The stock market has long been a fascinating avenue for individuals seeking to grow their wealth and secure their financial future. However, venturing into the world of investing can be intimidating, especially for those new to the game. That’s where Angel One comes in, a leading discount broking firm in India that offers a user-friendly platform for investors of all levels. In this comprehensive guide, we’ll walk you through the process of opening an Angel One account, empowering you to embark on your stock market journey with confidence.

Is Angel One the Right Fit for Your Investment Goals?

Before diving into the nitty-gritty of opening an Angel One account, it’s crucial to assess whether this platform aligns with your investment objectives and style. Consider the following factors:

- Investment Goals: Reflect on your short-term and long-term financial aspirations. Are you aiming for quick profits through short-term trading, or are you more focused on long-term wealth creation? Angel One caters to a wide range of investors, so ensure that their offerings align with your goals.

- Trading Experience: Evaluate your level of familiarity with the stock market. Are you a beginner just starting out, or do you have prior experience in trading? Angel One provides resources and tools for investors of all levels, but it’s essential to consider your comfort level and willingness to learn.

- Investment Capital: Assess the amount of capital you’re comfortable investing in the stock market. While Angel One allows you to start with a relatively low amount, it’s crucial to invest within your means and in line with your risk tolerance.

Remember, opening an Angel One account is just the first step in your investment journey. Successful investing requires continuous learning, disciplined decision-making, and a well-defined strategy.

The Advantages of Opening an Angel One Account

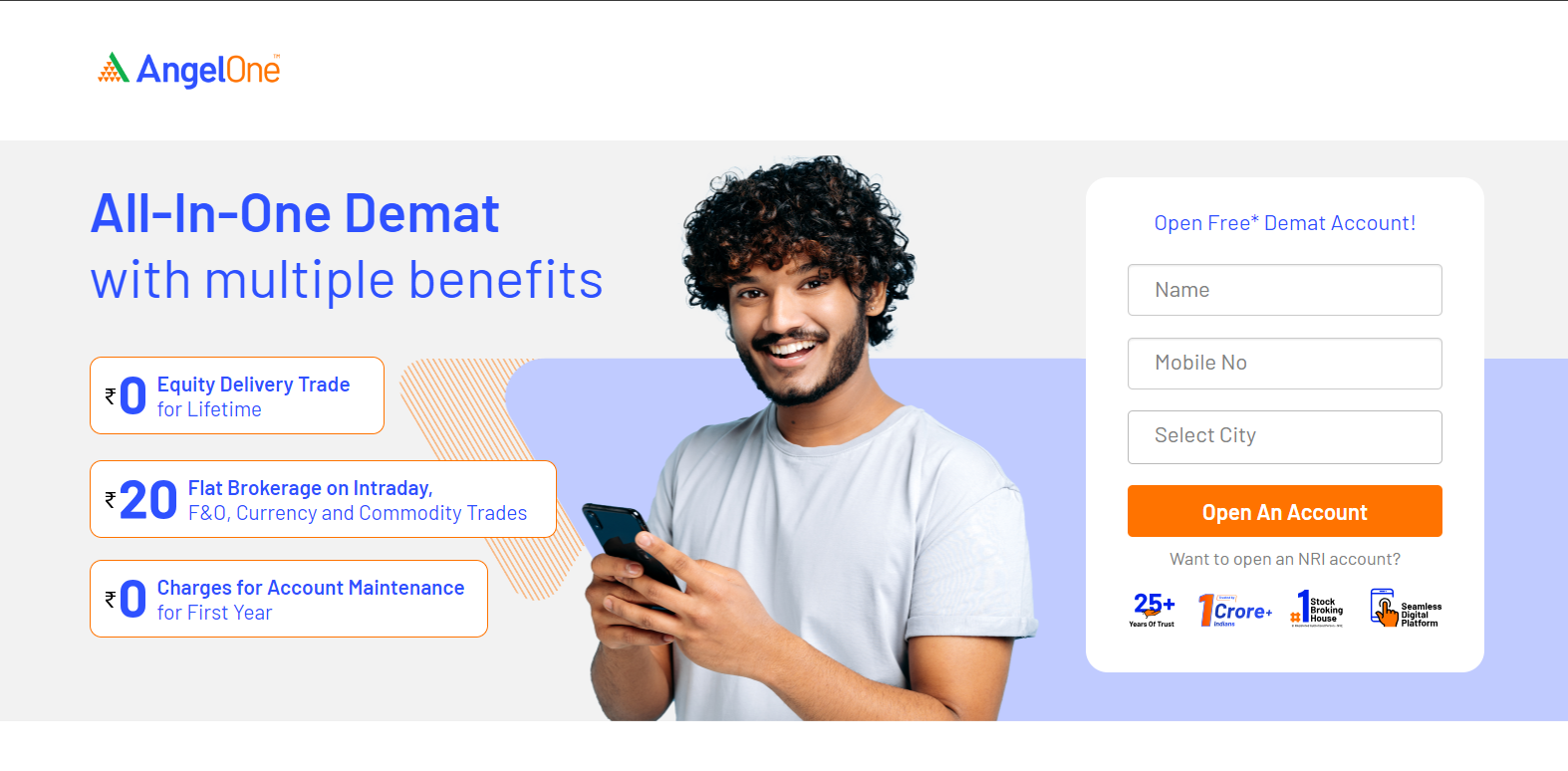

Now that you’ve determined that Angel One aligns with your investment goals, let’s explore the benefits of opening an account with this renowned discount broker:

- Cost-Effective Trading: As a discount broker, Angel One offers competitive brokerage fees, allowing you to keep more of your profits. Lower transaction costs can have a significant impact on your overall returns, especially if you plan to trade frequently.

- User-Friendly Trading Platform: Angel One’s flagship trading platform, Angel One ARQ, is designed to cater to both novice and experienced investors. With its intuitive interface, advanced charting tools, and real-time market data, you can navigate the platform with ease and make informed trading decisions.

- Mobile Trading App: In today’s fast-paced world, the ability to trade on the go is invaluable. Angel One’s mobile app allows you to manage your investments, place trades, and monitor your portfolio performance from the palm of your hand.

- Diverse Account Options: Angel One offers a range of account types to suit different investor profiles. Whether you’re interested in equity trading, commodity trading, or margin trading, you can choose an account that aligns with your specific needs.

Important Note: If you’re considering margin trading, it’s crucial to understand the associated risks. Margin trading involves borrowing funds from the broker to amplify your investment positions, which can potentially magnify both profits and losses. Exercise caution and have a robust risk management strategy in place.

Why choose Angel One over other brokers?

With numerous broking firms vying for your attention, you might wonder what sets Angel One apart. Here are a few compelling reasons to consider opening an Angel One account:

- Established Reputation: Angel One is a well-respected and trusted name in the Indian brokerage industry. With a proven track record of reliability and customer satisfaction, you can have peace of mind knowing that your investments are in capable hands.

- Cutting-Edge Technology: Angel One is committed to staying at the forefront of technological advancements. The company continuously invests in enhancing its trading platform, ensuring a seamless and feature-rich experience for its users.

- Educational Resources: If you’re new to the world of investing, Angel One provides a wealth of educational resources to help you get started. From beginner-friendly tutorials to in-depth market analysis, you can access the knowledge and insights needed to make informed investment decisions.

- Robust Customer Support: Angel One understands the importance of prompt and reliable customer support. Whether you have a question about account opening, need assistance with a trade, or require technical support, their dedicated team is ready to help you every step of the way.

Expert Tip: Before committing real money, consider opening a demo account with Angel One. A demo account allows you to explore the platform, test your trading strategies, and familiarize yourself with the tools and features in a risk-free environment.

Step-by-Step Guide: Opening Your Angel One Account

Now that you’re convinced of the benefits of opening an Angel One account, let’s walk through the process step by step:

- Visit the Angel One Website: Begin by accessing the official Angel One website at https://www.angelone.in.

- Locate the Account Opening Section: Look for the section dedicated to opening a new account. It may be labeled as “Open Demat Account,” “New Account,” or “Sign Up.”

- Complete the application form: Fill out the online application form with your personal details, contact information, and investment experience level (beginner, intermediate, or advanced).

- Submit Required Documents: To comply with Know Your Customer (KYC) regulations, you’ll need to provide certain documents for verification. Typically, this includes a PAN card, Aadhaar card (or any other government-issued ID proof), and address proof. Upload clear and legible scanned copies of these documents.

- E-Sign the Agreement: Angel One offers the convenience of e-signature, allowing you to electronically sign the account opening agreement using your Aadhaar card. This streamlines the verification process and eliminates the need for physical paperwork.

- Account Activation: Once your documents are verified and your application is approved, your Angel One account will be activated. You’ll receive a confirmation via email or SMS, along with your login credentials.

Congratulations! You have successfully opened your Angel One account and are ready to embark on your stock market investing journey.

Navigating the Angel One ARQ Platform

With your Angel One account up and running, it’s time to familiarize yourself with the Angel One ARQ trading platform. Here are some key features to explore:

- Market Watch: Stay up-to-date with real-time market data for stocks, indices, and commodities. Create personalized watchlists to monitor the performance of your favorite stocks and track price movements.

- Advanced Charting Tools: Utilize Angel One ARQ’s powerful charting tools to analyze market trends and identify potential trading opportunities. Access a wide range of technical indicators and drawing tools to support your investment decisions.

- Order Placement: Execute trades seamlessly within the platform. Angel One ARQ offers various order types, such as market orders, limit orders, and stop-loss orders, catering to different trading strategies and risk preferences.

- Portfolio Management: Keep a close eye on your investment performance. The platform provides a comprehensive view of your portfolio, including your holdings, unrealized profits or losses, and overall portfolio value.

- Research and Insights: Benefit from Angel One’s in-house research team’s expertise. Access detailed research reports, market insights, and investment recommendations to make well-informed decisions.

Take the time to explore the Angel One ARQ platform thoroughly. The more familiar you become with its features and capabilities, the more effectively you can leverage them to enhance your trading experience.

Essential Considerations Before Placing Your First Trade

While opening an Angel One account is a significant step, it’s important to approach stock market investing with caution and preparation. Consider the following essential aspects before placing your first trade:

- Develop a Trading Plan: Create a well-defined trading plan that outlines your investment goals, risk tolerance, and strategies. Conduct thorough research, analyze market trends, and identify potential investment opportunities that align with your objectives.

- Start with Small Investments: As a beginner, it’s wise to start with smaller investment amounts and gradually increase your exposure as you gain experience and confidence. This approach allows you to learn from your mistakes without risking significant capital.

- Utilize the Demo Account: Take advantage of Angel One’s demo account feature. Practice trading with virtual funds to familiarize yourself with the platform, test your strategies, and gain hands-on experience without the risk of losing real money.

- Stay Informed and Educated: Continuously educate yourself about the stock market, economic trends, and the companies you invest in. Stay updated on news and events that may impact stock prices and make informed decisions based on reliable information.

- Consider Seeking Professional Advice: If you’re unsure about your investment strategies or need guidance, consider consulting with a qualified financial advisor. They can provide personalized recommendations based on your specific financial situation and goals.

Remember, successful investing requires patience, discipline, and a long-term perspective. Opening an Angel One account is just the beginning of your journey. Continuously learn, adapt, and refine your strategies as you gain experience in the dynamic world of stock market investing.

Conclusion

Opening an Angel One account is a significant step towards unlocking the potential of the stock market and taking control of your financial future. By following the step-by-step guide outlined in this article and considering the essential factors discussed, you can confidently navigate the process and embark on your investing journey with Angel One.

However, it’s crucial to approach stock market investing with a well-informed and disciplined mindset. Develop a solid trading plan, start with small investments, utilize the educational resources available, and continuously educate yourself about the market and the companies you invest in.

Remember, investing carries inherent risks, and it’s essential to invest within your means and risk tolerance. Never invest more than you can afford to lose, and always prioritize the preservation of your capital.

With Angel One as your trusted partner and a commitment to continuous learning and responsible investing, you can unlock the doors to the exciting world of stock market investing and work to

Unlocking the Doors to Stock Market Investing: Your Guide to Opening an Angel One Account

The stock market has long been a fascinating avenue for individuals seeking to grow their wealth and secure their financial future. However, venturing into the world of investing can be intimidating, especially for those new to the game. That’s where Angel One comes in – a leading discount broking firm in India that offers a user-friendly platform for investors of all levels. In this comprehensive guide, we’ll walk you through the process of opening an Angel One account, empowering you to embark on your stock market journey with confidence.

Is Angel One the Right Fit for Your Investment Goals?

Before diving into the nitty-gritty of opening an Angel One account, it’s crucial to assess whether this platform aligns with your investment objectives and style. Consider the following factors:

- Investment Goals: Reflect on your short-term and long-term financial aspirations. Are you aiming for quick profits through short-term trading, or are you more focused on long-term wealth creation? Angel One caters to a wide range of investors, so ensure that their offerings align with your goals.

- Trading Experience: Evaluate your level of familiarity with the stock market. Are you a beginner just starting out, or do you have prior experience in trading? Angel One provides resources and tools for investors of all levels, but it’s essential to consider your comfort level and willingness to learn.

- Investment Capital: Assess the amount of capital you’re comfortable investing in the stock market. While Angel One allows you to start with a relatively low amount, it’s crucial to invest within your means and in line with your risk tolerance.

Remember, opening an Angel One account is just the first step in your investment journey. Successful investing requires continuous learning, disciplined decision-making, and a well-defined strategy.

The Advantages of Opening an Angel One Account

Now that you’ve determined that Angel One aligns with your investment goals, let’s explore the benefits of opening an account with this renowned discount broker:

- Cost-Effective Trading: As a discount broker, Angel One offers competitive brokerage fees, allowing you to keep more of your profits. Lower transaction costs can have a significant impact on your overall returns, especially if you plan to trade frequently.

- User-Friendly Trading Platform: Angel One’s flagship trading platform, Angel One ARQ, is designed to cater to both novice and experienced investors. With its intuitive interface, advanced charting tools, and real-time market data, you can navigate the platform with ease and make informed trading decisions.

- Mobile Trading App: In today’s fast-paced world, the ability to trade on the go is invaluable. Angel One’s mobile app allows you to manage your investments, place trades, and monitor your portfolio performance from the palm of your hand.

- Diverse Account Options: Angel One offers a range of account types to suit different investor profiles. Whether you’re interested in equity trading, commodity trading, or margin trading, you can choose an account that aligns with your specific needs.

Important Note: If you’re considering margin trading, it’s crucial to understand the associated risks. Margin trading involves borrowing funds from the broker to amplify your investment positions, which can potentially magnify both profits and losses. Exercise caution and have a robust risk management strategy in place.

Why Choose Angel One Over Other Brokers?

With numerous broking firms vying for your attention, you might wonder what sets Angel One apart. Here are a few compelling reasons to consider opening an Angel One account:

- Established Reputation: Angel One is a well-respected and trusted name in the Indian brokerage industry. With a proven track record of reliability and customer satisfaction, you can have peace of mind knowing that your investments are in capable hands.

- Cutting-Edge Technology: Angel One is committed to staying at the forefront of technological advancements. The company continuously invests in enhancing its trading platform, ensuring a seamless and feature-rich experience for its users.

- Educational Resources: If you’re new to the world of investing, Angel One provides a wealth of educational resources to help you get started. From beginner-friendly tutorials to in-depth market analysis, you can access the knowledge and insights needed to make informed investment decisions.

- Robust Customer Support: Angel One understands the importance of prompt and reliable customer support. Whether you have a question about account opening, need assistance with a trade, or require technical support, their dedicated team is ready to help you every step of the way.

Expert Tip: Before committing real money, consider opening a demo account with Angel One. A demo account allows you to explore the platform, test your trading strategies, and familiarize yourself with the tools and features in a risk-free environment.

Step-by-Step Guide: Opening Your Angel One Account

Now that you’re convinced of the benefits of opening an Angel One account, let’s walk through the process step by step:

- Visit the Angel One Website: Begin by accessing the official Angel One website at https://www.angelone.in.

- Locate the Account Opening Section: Look for the section dedicated to opening a new account. It may be labeled as “Open Demat Account,” “New Account,” or “Sign Up.”

- Complete the Application Form: Fill out the online application form with your personal details, contact information, and investment experience level (beginner, intermediate, or advanced).

- Submit Required Documents: To comply with Know Your Customer (KYC) regulations, you’ll need to provide certain documents for verification. Typically, this includes a PAN card, Aadhaar card (or any other government-issued ID proof), and address proof. Upload clear and legible scanned copies of these documents.

- E-Sign the Agreement: Angel One offers the convenience of e-signature, allowing you to electronically sign the account opening agreement using your Aadhaar card. This streamlines the verification process and eliminates the need for physical paperwork.

- Account Activation: Once your documents are verified and your application is approved, your Angel One account will be activated. You’ll receive a confirmation via email or SMS, along with your login credentials.

Congratulations! You have successfully opened your Angel One account and are ready to embark on your stock market investing journey.

Navigating the Angel One ARQ Platform

With your Angel One account up and running, it’s time to familiarize yourself with the Angel One ARQ trading platform. Here are some key features to explore:

- Market Watch: Stay up to date with real-time market data for stocks, indices, and commodities. Create personalized watchlists to monitor the performance of your favorite stocks and track price movements.

- Advanced Charting Tools: Utilize Angel One ARQ’s powerful charting tools to analyze market trends and identify potential trading opportunities. Access a wide range of technical indicators and drawing tools to support your investment decisions.

- Order Placement: Execute trades seamlessly within the platform. Angel One ARQ offers various order types, such as market orders, limit orders, and stop-loss orders, catering to different trading strategies and risk preferences.

- Portfolio Management: Keep a close eye on your investment performance. The platform provides a comprehensive view of your portfolio, including your holdings, unrealized profits or losses, and overall portfolio value.

- Research and Insights: Benefit from Angel One’s in-house research team’s expertise. Access detailed research reports, market insights, and investment recommendations to make well-informed decisions.

Take the time to explore the Angel One ARQ platform thoroughly. The more familiar you become with its features and capabilities, the more effectively you can leverage them to enhance your trading experience.

Essential Considerations Before Placing Your First Trade

While opening an Angel One account is a significant step, it’s important to approach stock market investing with caution and preparation. Consider the following essential aspects before placing your first trade:

- Develop a Trading Plan: Create a well-defined trading plan that outlines your investment goals, risk tolerance, and strategies. Conduct thorough research, analyze market trends, and identify potential investment opportunities that align with your objectives.

- Start with Small Investments: As a beginner, it’s wise to start with smaller investment amounts and gradually increase your exposure as you gain experience and confidence. This approach allows you to learn from your mistakes without risking significant capital.

- Utilize the Demo Account: Take advantage of Angel One’s demo account feature. Practice trading with virtual funds to familiarize yourself with the platform, test your strategies, and gain hands-on experience without the risk of losing real money.

- Stay Informed and Educated: Continuously educate yourself about the stock market, economic trends, and the companies you invest in. Stay updated on news and events that may impact stock prices and make informed decisions based on reliable information.

- Consider Seeking Professional Advice: If you’re unsure about your investment strategies or need guidance, consider consulting with a qualified financial advisor. They can provide personalized recommendations based on your specific financial situation and goals.

Remember, successful investing requires patience, discipline, and a long-term perspective. Opening an Angel One account is just the beginning of your journey. Continuously learn, adapt, and refine your strategies as you gain experience in the dynamic world of stock market investing.

Conclusion

Opening an Angel One account is a significant step towards unlocking the potential of the stock market and taking control of your financial future. By following the step-by-step guide outlined in this article and considering the essential factors discussed, you can confidently navigate the process and embark on your investing journey with Angel One.

However, it’s crucial to approach stock market investing with a well-informed and disciplined mindset. Develop a solid trading plan, start with small investments, utilize the educational resources available, and continuously educate yourself about the market and the companies you invest in.

Remember, investing carries inherent risks, and it’s essential to invest within your means and risk tolerance. Never invest more than you can afford to lose, and always prioritize the preservation of your capital.

With Angel One as your trusted partner and a commitment to continuous learning and responsible investing, you can unlock the doors to the exciting world of stock market investing and work towards achieving your financial goals.

Happy investing!

Add Comment