Retirement planning might seem like a distant concern, but taking proactive steps towards financial security early in your career can make a significant difference in your golden years. In India, the Employees’ Provident Fund (EPF) is a government-backed savings scheme designed to help salaried individuals accumulate funds for retirement. If you’re wondering how to open an EPF account and start reaping its benefits, this comprehensive guide will walk you through the process, ensuring a smooth and secure experience.

What is an EPF account?

The Employees’ Provident Fund (EPF) is a retirement savings scheme managed by the Employees’ Provident Fund Organization (EPFO), a government entity in India. It is a mandatory savings plan for salaried employees, where both the employee and the employer contribute a fixed percentage of the employee’s salary towards the EPF account. These contributions accumulate over time, along with the interest earned, creating a substantial retirement corpus.

Who is eligible for an EPF account?

Most salaried employees in India are eligible for an EPF account. Here are the key eligibility criteria:

- Age: Employees below the age of 58 are eligible for EPF membership.

- Salary: Employees earning a basic salary of more than ₹15,000 per month are required to contribute to EPF. However, even if your salary is below this threshold, you can still choose to contribute voluntarily.

- Establishment Size: Companies with 20 or more employees are mandated to register with the EPFO and provide EPF benefits to their employees. Smaller establishments can also choose to participate voluntarily.

Benefits of Opening an EPF Account

Opening an EPF account offers several attractive benefits for salaried employees:

- Compulsory Savings: The EPF scheme enforces regular savings by automatically deducting a portion of your salary each month, helping you build a retirement corpus effortlessly.

- Employer Contribution: In addition to your own contributions, your employer also contributes an equal amount towards your EPF account, significantly boosting your retirement savings.

- Tax Benefits: Your contributions to the EPF account are eligible for tax deductions under Section 80C of the Income Tax Act, reducing your taxable income.

- Competitive Interest Rates: The EPF scheme offers attractive interest rates on your contributions, which are declared annually by the government. These interest rates are usually higher than those offered by traditional savings accounts.

- Life Insurance Coverage: EPF accounts come with a built-in life insurance component, providing financial security for your dependents in case of unfortunate events.

- Pension Benefits: Upon reaching retirement age, you can opt to receive a regular pension from your EPF corpus, ensuring a steady income stream in your golden years.

Step-by-Step Guide: How to Open an EPF Account

Now that you understand the eligibility criteria and benefits of an EPF account, let’s dive into the step-by-step process of opening one:

Step 1: The employer initiates the Process

The primary responsibility of opening an EPF account lies with your employer. They are required to register their establishment with the EPFO and enroll eligible employees into the EPF scheme. If your company has 20 or more employees, EPF registration is mandatory. Smaller establishments can choose to participate voluntarily.

Step 2: Provide the necessary information to Your Employer

Once your employer initiates the EPF registration process, they will require certain information from you. This typically includes:

- Full Name

- Date of Birth

- Permanent Account Number (PAN)

- Aadhar Card Number

- Bank Account Details

Ensure that you provide accurate and up-to-date information to your employer to facilitate a smooth registration process.

Step 3: The employer completes the Registration

Your employer will submit the necessary documents and information to the EPFO, including the details provided by you. They will also make the required contributions towards your EPF account on a monthly basis.

Step 4: Obtain Your Universal Account Number (UAN)

Upon successful registration, the EPFO will generate a unique 12-digit number called the Universal Account Number (UAN) for each employee. Your employer will provide you with your UAN, which serves as your permanent identification number for all EPF-related transactions.

Step 5: Activate Your UAN

To access your EPF account online and avail various services, you need to activate your UAN. Here’s how you can do it:

- Visit the official EPFO website: https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Click on the “Activate UAN” option.

- Enter your UAN, personal details, and mobile number.

- Set a password for your account.

- Your UAN will be activated, and you can now access your EPF account online.

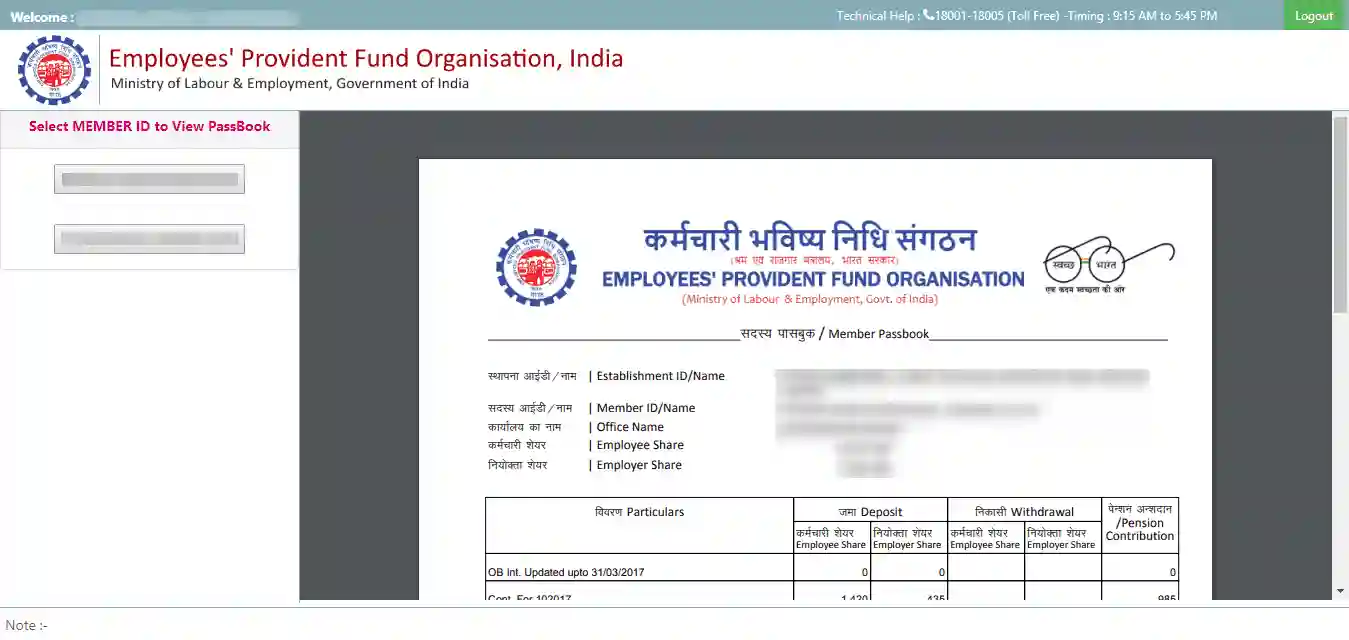

Managing Your EPF Account Online

Once your UAN is activated, you can easily manage your EPF account online through the EPFO portal. Here are some key features and services available:

Check Your EPF Balance

You can check your EPF account balance and view your contribution history by logging into your account on the EPFO portal. This allows you to keep track of your retirement savings and ensure that your employer is making regular contributions.

Update Your Personal Information

It’s important to keep your personal information, such as contact details and bank account information, up-to-date in your EPF account. You can easily update these details online through the EPFO portal.

Nomination Facility

The EPF scheme allows you to nominate beneficiaries who will receive the accumulated funds in your account in the event of your unfortunate demise. You can add or modify your nominees online through the EPFO portal.

Partial Withdrawals

In certain circumstances, such as medical emergencies, marriage, or home loan down payments, you can make partial withdrawals from your EPF account. The EPFO portal provides an online facility to apply for these withdrawals, making the process convenient and hassle-free.

Frequently Asked Questions (FAQs)

1. Can I open an EPF account independently if my employer doesn’t provide it?

No, the EPF account is primarily opened through your employer. If your employer meets the eligibility criteria (20 or more employees), they are legally obligated to provide EPF benefits to their employees.

2. What happens to my EPF account if I change jobs?

Your EPF account remains portable across employers. When you change jobs, you can transfer your EPF balance from your previous employer to your new employer’s EPF account. Alternatively, you can choose to keep your EPF account active with the previous employer and continue to earn interest on the accumulated funds.

3. How much do I need to contribute towards my EPF account?

As per the current EPF rules, employees are required to contribute 12% of their basic salary and dearness allowance towards their EPF account. The employer makes an equal contribution of 12%, out of which 8.33% goes towards the Employee’s Pension Scheme (EPS), and the remaining 3.67% is deposited into the EPF account.

4. Can I make voluntary contributions to my EPF account?

Yes, you can make voluntary contributions to your EPF account over and above the mandatory 12% contribution. This can help you boost your retirement savings and avail additional tax benefits.

5. Is there a minimum amount required to open an EPF account?

There is no minimum amount required to open an EPF account. The contributions are calculated based on your salary, and the account is opened by your employer as part of the mandatory EPF scheme.

Conclusion

Opening an EPF account is a crucial step towards securing your financial future and building a substantial retirement corpus. By understanding the eligibility criteria, benefits, and the step-by-step process involved, you can ensure that you are making the most of this valuable savings scheme. Remember to actively manage your EPF account, keep your information up-to-date, and make informed decisions about withdrawals and nominations.

While the EPF scheme is an excellent foundation for retirement planning, it’s important to explore other investment options and seek professional financial advice to create a well-rounded retirement portfolio. By taking control of your finances and making informed decisions, you can pave the way for a comfortable and financially secure retirement.

Add Comment