Touch ‘n Go (TNG) Digital has announced a crucial deadline for its eWallet users, marking a pivotal shift in Malaysia’s digital payment landscape. Users who fail to complete their electronic Know-Your-Customer (eKYC) verification by December 20, 2024, risk losing access to key features of their digital wallets, potentially disrupting their daily financial transactions.

This mandatory verification requirement, announced as part of TNG Digital’s comprehensive security enhancement initiative, represents a landmark decision in Malaysia’s fintech sector. The company is positioning itself as the first eWallet provider in the country to implement full eKYC verification, setting a new standard for digital payment security.

TNG Digital’s Chief Executive Officer, Alan Ni, emphasized the critical nature of this security measure, stating that protecting users is a non-negotiable priority for the company. The implementation of mandatory eKYC verification is designed to significantly reduce the risk of account takeovers and enhance overall platform security, reflecting the company’s commitment to safeguarding its users’ financial interests.

The eKYC process, which serves as a digital method of identity verification, is crucial for maintaining compliance with government regulations while ensuring the security of users’ digital transactions. This verification system acts as a protective barrier against potential fraud and unauthorized access, making it an essential component of modern digital financial services.

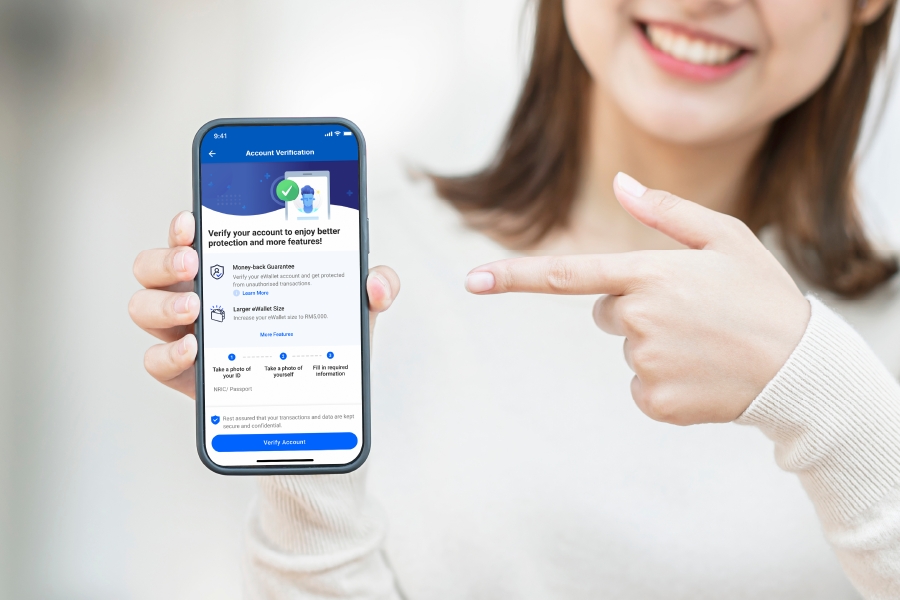

For Malaysian users, the verification process requires a clear photograph of their MyKad, while international users need to submit passport documentation. The process also includes a facial recognition component, requiring users to capture a clear selfie for biometric verification. This dual-layer verification approach adds an extra security dimension to the traditional documentation process.

The implications of not completing the verification process by the deadline are significant. Users who fail to comply will experience gradual restrictions on their account functionality, potentially losing access to essential features such as balance usage and payment capabilities. This phased approach to implementing restrictions demonstrates TNG Digital’s effort to balance security requirements with user convenience.

The timing of this announcement is particularly significant as it comes amid growing concerns about digital security and fraud in the fintech sector. By taking this proactive step, TNG Digital is not only enhancing its security infrastructure but also setting a precedent for other digital payment providers in the region.

For users who have already completed their verification, indicated by a “Completed” status in their account, no further action is required. This early verification not only ensures uninterrupted service but also positions these users to access additional features and benefits that may be introduced as part of TNG Digital’s ongoing platform development.

The verification requirement reflects a broader trend in the financial technology sector, where enhanced security measures are becoming increasingly important as digital transactions become more prevalent. This move by TNG Digital aligns with global best practices in digital payment security and demonstrates Malaysia’s commitment to maintaining high standards in its fintech ecosystem.

Industry experts view this development as a positive step toward creating a more secure digital payment environment. The implementation of mandatory eKYC is expected to strengthen user confidence in digital payment systems while providing a more robust framework for preventing financial fraud and unauthorized access.

The deadline of December 20 gives users ample time to complete the verification process, but the company encourages early compliance to avoid any potential service disruptions. The straightforward nature of the verification process, which can be completed entirely through the mobile application, minimizes the burden on users while maximizing security benefits.

As the deadline approaches, this initiative by TNG Digital represents a significant milestone in Malaysia’s digital payment evolution. It sets a new benchmark for security standards in the industry and demonstrates how fintech companies can balance user convenience with robust security measures. Users are strongly advised to complete their verification well before the deadline to ensure continuous access to their digital wallet services and to contribute to a more secure digital payment ecosystem.

Add Comment