Tesla (TSLA) has been a driving force in the global shift towards electric vehicles, captivating investors with its innovative technology and ambitious growth plans. However, as the company’s stock price continues to soar, many are left wondering: is Tesla’s valuation justified, or is it fueled by overvalued hype? To answer this question, we’ll dive deep into a Discounted Cash Flow (DCF) valuation of Tesla and examine the key factors influencing its current market price.

The Fundamentals of DCF Valuation

Before we delve into Tesla’s specific case, let’s take a moment to understand the core principles of DCF valuation. This financial modeling technique aims to determine the intrinsic value of a company by projecting its future cash flows and discounting them back to their present value. The process can be broken down into three main steps:

- Forecasting Future Cash Flows: Analysts estimate the company’s future free cash flows over a specific period, typically several years into the future. Free cash flow represents the amount of cash a company generates after accounting for its operating expenses and capital expenditures.

- Discounting to Present Value: Since the value of money changes over time (a concept known as the time value of money), the projected future cash flows are discounted back to their present value using a discount rate. This rate accounts for the risk associated with the investment and the expected return on alternative investments.

- Calculating Intrinsic Value: The present values of all the projected cash flows are summed up to arrive at the company’s estimated intrinsic value. This value represents what the company is theoretically worth based on its expected future performance.

By comparing the intrinsic value derived from the DCF valuation to the company’s current market price, investors can assess whether the stock is undervalued, fairly valued, or overvalued.

Applying DCF Valuation to Tesla

Now that we’ve covered the basics of DCF valuation, let’s apply this method to analyze Tesla’s stock. To conduct a comprehensive valuation, we must consider several crucial factors that impact the company’s future cash flows and overall financial performance.

Factor 1: Growth Trajectory

One of the primary drivers of Tesla’s valuation is its potential for future growth. The company’s ability to expand its production capacity, increase its market share in the electric vehicle sector, and successfully venture into new business segments like solar energy and autonomous driving will significantly influence its future cash flows. When forecasting Tesla’s growth, analysts must weigh the company’s historical performance, its strategic plans, and the overall market demand for electric vehicles.

Factor 2: Competitive Landscape

The electric vehicle market is becoming increasingly competitive, with established automakers and emerging startups alike vying for a piece of the pie. Tesla’s valuation must account for its ability to maintain its competitive edge in terms of technology, brand recognition, and customer loyalty. Analysts must assess how Tesla’s market position may evolve as more players enter the space and how this could impact the company’s future cash flows.

Factor 3: Path to Profitability

While Tesla has demonstrated impressive revenue growth in recent years, the company’s profitability has been a point of concern for some investors. When applying the DCF valuation method, analysts must consider Tesla’s potential path to achieving and sustaining profitability. This involves examining factors such as the company’s ability to scale its operations efficiently, reduce production costs, and generate consistent positive cash flows.

Factor 4: Discount Rate Selection

The discount rate used in the DCF valuation plays a crucial role in determining Tesla’s intrinsic value. This rate should reflect the inherent risk associated with investing in Tesla and the expected return on alternative investments. A higher discount rate, which accounts for greater uncertainty in Tesla’s future performance, will result in a lower estimated intrinsic value. Conversely, a lower discount rate, reflecting a more optimistic outlook, will yield a higher intrinsic value estimate.

Interpreting the DCF Valuation Results

Given the complexity of the factors involved, it’s not surprising that financial analysts applying DCF models to Tesla arrive at a wide range of valuation estimates. Some analysts conclude that Tesla’s intrinsic value is significantly lower than its current market price, suggesting that the stock is overvalued. Others, however, factor in Tesla’s disruptive potential and long-term growth prospects, arriving at valuations closer to or even exceeding the current market price.

It’s important to recognize that the results of a DCF valuation are highly sensitive to the assumptions made about Tesla’s future performance. Small changes in the projected growth rates, profit margins, or discount rate can lead to substantial differences in the final valuation. As such, investors should view DCF valuation as a tool to inform their decision-making process rather than a definitive answer to whether Tesla’s stock is appropriately priced.

Beyond DCF: Additional Valuation Considerations

While DCF valuation provides valuable insights into Tesla’s intrinsic value, it’s not the only factor influencing the company’s stock price. Investors must also consider the following aspects when evaluating Tesla’s valuation:

Market Sentiment and Investor Psychology

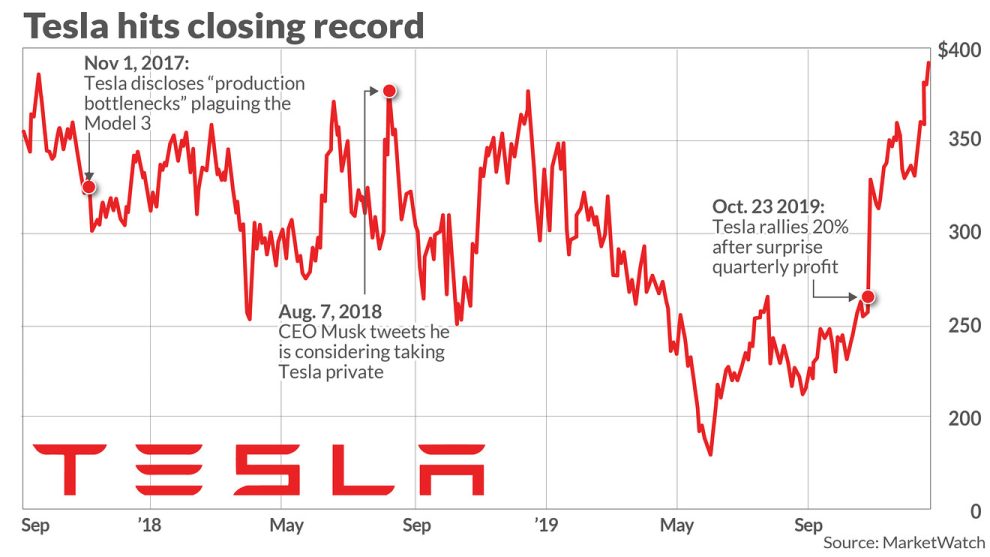

The stock market is driven not only by fundamental analysis but also by the collective sentiments and emotions of investors. Tesla’s strong brand recognition, its association with innovation and sustainability, and the charismatic leadership of Elon Musk have all contributed to a sense of excitement and optimism surrounding the company. This positive market sentiment can lead to a higher stock price, even if the underlying fundamentals suggest a lower intrinsic value.

Technological Leadership and Disruptive Potential

Tesla’s position at the forefront of the electric vehicle revolution and its reputation for pushing the boundaries of automotive technology can command a premium in the market. Investors may be willing to pay a higher price for Tesla’s stock, betting on the company’s potential to disrupt the traditional automotive industry and shape the future of transportation. The value placed on Tesla’s technological leadership and innovative spirit may not be fully captured by a DCF valuation alone.

Conclusion: Navigating the Complexity of Tesla’s Valuation

Assessing the fairness of Tesla’s stock price is a multifaceted challenge that requires a deep understanding of the company’s fundamentals, growth prospects, and the broader market dynamics. While a DCF valuation provides a useful starting point for estimating Tesla’s intrinsic value, it’s essential to recognize the limitations and uncertainties inherent in the process.

Ultimately, the decision to invest in Tesla should be based on a comprehensive analysis that takes into account not only the DCF valuation but also the company’s competitive position, its potential for innovation and disruption, and the overall market sentiment. Investors must weigh the potential rewards of being part of Tesla’s electrifying journey against the risks associated with its lofty valuation and the rapidly evolving electric vehicle landscape.

As with any investment decision, thorough research, a long-term perspective, and a clear understanding of one’s own risk tolerance are essential. By critically examining the factors driving Tesla’s valuation and staying attuned to the company’s ongoing developments, investors can make informed choices about whether Tesla deserves a place in their investment portfolios.

In the end, the question of whether Tesla’s stock price reflects its true potential or is driven by overvalued hype remains open to interpretation. As the electric vehicle market continues to evolve and Tesla’s story unfolds, investors will need to remain vigilant, adapting their views as new information comes to light. One thing, however, is certain: Tesla’s charged-up future is sure to keep the investment world captivated for years to come.

Add Comment