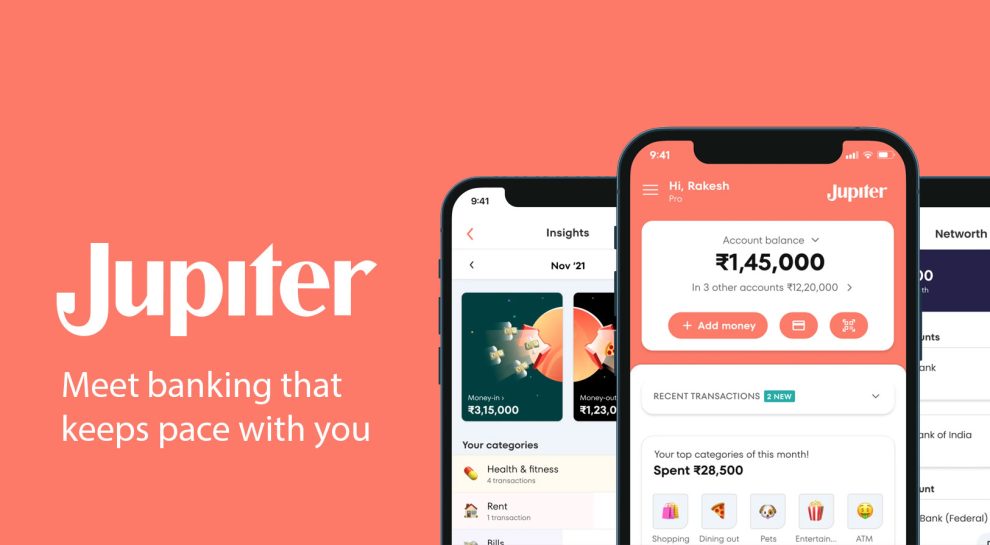

The world of personal finance is undergoing a dramatic shift. Traditional banks, with their brick-and-mortar branches and mountains of paperwork, are quickly being replaced by innovative digital platforms that prioritize speed, convenience, and seamless user experiences. Leading the charge in this banking revolution is Jupiter, a 100% digital banking app that allows you to open a fully functional savings account in a mere 180 seconds – all from the comfort of your smartphone.

In this comprehensive guide, we’ll walk you through the process of opening a Jupiter account, highlight the key features and benefits that set Jupiter apart from the competition, and explore why this new-age banking platform is poised to redefine the way we manage our money in the digital era.

What Makes Jupiter Different?

Before diving into the account opening process, let’s take a moment to understand what makes Jupiter a game-changer in the world of personal finance:

- 100% Digital: Jupiter operates entirely through a mobile app, eliminating the need for physical branches and the associated overhead costs. This allows them to pass on the savings to customers in the form of higher interest rates and lower fees.

- Zero Minimum Balance: Unlike many traditional banks that require customers to maintain a minimum balance to avoid penalties, Jupiter has no such requirement. This makes it an ideal choice for individuals just starting their financial journey or those who prefer flexibility in managing their funds.

- Competitive Interest Rates: By minimizing operational costs, Jupiter can offer highly competitive interest rates on savings accounts, helping your money grow faster.

- Instant Virtual Debit Card: The moment your Jupiter account is activated, you’ll receive a virtual debit card that can be used for online transactions. You can also request a physical debit card for in-store purchases.

- Advanced Money Management Tools: Jupiter’s user-friendly app provides a suite of tools to help you track expenses, categorize transactions, set financial goals, and gain valuable insights into your spending habits.

Eligibility and Requirements

To open a Jupiter account, you must meet the following criteria:

- Be an Indian resident above the age of 18

- Possess a valid PAN card

- Have a government-issued photo ID (such as an Aadhaar card, passport, or driver’s license)

During the signup process, you’ll need to provide clear images of your PAN card and chosen photo ID for verification purposes.

Opening Your Jupiter Account

Now that you understand the benefits and requirements, let’s walk through the simple steps to open your Jupiter account:

- Download the App: Visit the Google Play Store or Apple App Store and download the Jupiter app on your smartphone.

- Enter Your Mobile Number: Open the app and provide your mobile number. You’ll receive a one-time password (OTP) via SMS for verification.

- Fill in Basic Information: Input your full name, email address, and date of birth. Double-check for accuracy to ensure a smooth verification process.

- Verify Your Identity: Upload clear images of your PAN card and chosen government-issued photo ID. Ensure all four corners are visible and the text is legible.

- Set Up Your UPI PIN: Create a 4-digit or 6-digit UPI PIN for secure transactions through the Unified Payments Interface (UPI).

Once you’ve completed these steps, your Jupiter account will be activated, and you’ll gain access to your virtual debit card for immediate use. The entire process takes just 3 minutes, making it one of the fastest account opening experiences in the industry.

Maximizing Your Jupiter Account

With your Jupiter account up and running, you can start taking advantage of its wide range of features:

- Seamless Fund Transfers: Move money to and from your Jupiter account using popular methods like IMPS, NEFT, and UPI.

- Bill Payments: Settle your utility bills, mobile recharges, and other recurring expenses directly through the Jupiter app.

- Online Shopping: Use your virtual debit card for secure online purchases across various e-commerce platforms.

- Subscription Management: Keep tabs on your subscriptions and manage them efficiently within the app.

- Goal-Based Saving: Set personalized financial goals and track your progress towards achieving them.

- Instant Cash Advances: Eligible users can access instant cash advances directly through the app, providing a convenient solution for short-term liquidity needs.

Why Choose Jupiter: Benefits Beyond Speed

While the lightning-fast account opening process is undoubtedly a major draw, Jupiter offers a host of other compelling reasons to make the switch:

- User-Centric Design: Jupiter’s app boasts an intuitive, clutter-free interface that makes navigating and managing your finances a breeze.

- Savings-Focused Approach: With competitive interest rates, expense tracking, and budgeting tools, Jupiter encourages a mindset of saving and financial responsibility.

- Rewards Program: Earn cashback on select transactions through Jupiter’s evolving rewards program, adding an extra incentive to use the platform.

- Exceptional Customer Support: Jupiter prides itself on prompt, helpful customer service, with a dedicated support team accessible directly through the app.

- Robust Security: Safeguard your financial information and transactions with Jupiter’s industry-standard security measures and real-time fraud monitoring.

- Continuous Innovation: Jupiter is committed to staying at the vanguard of digital banking, consistently introducing new features to meet the evolving needs of its users.

Limitations to Consider

While Jupiter offers a compelling digital banking experience, there are a few limitations to keep in mind:

- No Physical Cash Deposits: As an online-only platform, Jupiter currently lacks physical branches for cash deposits. However, you can easily transfer funds from other bank accounts or use digital payment methods to add money to your Jupiter account.

- Limited Investment Options: At present, Jupiter primarily focuses on savings accounts and everyday banking features. While investment options may be introduced in the future, they are not a core offering currently.

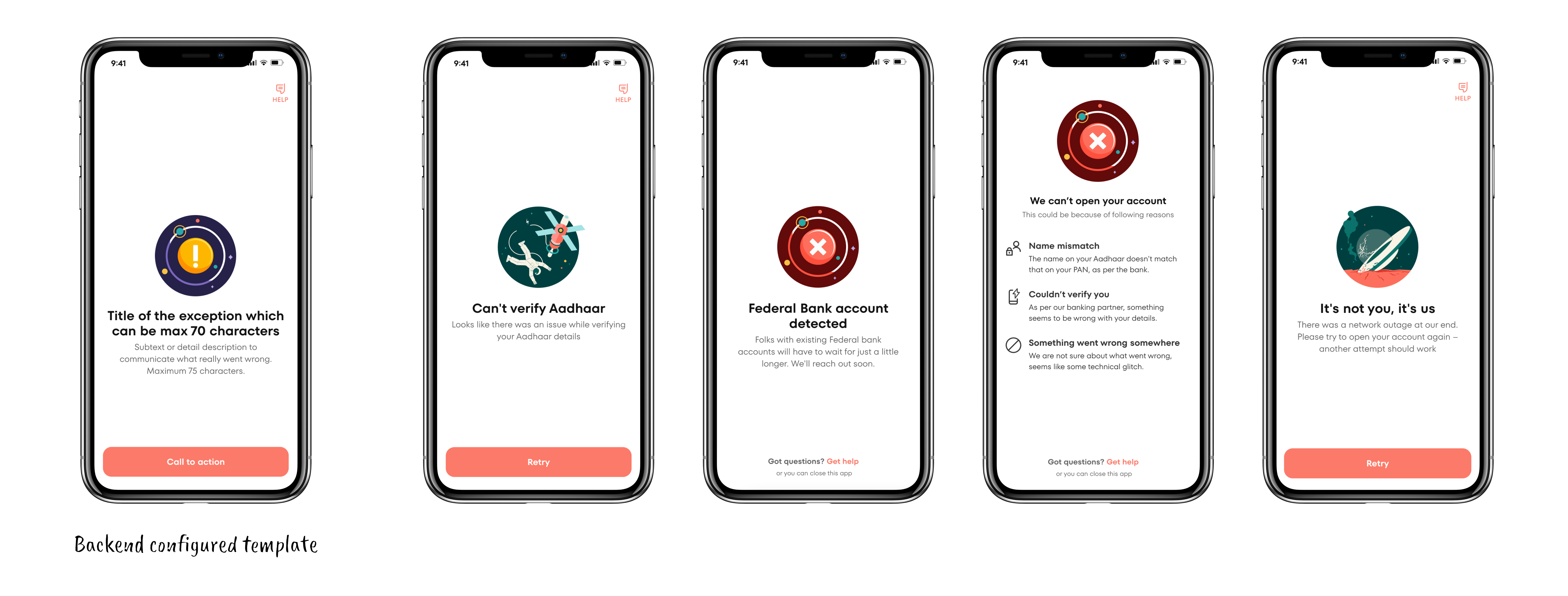

- Verification Timeframes: Although the account opening process typically takes just minutes, in some cases, additional information may be required, slightly extending the verification timeline.

Embracing the Future of Banking with Jupiter

In an era where speed, convenience, and digital-first experiences are paramount, Jupiter is revolutionizing the way we approach personal finance. By offering a seamless account opening process, competitive features, and a user-centric design, Jupiter is empowering individuals to take control of their financial lives like never before.

If you’re ready to embrace the future of banking and enjoy the benefits of a truly digital financial experience, opening a Jupiter account is a smart move. With its commitment to innovation, savings-focused approach, and customer-centric philosophy, Jupiter is poised to become the go-to choice for savvy, digitally-minded individuals looking to simplify and enhance their financial management.

So why wait? Download the Jupiter app today and discover how this game-changing platform can help you achieve your financial goals and thrive in the digital age.

Frequently Asked Questions

Is there a monthly fee for using a Jupiter account?

No, Jupiter does not charge any monthly maintenance fees for its savings accounts.

How long do transfers from other bank accounts to Jupiter typically take?

Transfer times vary based on the method used. IMPS transfers usually reflect within minutes, while NEFT transfers may take up to 24 hours.

Can I use my Jupiter account for international transactions?

At present, Jupiter accounts do not support international transactions. However, this feature may be introduced in the future.

Is my money safe in a Jupiter account?

Yes, Jupiter employs industry-standard security measures to protect your information and transactions, along with real-time monitoring for fraudulent activity.

How can I reach Jupiter’s customer support?

You can access customer support directly through the Jupiter app by navigating to the “Help” or “Support” section.

The world of personal finance is evolving rapidly, and digital banking platforms like Jupiter are leading the charge. By prioritizing speed, convenience, and user-centric experiences, Jupiter is redefining what it means to manage your money in the digital age. If you’re ready to embrace a smarter, more streamlined approach to banking, opening a Jupiter account is a decision that can pay dividends for years to come.

Add Comment