The Advantages of Opening a Chase Bank Account Online

Before diving into the application process, let’s explore some compelling reasons why opening a Chase bank account online might be the right move for you:

- Convenience Redefined: Say goodbye to long queues and limited branch hours. With Chase’s online banking platform, you can manage your finances from the comfort of your home or on-the-go, anytime, anywhere.

- Tech-Savvy Banking: If you prefer the convenience of digital banking over traditional methods, Chase’s user-friendly online and mobile banking platforms are tailored to meet your needs.

- Extensive Network: While online banking offers flexibility, Chase boasts an extensive network of physical branches across the United States, providing access to in-person assistance when needed.

- Diverse Account Options: Chase caters to various financial needs with a range of checking and savings accounts, offering features like ATM fee rebates, interest rewards, or student benefits.

Step-by-Step Guide: Opening a Chase Bank Account Online

Ready to embrace the convenience of online banking with Chase? Follow these simple steps:

- Visit the official Chase Bank website at https://www.chase.com/digital/online-banking.

- Explore Chase’s checking and savings account options to find the one that best suits your financial needs.

- On your chosen account page, click the “Open Account” button to initiate the online application process.

- Fill out the application form with your personal details, such as name, address, date of birth, and Social Security number.

- Upload scanned copies of a valid government-issued photo ID (passport or driver’s license) and proof of address (utility bill, bank statement, etc.) for identity verification.

- Choose your preferred method for funding your new Chase bank account, such as linking an existing bank account, making an ACH transfer, or mailing in a check.

- Carefully review all the information you’ve entered in the application before submitting it electronically.

- Chase will review your application and notify you via email about the approval status, typically within a few business days.

Remember: Have all the necessary documents (ID proof, address proof) scanned and ready to upload before starting the online application process.

Additional Considerations for Opening a Chase Bank Account Online

While the online application process is straightforward, here are a few additional factors to keep in mind:

- Minimum Opening Deposit: Each Chase account might have a minimum opening deposit requirement, so be sure to check the specific requirements for your chosen account before applying.

- Funding Methods and Availability: Chase offers various funding options, but some options might have limitations or processing times. Review the available methods and choose the one that best suits your needs.

- Account Features and Fees: Carefully review the features and associated fees of your chosen Chase bank account to ensure it aligns with your banking habits and financial goals.

Remember: Chase Bank’s website is a wealth of information about their accounts, features, and fees. Take the time to explore these resources before making your decision to open a Chase bank account online.

The Perks of Online Banking with Chase

Once you’ve opened your Chase bank account online, you’ll gain access to their robust online and mobile banking platforms. Here are some of the benefits you can enjoy:

- 24/7 Account Access: Manage your finances from anywhere, anytime with Chase’s online and mobile banking platforms. Check your account balance, transfer funds, deposit checks, and pay bills with ease.

- Bill Pay: Schedule and pay bills electronically directly from your Chase account, ensuring timely payments and avoiding late fees.

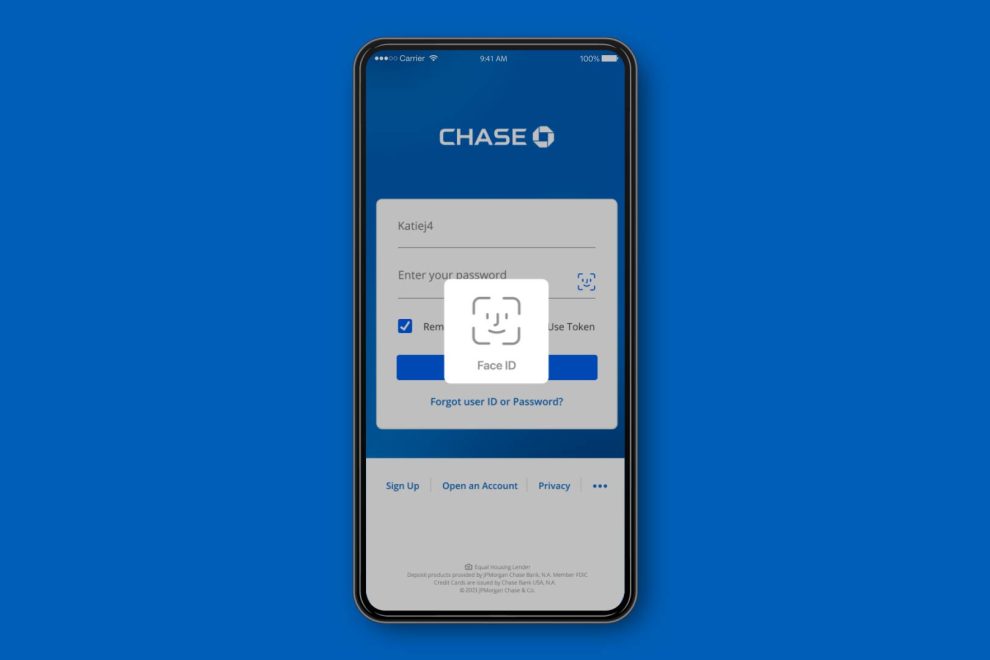

- Mobile Banking Features: Deposit checks, transfer funds, monitor your account activity, and access various other features conveniently through the Chase Mobile app.

- Card Controls: Enable or disable your debit card with a few clicks, offering an extra layer of security in case your card is lost or misplaced.

- Account Alerts: Set up customizable alerts to receive notifications about account activity, low balance warnings, or transaction confirmations, keeping you informed about your finances.

- Security Features: Chase employs robust security measures, including two-factor authentication and encryption technologies, to safeguard your online banking experience.

Explore the features and functionalities offered through Chase’s online and mobile platforms to discover how they can streamline your financial management.

Frequently Asked Questions (FAQs)

Here are some commonly asked questions regarding opening a Chase bank account online:

- Can I open a Chase bank account online if I’m not a US citizen? Generally, Chase requires applicants to be US citizens or permanent residents with a valid Social Security number. However, Chase offers specific account options for non-residents. Check their website for more information.

- What documents do I need to open a Chase bank account online? You’ll need a valid government-issued photo ID (passport or driver’s license) and proof of address (utility bill, bank statement, etc.) for identity verification.

- How long does it take to open a Chase bank account online? The online application takes only a few minutes, but approval can take up to a few business days. Chase will notify you via email about the status of your application.

- Can I fund my new Chase account online? Yes! Chase offers various funding options, including linking an existing bank account, making an ACH transfer, or mailing in a check.

If you have any further questions, don’t hesitate to visit the Chase Bank website or contact their customer service representatives for assistance.

Security Best Practices for Online Banking

Protecting your online banking information is crucial. Follow these security best practices after opening your Chase bank account online:

- Strong Password: Choose a strong and unique password for your Chase online banking access, avoiding easily guessable information like birthdays or pet names.

- Two-Factor Authentication: Enable two-factor authentication, which adds an extra layer of security by requiring a secondary verification code in addition to your password when logging in.

- Beware of Phishing Scams: Be cautious of any unsolicited communication claiming to be from Chase Bank. Chase will never ask for sensitive information through email.

- Update Your Devices: Ensure your computer and mobile devices are updated with the latest security patches to protect against vulnerabilities.

- Log Out Completely: Always log out of your online banking session after each use, especially if you’re using a shared device.

By following these security best practices, you can significantly reduce the risk of unauthorized access to your Chase online banking account and safeguard your financial information.

Conclusion

Opening a Chase bank account online is a convenient and secure way to embrace the future of banking. With Chase’s user-friendly online and mobile platforms, you can manage your finances effortlessly from anywhere, anytime. By following the step-by-step guide outlined in this article, you can navigate the application process with ease and confidence.

Remember, Chase offers a variety of account options to suit your needs, so take the time to explore their offerings and choose the one that aligns with your financial goals. Once you’ve opened your account, unlock the full potential of Chase’s online banking features and enjoy the convenience of managing your finances at your fingertips.

So, why wait? Head over to the Chase Bank website today and embark on a journey of streamlined banking with the click of a button.

Add Comment