Banking has evolved to keep up with our busy lifestyles. Gone are the days of standing in long lines and filling out endless paperwork to open a bank account. With Axis Bank, you can now embark on your digital banking journey from the comfort of your own home. In this comprehensive guide, we’ll walk you through the steps to open an Axis Bank account online, highlighting the benefits and addressing common questions along the way.

Why Choose Axis Bank for Your Online Banking Needs?

Axis Bank, one of India’s leading private sector banks, offers a seamless online account opening process that combines convenience, speed, and security. Here are some compelling reasons to open an Axis Bank account online:

- Convenience at Your Fingertips: With online account opening, you can bid farewell to the hassle of visiting a physical branch. The entire process can be completed from anywhere, at any time, using your computer or mobile device.

- Swift and Efficient: Say goodbye to lengthy wait times and endless paperwork. Opening an Axis Bank account online is a breeze, taking just a matter of minutes to complete.

- Paperless and Eco-Friendly: Embrace the digital revolution and contribute to a greener planet by eliminat ing the need for physical forms and documents. Axis Bank’s online account opening process is entirely paperless.

- Transparency and Accessibility: With an online account, you have 24/7 access to your account details, transaction history, and a wide range of banking services at your fingertips.

- Secure Video KYC: Axis Bank has introduced a secure video KYC (Know Your Customer) process, allowing you to complete the necessary verification steps remotely without the need for physical document submission.

Choosing the Right Axis Bank Account for You

Axis Bank offers a diverse range of savings account options tailored to suit various customer needs. When opening an account online, you can choose from the following popular options:

- Easy Savings Account: Ideal for those new to banking or who prefer maintaining a minimal balance. This account requires no initial deposit and comes with essential banking features.

- Salary Advantage Savings Account: Designed for salaried individuals, this account offers exclusive benefits such as higher interest rates and preferential services.

- Insta Savings Account: Enjoy the convenience of a RuPay debit card and earn interest on your daily balance. This account is perfect for those who value flexibility and accessibility.

- Prime Savings Account: Tailored for customers who maintain a higher average monthly balance, the Prime Savings Account offers attractive interest rates and premium banking privileges.

Consider your banking requirements and financial goals when selecting the account type that aligns with your needs.

Documents Required for Online Account Opening

One of the advantages of opening an Axis Bank account online is the minimal documentation required. To initiate the process, ensure you have the following documents readily available:

- PAN Card: A valid Permanent Account Number (PAN) card is mandatory for opening any bank account in India.

- Aadhaar Card (Optional): While not compulsory, providing your Aadhaar card details streamlines the KYC process and adds an extra layer of authentication.

- Valid Photo ID: You’ll need to furnish a government-issued photo identification document such as a passport, driver’s license, or voter ID card.

Having these documents handy will ensure a smooth and hassle-free online account opening experience.

Step-by-Step Guide to Opening an Axis Bank Account Online

Follow these simple steps to open your Axis Bank account online:

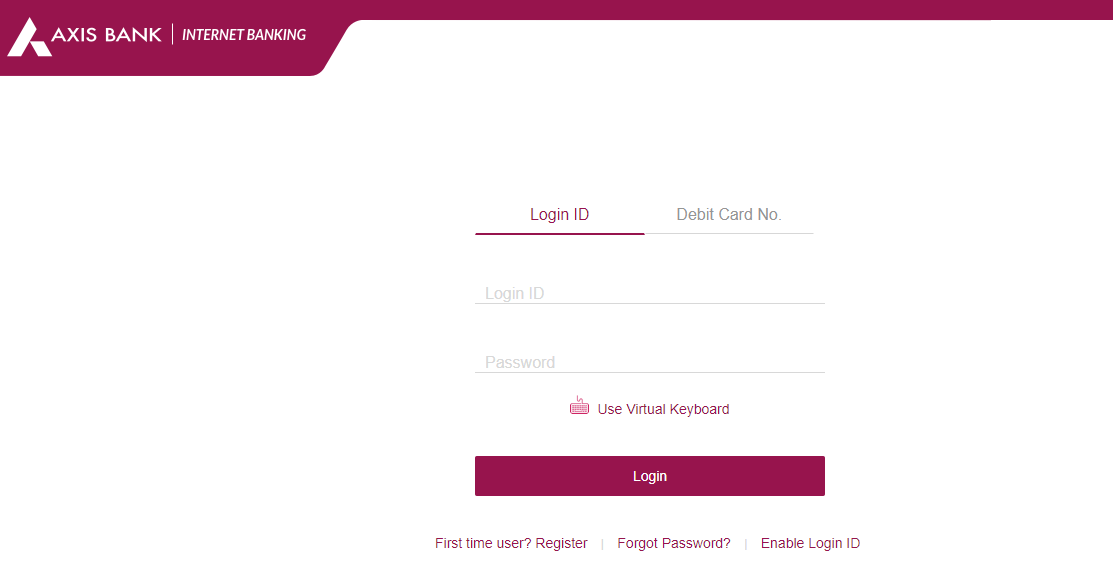

Step 1: Access the Axis Bank Online Portal

Visit the official Axis Bank website or download the Axis Mobile app from the App Store or Google Play Store to begin your online account opening journey.

Step 2: Select Your Preferred Account Type

Navigate to the “Accounts” section and explore the various savings account options available. Choose the account that best aligns with your banking needs and financial goals.

Step 3: Fill Out the Online Application Form

Once you’ve selected your desired account type, you’ll be directed to the online application form. Provide accurate information in the following sections:

- Personal Details: Enter your full name, date of birth, mobile number, and email address.

- Communication Address: Provide your permanent address and any additional communication address, if applicable.

- Occupation Details: Mention your occupation and employer details (if required for the chosen account type).

- Account Details: Choose a preferred username and password for your online banking access and set your debit card PIN.

Double-check all the information entered to avoid any discrepancies that may delay your account activation.

Step 4: Complete the Video KYC Process

Axis Bank has revolutionized the KYC process with its secure video KYC feature. Here’s what you need to know:

- Schedule a Video Call: Select a convenient time slot for your video KYC call with an Axis Bank representative.

- Prepare for the Call: Ensure a stable internet connection, a functional webcam, and good lighting for a seamless video KYC experience. Keep your original PAN card and Aadhaar card (or other valid ID proof) handy for verification.

- Verification Process: During the video call, the bank representative will guide you through the verification steps, requesting you display your original documents and perform simple live actions to confirm your identity.

Cooperate with the representative and communicate clearly to ensure a smooth and successful video KYC process.

Step 5: Activate Your Axis Bank Account

Upon successful completion of the video KYC, your Axis Bank account will be activated. You’ll receive a confirmation email and SMS containing your account details and login credentials.

Exploring the Features of Axis Bank Online Banking

With your newly opened Axis Bank account, a world of digital banking features awaits you. Download the Axis Mobile app on your smartphone or tablet for on-the-go access to your account. Once logged in, you can:

- Check your account balance and transaction history

- Transfer funds to other accounts seamlessly

- Pay bills, recharge your mobile phone, and make utility payments

- Explore investment opportunities like mutual funds (depending on your account type)

- Manage your debit card settings and request new checkbooks.

Axis Bank’s online banking portal opens up a world of convenience, allowing you to manage your finances anytime, anywhere.

Frequently Asked Questions

Let’s address some common questions that may arise when opening an Axis Bank account online:

- Can I open an Axis Bank account online without an Aadhaar card?

Yes, while an Aadhaar card simplifies the KYC process, it’s not mandatory. You can proceed with the online application using your PAN card and another valid government-issued photo ID. - Are there any charges for opening an Axis Bank account online?

Most Axis Bank savings accounts have no charges for online account opening. However, some accounts may have minimum balance requirements or transaction charges. Review the specific terms and conditions of your chosen account type for detailed information. - How long does the online account opening process take?

The entire process, including filling out the application form and completing the video KYC, typically takes around 15-20 minutes, subject to a stable internet connection. - Can I deposit cash in my Axis Bank account opened online?

Yes, once your account is activated, you can deposit cash at any Axis Bank branch using the account number provided after successful online account opening. - What if I encounter technical issues during the online application process?

Axis Bank offers round-the-clock customer support. You can contact their dedicated customer care team via phone, email, or chat for assistance with any technical difficulties you may face during the online account opening process.

Embrace the Future of Banking with Axis Bank

Opening an Axis Bank account online is a testament to the bank’s commitment to providing a seamless and convenient banking experience. By following the step-by-step guide outlined in this article and understanding the benefits and requirements, you can confidently embark on your digital banking journey with Axis Bank.

Say goodbye to the hassles of traditional banking and embrace the future of finance with Axis Bank’s online account opening process. With a wide range of account options, minimal documentation, and a secure video KYC process, opening an Axis Bank account online is a smart choice for those seeking convenience, flexibility, and a modern banking experience.

Take control of your financial life and enjoy the benefits of digital banking with Axis Bank. Open your account online today and discover a world of possibilities at your fingertips.

Add Comment