Paying for goods and services has undergone a seismic shift, transcending from the realm of physical currency to the digital frontier of online payment systems. This revolutionary transition, “The Evolution of Online Payment Systems,” has reshaped commerce as we know it, offering unparalleled convenience and security to consumers worldwide.

What Sparked the Rise of Online Payment Systems?

The advent of the internet and the subsequent boom of e-commerce ignited the need for secure, efficient digital payment methods. As more businesses embraced online selling and consumers grew accustomed to the convenience of shopping from the comfort of their homes, the limitations of traditional payment options became apparent.

Handling cash or checks over the internet was impractical, and early e-commerce transactions often relied on cumbersome processes like faxing credit card information or mailing payments. This paved the way for pioneering online payment solutions that could facilitate real-time, secure transactions between buyers and sellers, regardless of their physical locations.

How Have Online Payment Systems Evolved Over Time?

The evolution of online payment systems can be traced back to the late 1990s when companies like PayPal and early credit card processors like CyberCash and FirstVirtual began offering digital payment services. These initial solutions, while rudimentary by today’s standards, laid the foundation for the widespread adoption of online transactions.

As technology advanced and internet access became more ubiquitous, online payment systems rapidly evolved to meet the growing demands of consumers and businesses. The introduction of mobile wallets, like Apple Pay and Google Pay, revolutionized the way we make payments, allowing seamless integration with smartphones and wearable devices.

Cryptocurrencies, such as Bitcoin and Ethereum, also emerged as a decentralized and secure alternative to traditional online payment methods, leveraging blockchain technology to facilitate peer-to-peer transactions without the need for intermediaries like banks or payment processors.

What Are the Different Types of Online Payment Systems?

The landscape of online payment systems is vast and diverse, catering to a wide range of user needs and preferences. Here are some of the most common types:

- E-Wallets (e.g., PayPal, Skrill, Neteller) E-wallets act as digital counterparts to physical wallets, allowing users to store payment information and make online purchases securely. These services often offer additional features like peer-to-peer money transfers and the ability to link multiple payment sources.

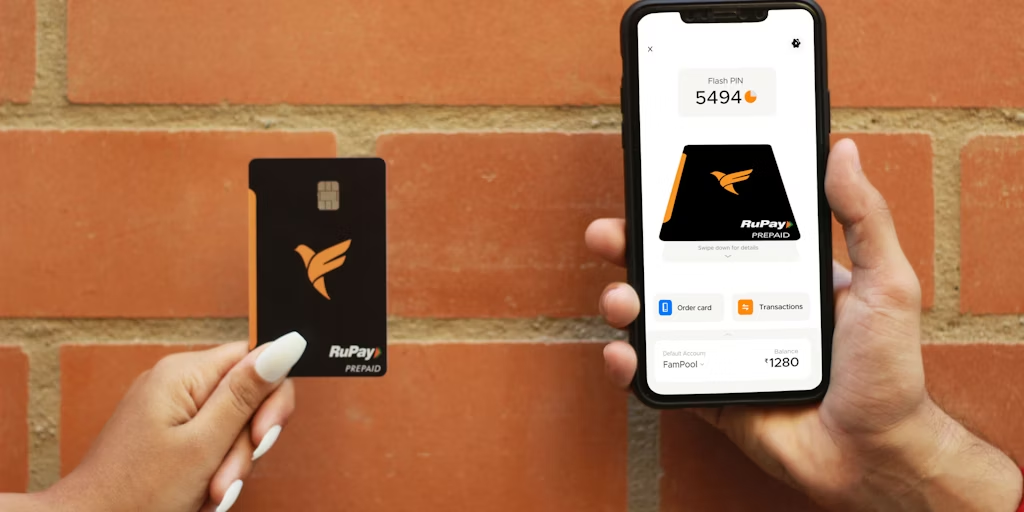

- Mobile Payments (e.g., Apple Pay, Google Pay, Samsung Pay) Mobile payment systems leverage near-field communication (NFC) technology to enable contactless payments at physical retail locations, as well as in-app purchases on mobile devices. These solutions offer a seamless and secure checkout experience by eliminating the need to carry physical cards or cash.

- Peer-to-Peer (P2P) Transfers (e.g., Venmo, Cash App, Zelle) P2P payment platforms facilitate direct money transfers between individuals, often through linked bank accounts or debit/credit cards. These services have gained immense popularity for splitting bills, sending money to friends and family, or paying freelancers and service providers.

- Cryptocurrency Payments (e.g., Bitcoin, Ethereum, Litecoin) Cryptocurrencies offer a decentralized and secure way to conduct online transactions without relying on traditional financial institutions. These digital currencies use cryptography and blockchain technology to facilitate peer-to-peer payments, providing anonymity and eliminating the need for intermediaries.

- Buy Now, Pay Later (BNPL) Services (e.g., Afterpay, Klarna, Affirm) BNPL solutions allow consumers to make purchases and pay for them in installments, often interest-free, over a predetermined period. These services have gained traction, particularly among younger consumers seeking more flexible payment options.

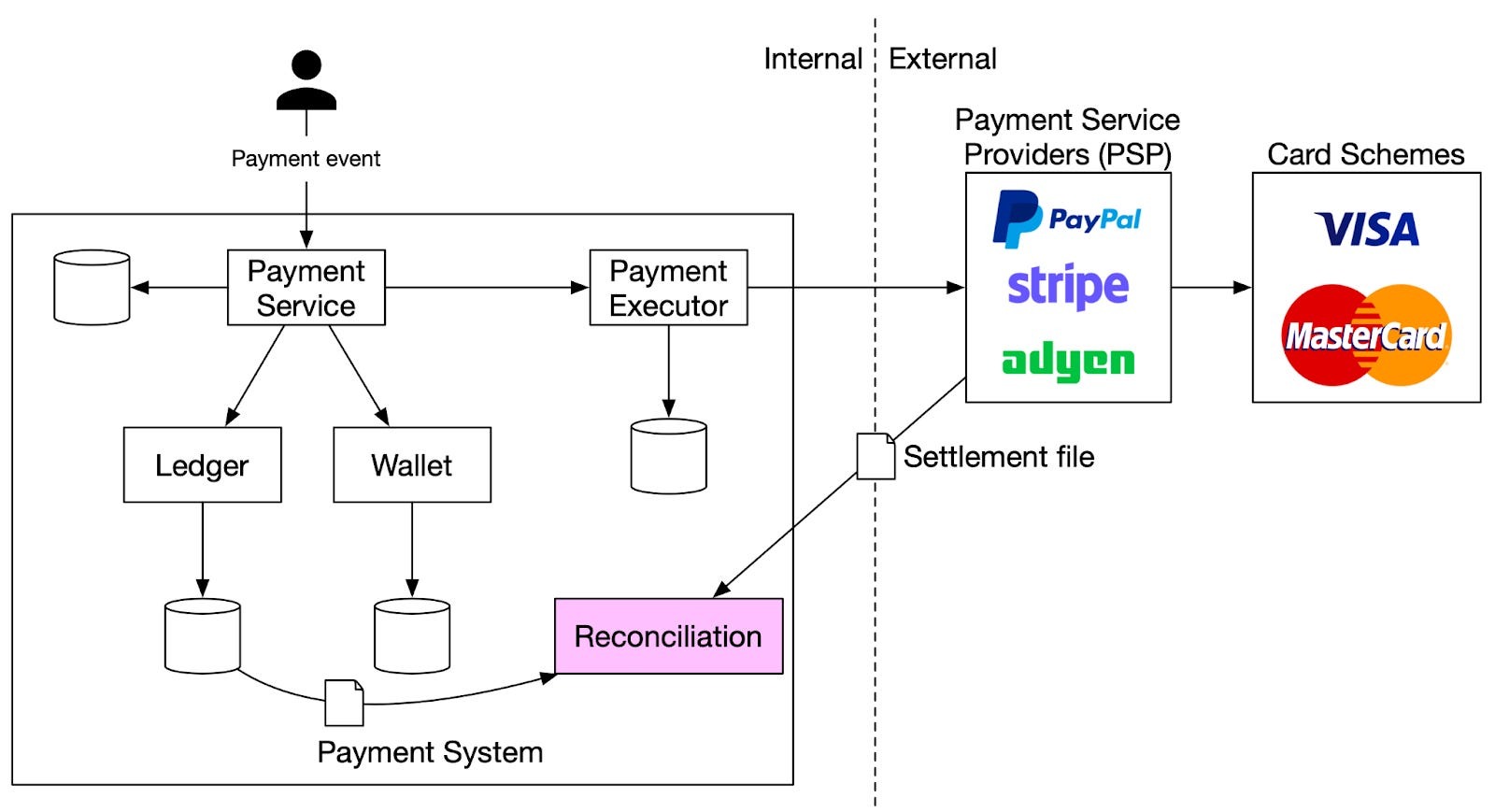

How Do Online Payment Systems Work Behind the Scenes?

While the user experience of online payment systems is designed to be seamless and intuitive, the behind-the-scenes processes are complex and involve several layers of security and data protection.

- Encryption: When initiating an online payment, sensitive information like credit card numbers and personal details are encrypted using advanced cryptographic algorithms, ensuring that the data remains secure during transmission.

- Authentication: Online payment systems employ various authentication methods to verify the identities of buyers and sellers. This may include passwords, biometrics (e.g., fingerprint or facial recognition), or multi-factor authentication for added security.

- Data Tokenization: Instead of storing sensitive payment information directly, many systems use tokenization, which replaces actual data with unique identifiers or “tokens” that can be used for future transactions without exposing the original data.

- Fraud Detection: Sophisticated algorithms and machine learning techniques are employed to analyze transaction patterns and detect potential fraudulent activities, such as unauthorized purchases or identity theft attempts.

- Settlement and Clearing: Once a transaction is authorized and deemed secure, the payment system facilitates the transfer of funds from the buyer’s account to the seller’s account, often involving intermediaries like banks or payment processors.

What Are the Benefits of Using Online Payment Systems?

The adoption of online payment systems has transformed the way we conduct transactions, offering numerous benefits to both consumers and businesses:

- Convenience: Online payment systems eliminate the need for physical cash or checks, enabling purchases from anywhere at any time, with just a few clicks or taps.

- Speed: Transactions are processed and settled almost instantly, ensuring a smooth and efficient checkout experience for customers and faster access to funds for merchants.

- Security: Advanced encryption, authentication, and fraud detection measures help protect sensitive financial data and minimize the risk of unauthorized access or theft.

- Global Accessibility: Online payment systems transcend geographical boundaries, enabling cross-border transactions and facilitating international commerce.

- Record-Keeping: Digital payment platforms maintain detailed records of all transactions, making it easier for individuals and businesses to track expenses and manage finances more effectively.

- Cost-Effectiveness: By reducing the need for physical infrastructure and streamlining processes, online payment systems often offer lower transaction fees compared to traditional payment methods, benefiting both consumers and merchants.

Are Online Payment Systems Secure, and How Do They Protect User Data?

As the adoption of online payment systems continues to soar, concerns about security and data privacy remain a top priority for both users and service providers. Fortunately, robust measures are in place to safeguard sensitive information and ensure the integrity of transactions.

- Encryption: Advanced encryption protocols, such as SSL (Secure Sockets Layer) and TLS (Transport Layer Security), are employed to protect data during transmission, making it virtually impossible for unauthorized parties to intercept or decode sensitive information.

- Tokenization and Data Storage: Instead of storing actual payment details, many online payment systems use tokenization, which replaces sensitive data with unique identifiers or “tokens.” This ensures that even if a system is compromised, the original payment information remains secure.

- Fraud Detection and Risk Management: Sophisticated algorithms and machine learning techniques are employed to analyze transaction patterns, user behavior, and various other data points to identify potential fraudulent activities, such as unauthorized purchases or identity theft attempts.

- Compliance with Regulations: Reputable online payment systems adhere to strict industry standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), which outlines comprehensive security requirements for handling and storing payment card data.

- Multi-Factor Authentication (MFA): Many online payment platforms require users to verify their identities through multiple authentication factors, such as a password combined with a one-time code sent to a registered phone number or biometric authentication like fingerprint or facial recognition.

- User Education and Awareness: Online payment providers actively promote user education and awareness campaigns, providing guidance on best practices for securing accounts, recognizing potential scams, and maintaining the overall safety of financial transactions.

While no system is entirely immune to security threats, the rigorous measures employed by online payment systems, combined with ongoing innovation and user vigilance, create a robust security framework that significantly reduces the risk of data breaches and unauthorized access.

How Have Online Payment Systems Impacted Global Commerce?

The rise of online payment systems has had a profound impact on global commerce, revolutionizing the way businesses and individuals conduct transactions across borders. Here are some of the key ways in which these digital payment solutions have reshaped international trade:

- Facilitating Cross-Border Transactions: Online payment systems have effectively eliminated geographical barriers, enabling businesses to seamlessly sell their products and services to customers worldwide. This has opened up new markets and revenue streams, fostering global economic growth and interconnectivity.

- Reducing Transaction Costs: Traditional cross-border payments often involved hefty fees and complex processes involving multiple intermediaries. Online payment systems have streamlined these transactions, significantly reducing the associated costs and making it more affordable for businesses to expand their global reach.

- Enhancing Financial Inclusion: In many parts of the world, access to traditional banking services remains a challenge. Online payment systems have bridged this gap by providing accessible and inclusive financial solutions, enabling individuals and businesses to participate in the global economy.

- Enabling Micro-Entrepreneurship: With the ability to receive payments from anywhere in the world, online payment systems have empowered individuals to pursue micro-entrepreneurship opportunities, such as freelancing, e-commerce, or offering digital services, regardless of their location.

- Fostering Transparency and Traceability: Digital payment systems provide detailed records and audit trails for every transaction, enhancing transparency and enabling businesses to track their global financial activities more effectively, while also aiding in compliance with regional regulations.

- Driving Innovation: The continuous evolution of online payment systems has fueled innovation in adjacent industries, such as logistics, supply chain management, and e-commerce platforms, as businesses strive to optimize their global operations and provide seamless cross-border experiences for customers.

As the world becomes increasingly interconnected, the role of online payment systems in facilitating global commerce will only continue to grow, opening up new opportunities for businesses and individuals alike to participate in the global marketplace.

What Challenges and Regulations Govern Online Payment Systems?

While online payment systems have revolutionized the way we conduct transactions, they are not without their challenges and complexities. Here are some of the key issues and regulatory frameworks that govern the operation of these digital payment solutions:

- Fraud Prevention: As online transactions continue to rise, so does the risk of fraudulent activities, such as identity theft, phishing scams, and unauthorized access to financial accounts. Online payment systems must constantly evolve their fraud detection and prevention measures to stay ahead of these threats.

- Data Privacy and Security: Ensuring the protection of sensitive user data, including payment information and personal details, is a paramount concern for online payment providers. They must adhere to strict data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States.

- Compliance with Regional Regulations: Different regions and countries have varying laws and regulations governing online payments, taxation, anti-money laundering measures, and consumer protection. Online payment systems must navigate this complex regulatory landscape to ensure compliance and avoid potential legal and financial penalties.

- Interoperability and Standardization: With the proliferation of payment platforms and technologies, ensuring seamless interoperability and adhering to industry standards is crucial for maintaining a consistent and reliable user experience across different systems and devices.

- Emerging Technologies: The rapid pace of technological advancements, such as the rise of cryptocurrencies, blockchain, and the Internet of Things (IoT), presents both opportunities and challenges for online payment systems to adapt and integrate these new technologies while maintaining security and reliability.

- Customer Adoption and Education: While online payment systems offer convenience and security, some consumers may still harbor concerns or hesitations about adopting digital payment methods. Effective user education and awareness campaigns are essential to address these concerns and promote widespread adoption.

To navigate these challenges, online payment systems operate within a complex regulatory framework that includes industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS), as well as regional and national laws governing financial transactions, data privacy, and consumer protection.

Continuous innovation, collaboration with regulatory bodies, and a commitment to security and user education will be crucial for online payment systems to maintain trust, ensure compliance, and continue driving the evolution of digital commerce.

What Lies Ahead for the Future of Online Payment Systems?

As technology continues to advance at a rapid pace, the future of online payment systems promises even greater innovation, convenience, and security. Here are some potential developments and trends that could shape the industry in the years to come:

- Blockchain and Cryptocurrency Integration: The adoption of blockchain technology and cryptocurrencies is expected to gain further momentum, offering increased transparency, security, and decentralization for online transactions. We may see more mainstream integration of cryptocurrencies as a payment option, as well as the development of new blockchain-based payment solutions.

- Biometric Authentication: Biometric authentication methods, such as fingerprint, facial recognition, and voice recognition, are likely to become more prevalent in online payment systems, providing an additional layer of security while offering a seamless user experience.

- Artificial Intelligence and Machine Learning: AI and machine learning algorithms will play a crucial role in enhancing fraud detection, risk management, and personalization of online payment systems. These technologies can analyze vast amounts of data to identify patterns and anomalies, enabling more accurate and proactive security measures.

- Internet of Things (IoT) Integration: As the Internet of Things (IoT) continues to expand, with more devices and appliances becoming connected, we may see the integration of online payment systems into these IoT ecosystems, enabling seamless and automated transactions for a wide range of goods and services.

- Greater Financial Inclusion: Online payment systems have the potential to further bridge the gap in financial inclusion, particularly in underserved or remote areas, by leveraging mobile technologies and innovative solutions like microfinancing and peer-to-peer lending platforms.

- Regulatory Evolution: As the online payment landscape evolves, regulatory frameworks will need to adapt to address emerging challenges and ensure consumer protection, data privacy, and fair competition. We may see increased collaboration between payment providers, government agencies, and international bodies to establish standardized regulations and guidelines.

- Embedded Finance and Contextual Payments: The integration of financial services directly into non-financial applications and platforms, known as embedded finance, is gaining traction. Online payment systems may become seamlessly integrated into various digital experiences, enabling contextual and frictionless transactions within the user’s natural flow.

The future of online payment systems is poised for transformative changes, driven by technological advancements, evolving consumer behaviors, and the need for greater security, convenience, and inclusivity in financial transactions. As this evolution continues, it will shape the way we interact with money and conduct commerce, paving the way for a more connected and efficient global economy.

Conclusion: Transcending Borders, Unlocking Possibilities

The “Evolution of Online Payment Systems” has been nothing short of remarkable, revolutionizing how we conduct transactions and enabling seamless commerce across borders. From the early pioneers like PayPal and credit card processors to the emergence of mobile wallets, cryptocurrencies, and innovative solutions like buy now, pay later services, the digital payment landscape has undergone a seismic shift.

As technology continues to advance, we can expect even more groundbreaking developments in online payment systems, integrating cutting-edge technologies like blockchain, artificial intelligence, and biometric authentication. These advancements will not only enhance security and convenience but also foster greater financial inclusion, enabling individuals and businesses worldwide to participate in the global economy.

With the rise of cross-border transactions, online payment systems have transcended geographical boundaries, reducing transaction costs and fostering transparency in international trade. As regulatory frameworks evolve to keep pace with these changes, we can anticipate increased collaboration between payment providers, government agencies, and international bodies to ensure consumer protection, data privacy, and fair competition.

The future of online payment systems promises to be an exciting journey, where embedded finance and contextual payments will seamlessly integrate financial services into our daily digital experiences, enabling frictionless transactions within our natural flow.

As we embrace this evolution, we unlock a world of possibilities, where the seamless flow of funds and the secure exchange of value become the backbone of a truly interconnected global economy, fostering growth, innovation, and boundless opportunities for individuals and businesses alike.

Add Comment