With the rise of digital payment platforms, managing your finances has never been more convenient. Among the leading players in this space is Paytm Payment Bank, a subsidiary of the renowned digital payments company Paytm. If you’re looking to simplify your financial life and embrace the benefits of digital banking, opening a Paytm Payment Bank account is a smart choice. In this comprehensive guide, we’ll walk you through the process of creating an account and explore the features and considerations to help you make an informed decision.

Why Choose Paytm Payment Bank?

Before we delve into the account opening process, let’s explore the compelling reasons why Paytm Payment Bank stands out as a preferred choice for digital banking enthusiasts:

- Seamless Account Opening: Say goodbye to the hassle of paperwork and lengthy bank visits. Opening a Paytm Payment Bank account is entirely digital, allowing you to complete the process from the comfort of your own home.

- Swift Account Activation: Unlike traditional banks that may take days to activate your account, Paytm Payment Bank’s online verification process ensures your account is ready to use within minutes.

- Zero Balance Requirement: One of the standout features of Paytm Payment Bank is the absence of a minimum balance requirement. This makes it an accessible option for individuals who are new to digital banking or those who prefer to maintain low balances.

- Effortless Money Management: With the user-friendly Paytm app, managing your finances becomes a breeze. Transfer money to friends and family, pay bills, recharge your mobile phone, and more—all from a single platform.

- Extensive ATM Network: Paytm Payment Bank account holders can access their funds at millions of ATMs across India using the Paytm debit card. This widespread network ensures that you can withdraw cash whenever and wherever you need it.

While the benefits of opening a Paytm Payment Bank account are numerous, it’s essential to understand the account features and limitations to determine if it aligns with your financial needs.

Eligibility Criteria for Opening a Paytm Payment Bank Account

Before embarking on the account opening journey, let’s ensure you meet the eligibility criteria set by Paytm Payment Bank:

- Age Requirement: You must be at least 18 years old to open a Paytm Payment Bank account independently.

- Indian Residency: Currently, Paytm Payment Bank accounts are exclusively available to Indian residents. Non-Resident Indians (NRIs) may need to explore alternative banking options.

- Unique Account: You can only have one Paytm Payment Bank account linked to your Aadhaar card.

- Document Checklist: To complete the account-opening process, you’ll need the following documents:

- PAN Card: This is a mandatory requirement for tax purposes and serves as a primary identification document.

- Aadhaar Card: Aadhaar is essential for online KYC (Know Your Customer) verification, streamlining the account opening process.

- Mobile Number: Your mobile number should be linked to your Aadhaar card for seamless verification. If it’s not linked, consider getting it done before proceeding.

Expert Tip: Linking your Aadhaar card to your mobile number prior to initiating the account opening process can significantly simplify the verification step.

Step-by-Step Guide: Opening Your Paytm Payment Bank Account

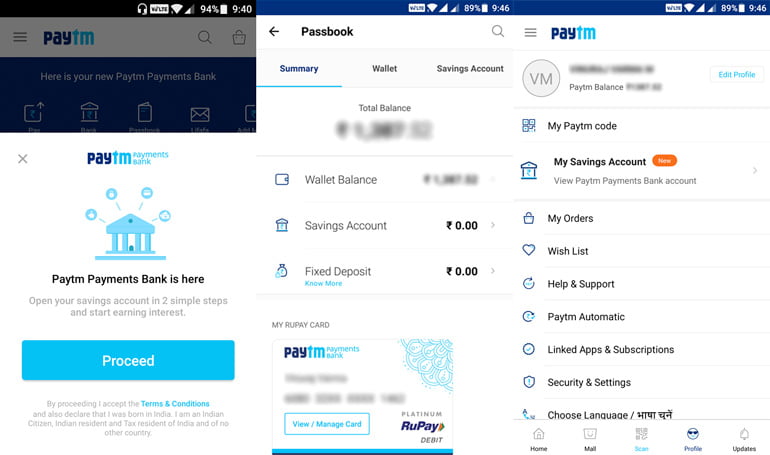

Now that you’ve confirmed your eligibility and gathered the necessary documents, let’s walk through the simple steps to open your Paytm Payment Bank account:

- Download the Paytm App: If you haven’t already, head to the App Store (for iOS devices) or Google Play Store (for Android devices) and download the official Paytm app.

- Initiate Account Opening: Launch the Paytm app and look for the “Open New Account” or “Sign Up” option, usually prominently displayed on the app’s homepage.

- Provide a mobile number: Enter your valid mobile number and proceed. Paytm will send a one-time password (OTP) to your number for verification purposes.

- Complete KYC verification: Paytm employs a paperless online KYC verification process to confirm your identity. Here’s what you need to do:

- Grant permission for Paytm to access your Aadhaar details electronically, eliminating the need for manual document uploads.

- Participate in a quick live photo verification using your smartphone camera. Ensure adequate lighting and hold your Aadhaar card clearly in front of the camera.

- Set Up Account Security: Upon successful completion of the KYC verification, you’ll be prompted to create a secure password for your Paytm account. Additionally, you’ll need to set up a four-digit mPIN for quick and convenient access within the app.

Congratulations! You have now successfully opened your Paytm Payment Bank account. You’ll receive a confirmation via SMS or email, which will provide you with your account details.

Important Note: While the account opening process itself is quick, the KYC verification may take up to 24 hours in some cases.

Exploring the Features of Your Paytm Payment Bank Account

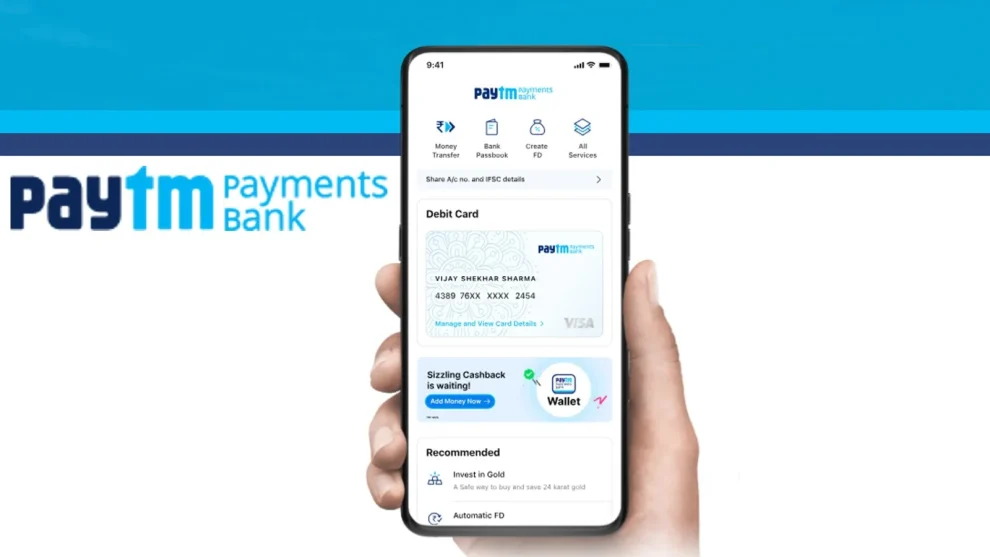

With your Paytm Payment Bank account up and running, it’s time to discover the various features and functionalities at your fingertips:

- Seamless Money Transfers: Instantly send and receive money to other Paytm users or any bank account in India, making it convenient to settle bills, split expenses, or send financial support to loved ones.

- Bill Payments Made Easy: Say goodbye to the hassle of standing in long lines to pay your utility bills. With Paytm Payment Bank, you can effortlessly pay your mobile phone, electricity, water, and other bills right from the app.

- Quick Recharges: Running low on mobile balance or need to renew your DTH subscription? Your Paytm Payment Bank account allows you to recharge your mobile phone, DTH services, and data plans in just a few taps.

- Seamless Online Shopping: Enjoy a smooth and secure online shopping experience by using your Paytm wallet, which is conveniently linked to your Paytm Payment Bank account, to make payments on various e-commerce platforms.

- ATM Withdrawals: Need cash on hand? Your Paytm Payment Bank account comes with a debit card that allows you to withdraw money from millions of ATMs nationwide. Keep in mind that transaction fees may apply if you exceed the specified number of free withdrawals per month.

Take the time to explore the Paytm app and familiarize yourself with the additional features and services available, as they may cater to your specific financial needs.

Understanding the Limitations of Paytm Payment Bank Accounts

While Paytm Payment Bank offers a convenient and user-friendly banking experience, it’s crucial to be aware of certain limitations:

- Transaction Limits: Paytm Payment Bank accounts have restrictions on the daily and monthly transaction amounts for cash deposits, transfers, and withdrawals. These limits are subject to change, so it’s advisable to refer to Paytm’s official website for the most up-to-date information.

- No Cheque Facilities: Unlike traditional banks, Paytm Payment Bank does not offer check services. If you require check facilities for your financial transactions, you may need to consider alternative banking options.

- Limited Investment Options: Paytm Payment Bank accounts do not provide investment products such as fixed deposits or mutual funds. If you’re looking for investment opportunities, you may need to explore other financial institutions or platforms.

It’s essential to carefully evaluate these limitations and determine if a Paytm Payment Bank account aligns with your specific financial requirements and goals.

Ensuring the Security of Your Paytm Payment Bank Account

While Paytm Payment Bank provides a secure platform for managing your finances, it’s always wise to take additional precautions to safeguard your account. Here are some valuable security tips to keep in mind:

- Create Strong Credentials: When setting up your Paytm account, choose a strong and unique password that is difficult to guess. Additionally, create a separate and secure mPIN for quick access within the app.

- Be Cautious of Phishing Attempts: Paytm will never request your confidential information, such as login credentials, through calls, text messages, or emails. Be vigilant and cautious of any suspicious communication claiming to be from Paytm, and never share your sensitive account details.

- Enable Two-Factor Authentication: Consider adding an extra layer of security to your account by enabling two-factor authentication (2FA). This feature requires an additional verification step, typically a code sent to your registered mobile number, whenever you log in to your account.

- Monitor Your Account Activity: Regularly review your account statements and transaction history for any unauthorized or suspicious activities. If you notice any discrepancies, report them to Paytm’s customer support immediately.

By implementing these security measures and staying vigilant, you can ensure the safety and integrity of your Paytm Payment Bank account.

Conclusion

Opening a Paytm Payment Bank account is a gateway to the world of digital banking, offering convenience, flexibility, and a range of features to simplify your financial life. By following the step-by-step guide outlined in this article, you can create your account in a matter of minutes and embark on a seamless digital banking journey.

However, it’s crucial to carefully consider the limitations of Paytm Payment Bank accounts and assess if they align with your specific financial needs and goals. While Paytm provides a user-friendly platform and a wide range of services, it may not be suitable for all banking requirements.

As you navigate the digital banking landscape with your Paytm Payment Bank account, prioritize the security of your account by implementing strong credentials, being cautious of phishing attempts, enabling two-factor authentication, and regularly monitoring your account activity.

Embrace the convenience and efficiency that Paytm Payment Bank offers, and take control of your financial life in the digital age. With the power of digital banking at your fingertips, managing your money has never been easier.

Add Comment