Artificial intelligence (AI) is no longer a buzzword; it’s a booming ecosystem churning out innovative solutions for every facet of life. With the promise of revolutionizing industries and transforming daily experiences, it’s no surprise that AI startups are attracting substantial investments from some of the world’s biggest financial titans. Let’s explore the vibrant world of AI funding and meet the investors fueling this futuristic gold rush.

Venture Capital Giants Backing the Future

Leading venture capital firms like Sequoia Capital, Andreessen Horowitz (a16z), and SoftBank Vision Fund are pouring billions into promising AI startups. Sequoia invested in OpenAI, the research lab behind ChatGPT and Dall-E 2, demonstrating their bullish outlook on generative AI. Andreessen Horowitz, with its aggressive AI-first strategy, has backed AI unicorns like Cohere and SambaNova, highlighting their belief in the transformative potential of the technology. SoftBank Vision Fund, with its massive capital, has invested in companies like Nauto (autonomous driving) and Meituan (AI-powered food delivery), showcasing their global reach and focus on diverse AI applications.

Beyond Unicorns: Emerging Stars Rise

Venture capitalists aren’t just playing the unicorn game. They’re actively seeking early-stage AI startups with disruptive potential. Firms like Y Combinator, First Round Capital, and General Catalyst are known for supporting early-stage AI ventures, identifying hidden gems like AnthropicAI (large language models) and Weights & Biases (MLOps platform). These investments signal their commitment to nurturing the next generation of AI leaders.

Industry-Specific Investors Join the Fray

Beyond traditional VC firms, corporations and industry players are actively investing in AI startups that address specific challenges within their domain. Healthcare giants like Pfizer and Johnson & Johnson are backing AI startups developing drug discovery tools and personalized medicine solutions. Retail leaders like Walmart and Amazon are investing in AI companies for logistics optimization and improved customer experiences. This trend towards domain-specific AI investments indicates a growing understanding of the technology’s value across various industries.

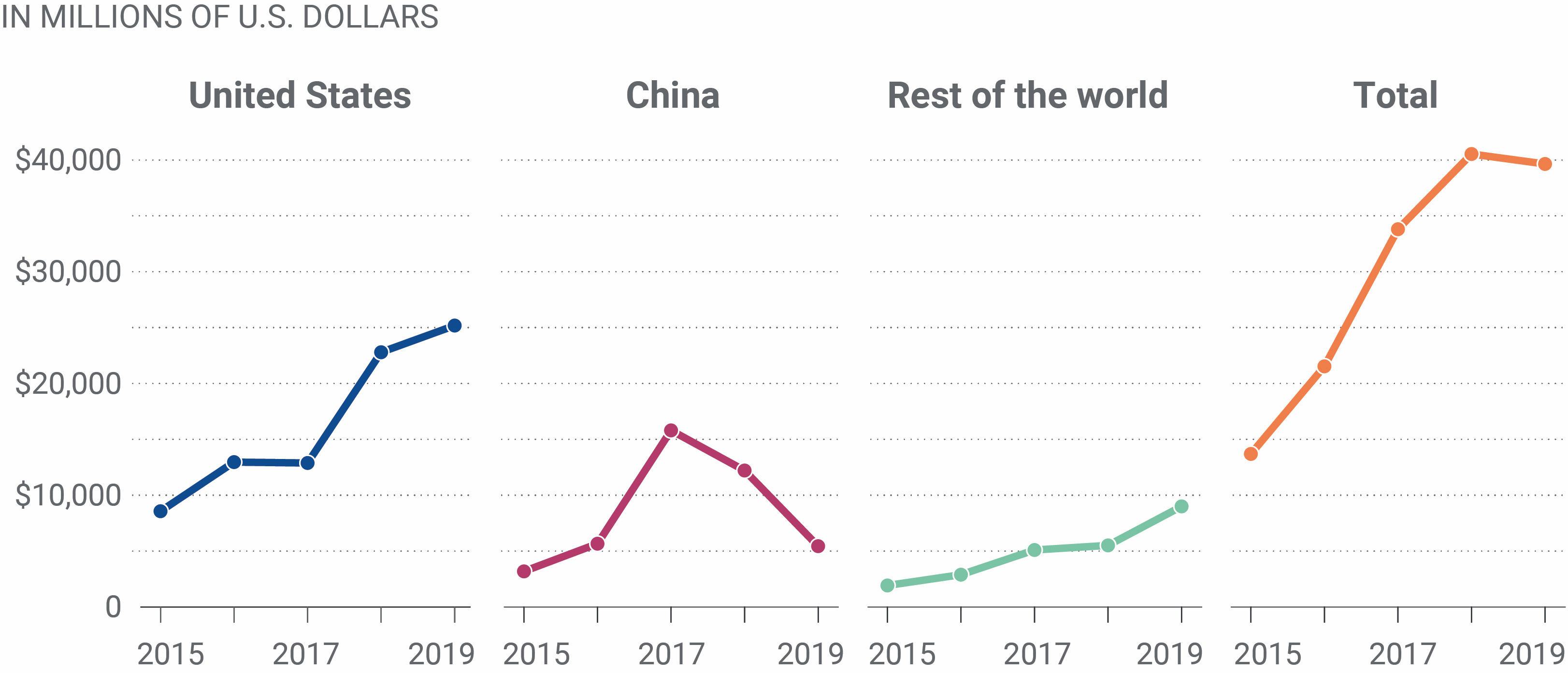

The Global AI Investment Landscape

The AI funding boom is not limited to Silicon Valley. China, with its ambitious AI roadmap, boasts significant investments from Tencent, Alibaba, and Baidu. Europe, with its focus on ethical AI development, sees substantial VC activity from Accel and Atomico. This global wave of AI investment points towards a future where AI innovation transcends borders and benefits diverse communities.

Conclusion

The AI gold rush is in full swing, with investors recognizing the immense potential of this transformative technology. Venture capitalists, industry giants, and global players are all placing bets on AI startups, shaping the future of various sectors and propelling us towards an AI-powered world. As this ecosystem continues to evolve, it’s crucial to ensure responsible development, ethical considerations, and equitable access to the benefits of AI for all.

Add Comment