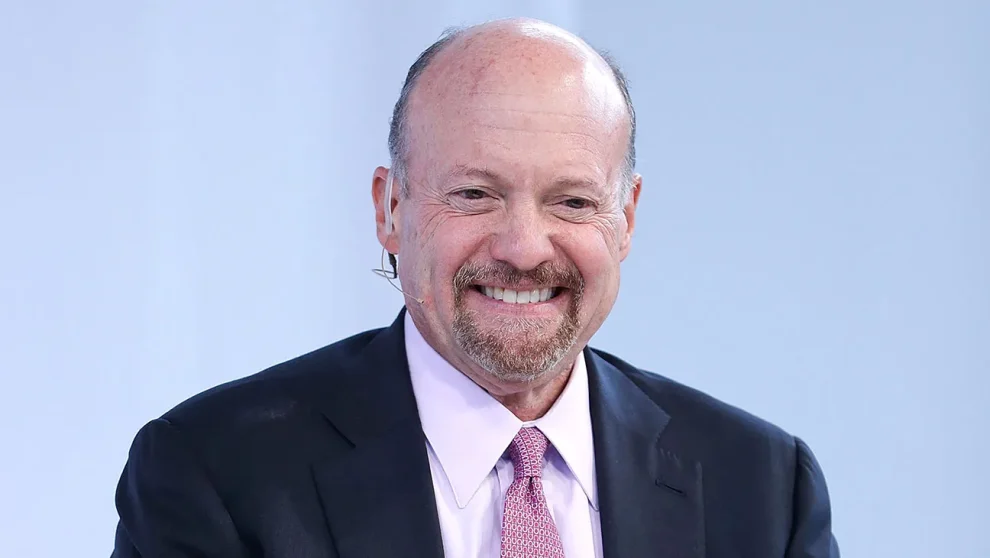

CNBC’s Jim Cramer pushes back on recent downgrades of Amazon and Apple, urging investors to stick with solid companies despite market fluctuations.

In a bold stance against recent Wall Street sentiment, CNBC’s Jim Cramer has come out swinging in defense of tech giants Amazon and Apple. On Monday, October 7, 2024, as the market faced a sea of red, Cramer urged investors to look beyond short-term fluctuations and focus on the long-term potential of these industry leaders.

Market Downturn Sparks Debate

As the closing bell rang on Monday, the numbers painted a grim picture:

– Dow Jones Industrial Average: Down 0.94%

– S&P 500: Shed 0.96%

– Nasdaq Composite: Declined 1.18%

These drops came amidst what Cramer described as a “ridiculous plethora of sell-side downgrades.” However, the veteran market analyst was quick to caution against panic.

“When I look at the history of this incredible bull market—and it has been an incredible bull market—it’s littered with ‘buy-to-hold, hold-to-sell, buy-to-hold, hold-to-sell,'” Cramer explained. “These downgrades scare you out of amazing stocks at levels that may temporarily be too high, but will recover later.”

Amazon: A Temporary Setback or Cause for Concern?

Wells Fargo’s recent downgrade of Amazon caught many by surprise. However, Cramer remains unconvinced by the bearish outlook.

“Sure, Amazon is facing some hurdles,” Cramer admitted. “But let’s not forget, this is a company that’s bounced back from challenges time and time again.”

He pointed to the company’s resilience earlier this year:

“Remember August? Amazon reported a revenue miss, and shares took a hit. But look where they are now. It’s only a matter of time before we see another rebound.”

Market analyst Sarah Johnson agrees with Cramer’s assessment. “Amazon’s diverse revenue streams and dominant market position make it uniquely positioned to weather short-term storms,” she told us in an exclusive interview.

Apple: Betting Against Excellence?

Jefferies’ downgrade of Apple also drew Cramer’s ire. While acknowledging potential near-term headwinds with the upcoming iPhone 16 release, he remained bullish on the tech giant’s prospects.

“This downgrade is essentially betting against Apple’s entire culture of excellence,” Cramer argued. “When has Apple ever had a track record of releasing subpar products? It’s just not in their DNA.”

Tech industry insider Mark Thompson echoed Cramer’s sentiments. “Apple’s ecosystem and brand loyalty are unparalleled. They’ve consistently shown an ability to innovate and capture market share, even in saturated markets.

The Perils of Short-Term Trading

Throughout his commentary, Cramer emphasized the dangers of getting caught up in day-to-day market movements, especially for individual investors.

“Wall Street is addicted to trading,” he noted. “But if you’re managing your own money, you should not be listening to all of this trading advice. You can’t afford to do what they want you to do because trading is a full-time job.”

Financial advisor Lisa Patel agrees. “For most individual investors, a long-term, buy-and-hold strategy is far more likely to yield positive results than trying to time the market based on daily fluctuations or analyst reports.”

To illustrate his point, Cramer drew on historical examples of companies that have rewarded patient investors:

1. Microsoft: Despite facing numerous challenges and market downturns since its IPO in 1986, Microsoft has delivered a staggering return to long-term investors.

2. Netflix: The streaming giant has faced skepticism and downgrades throughout its history, yet has consistently proven doubters wrong.

3. Tesla: Elon Musk’s electric vehicle company has been a frequent target of short-sellers and skeptics, but has delivered exceptional returns to believers.

“If you had listened to every downgrade or negative report on these companies, you would have missed out on some of the most significant wealth-creation opportunities of our time,” Cramer pointed out.

For many retail investors, the barrage of market news and analyst reports can be overwhelming. John Smith, a 35-year-old software engineer and casual investor, shared his perspective:

“It’s tough to know who to listen to. One day, a stock is a ‘strong buy,’ and the next, it’s being downgraded. Cramer’s advice to focus on the long-term is reassuring, but it’s not always easy to tune out the noise.”

This sentiment is common among individual investors, highlighting the importance of developing a sound investment strategy and sticking to it.

As the market continues to grapple with uncertainty, Jim Cramer’s message serves as a reminder of the importance of conviction in investing. While it’s crucial to stay informed about market trends and analyst opinions, blindly following every upgrade or downgrade can lead to missed opportunities.

For investors in Amazon and Apple, Cramer’s advice is clear: look beyond the short-term noise and focus on the fundamental strengths of these companies. As history has shown, patience and a long-term perspective can often be the most rewarding investment strategy.

In a world where market sentiment can shift rapidly, Cramer’s steadfast defense of these tech giants provides a counterbalance to the day’s negative headlines. Whether his optimism will be vindicated remains to be seen, but his message of looking beyond short-term fluctuations is one that resonates with many seasoned investors.

As the market continues to evolve, one thing remains clear: the debate between short-term trading and long-term investing is far from over. For now, Cramer’s voice serves as a powerful reminder to stay the course in turbulent times.

Add Comment