Apple has taken a significant stride in expanding its contactless payment ecosystem by introducing Tap to Pay on iPhone in Italy. This groundbreaking feature, which debuted in the US last year, transforms iPhones into secure payment terminals, allowing merchants to accept contactless payments without the need for additional hardware. The Italian launch represents a major milestone for mobile payments in the country, providing a convenient and secure alternative for both consumers and businesses.

The Global Shift Towards Contactless Payments

The world of payments is undergoing a rapid transformation, with consumers increasingly favoring contactless payment methods such as credit cards, debit cards, and digital wallets. These payment options offer speed, convenience, and enhanced security compared to traditional methods. In Italy, while conventional point-of-sale (POS) terminals still dominate the market, there is a growing adoption of contactless payments among consumers.

How Tap to Pay on iPhone Works

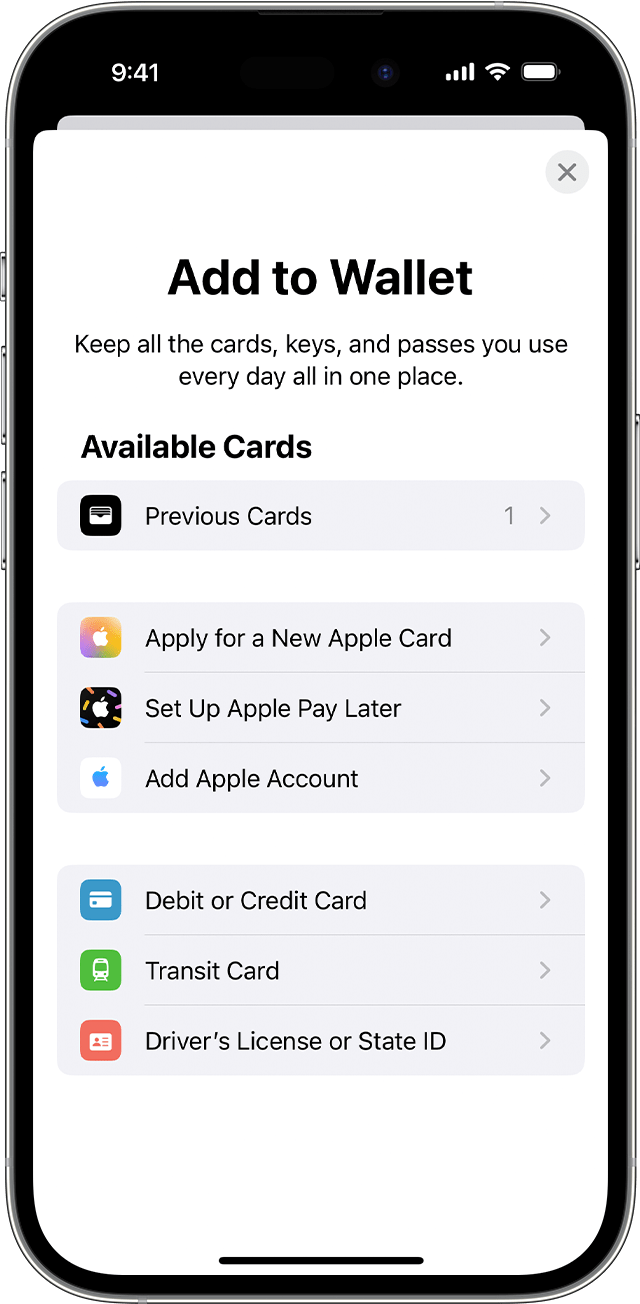

Tap to Pay on iPhone utilizes the Near Field Communication (NFC) technology already built into iPhones. The process is simple and straightforward:

- For Consumers: Instead of swiping a physical card or using a separate digital wallet app, consumers simply hold their iPhone near the merchant’s iPhone equipped with a compatible iOS app. The transaction is authenticated using facial recognition or Touch ID, and the payment is securely processed through Apple Pay.

- For Businesses: Merchants no longer need to invest in expensive POS terminals. They only require a compatible iOS app running on an iPhone or iPad. This eliminates the need for additional hardware, reducing costs and simplifying the payment setup process.

The Advantages of Tap to Pay on iPhone

The introduction of Tap to Pay on iPhone brings numerous benefits for both consumers and businesses:

- Increased Convenience: Tap to Pay eliminates the need for consumers to carry physical cards or open separate apps, offering a seamless and quick way to complete transactions.

- Enhanced Security: Tap to Pay leverages the robust security features of Apple Pay, including tokenization and secure element technology, making contactless payments more secure than traditional methods.

- Cost Savings for Businesses: By eliminating the need for expensive POS terminals and associated fees, Tap to Pay provides a cost-effective solution for businesses.

- Empowering Small Businesses: Tap to Pay enables even small businesses and pop-up shops to accept contactless payments, removing barriers to entry and potentially boosting sales.

Transforming Italy’s Payment Landscape

The arrival of Tap to Pay on iPhone has the potential to revolutionize the Italian payments ecosystem. While established players like Bancomat and contactless card payments have a strong presence, Tap to Pay offers a compelling alternative due to its simplicity, security, and cost-effectiveness.

Initial reports from Italy indicate that businesses are enthusiastically adopting Tap to Pay. Major retailers like Apple Stores have embraced the technology, while smaller businesses are recognizing the potential benefits. Payment processing platforms like Viva.com are also integrating Tap to Pay within their iOS apps, providing a seamless solution for businesses of all sizes.

The Road Ahead for Tap to Pay in Italy

The success of Tap to Pay in Italy will depend on several key factors:

- Consumer Adoption: Encouraging consumers to switch from traditional payment methods to Tap to Pay will be crucial. Educational campaigns highlighting the benefits of contactless payments will play a vital role.

- Merchant Support: Expanding the network of businesses that accept Tap to Pay will be essential for widespread adoption. Collaborating with payment processors and industry associations can accelerate this process.

- Security and Privacy: Maintaining robust security measures and ensuring user privacy will be paramount in building trust among consumers.

A Global Phenomenon: Tap to Pay’s Worldwide Expansion

Italy joins a growing list of countries where Tap to Pay is now available, including the US, France, the UK, and the Netherlands. This global expansion demonstrates Apple’s commitment to transforming the mobile payment landscape and providing a convenient and secure alternative for consumers and businesses worldwide.

Embracing the Future of Payments in Italy

The introduction of Tap to Pay on iPhone in Italy marks a significant step towards a more convenient and secure future for mobile payments. With its potential benefits for both consumers and businesses, Tap to Pay has the capacity to become a widely adopted payment method in the Italian market.

As consumer awareness grows and businesses embrace this innovative technology, we can anticipate a substantial shift towards contactless payments in Italy. The future of payments in the country seems to be firmly rooted in the tap of an iPhone, ushering in a new era of convenience and security for all.

Add Comment