant benefits, and users will have full control over their data, with the option to opt out of the feature if desired. The communication between Google Pay and credit card issuers will be fully encrypted, ensuring the safety of sensitive financial information.

Benefits for Consumers and Businesses Alike

This update to Google Pay isn’t just a win for consumers; it also presents significant opportunities for businesses. By leveraging the platform’s targeted promotion capabilities, merchants can reach customers with personalized offers and incentives. Imagine receiving a notification about an exclusive cashback deal for using a specific credit card at your favorite store. This level of targeted marketing could drive sales, boost customer loyalty, and create a more engaging shopping experience.

For consumers, the benefits are clear. No longer will you need to spend hours researching credit card rewards programs or trying to decipher complicated terms and conditions. With Google Pay’s new feature, you’ll have instant access to the information you need to make smart spending decisions and maximize your rewards. Whether you’re a savvy credit card user or just looking to get the most out of your purchases, this update empowers you to shop with confidence.

The Future of Mobile Payments: Beyond Transactions

Google Pay’s introduction of credit card benefit displays marks a significant shift in the role of mobile payment platforms. No longer just a means of conducting transactions, these apps are evolving into powerful financial tools that offer personalized guidance and insights.

As the technology develops, we can envision a future where Google Pay not only displays credit card benefits but also suggests the optimal card to use for a given purchase based on your spending habits and rewards preferences. The possibilities are endless, and this update is just the beginning of a new era in smart, rewarding spending.

The Ripple Effect: Industry Impact and Competition

The success of Google Pay’s new feature is likely to send shockwaves through the mobile payment industry. As users embrace the convenience and value of instant benefit information, other payment apps may feel compelled to offer similar functionalities. This could spark a wave of innovation and competition, ultimately benefiting consumers through better deals, enhanced rewards programs, and more user-centric features.

In the long run, this shift towards smarter, more transparent mobile payments could reshape the way we interact with our credit cards and make purchasing decisions. As platforms like Google Pay continue to evolve and integrate new capabilities, we may see a future where mobile wallets become the primary tool for managing our financial lives.

Embracing the Future of Smart Spending

For consumers looking to get the most out of their credit card rewards, Google Pay’s new feature is a game-changer. By providing instant access to benefit information at the point of sale, the platform empowers users to make informed, rewarding spending decisions.

As the update rolls out, it’s worth taking the time to explore how it can enhance your shopping experience. Link your credit cards to Google Pay, familiarize yourself with the interface, and get ready to unlock a new level of smart spending. Whether you’re a dedicated rewards enthusiast or just looking to make the most of your purchases, this feature has the potential to transform the way you shop.

The Bottom Line: A Smart Move for Savvy Shoppers

Google Pay’s introduction of credit card benefit displays at checkout is a significant step forward in the world of mobile payments. By empowering consumers with instant access to rewards information and offering businesses new opportunities for targeted promotion, this feature sets the stage for a more transparent, user-centric future in digital transactions.

As the platform continues to evolve and integrate new capabilities, it’s an exciting time to be a Google Pay user. Embrace the power of smart spending, and get ready to maximize your rewards like never before.

Add Comment