Managing your long-term savings has never been easier. With the advent of online banking, you can now open and manage a Public Provident Fund (PPF) account from the comfort of your home. HDFC Bank, one of India’s leading financial institutions, offers a seamless online process for opening a PPF account. In this comprehensive guide, we’ll explore the benefits of PPF accounts, the eligibility criteria, and walk you through the step-by-step process of opening a PPF account online with HDFC Bank.

What is a Public Provident Fund (PPF) Account?

A Public Provident Fund (PPF) account is a government-backed savings scheme that offers a combination of safety, attractive returns, and tax benefits. It is a popular choice among individuals looking for a secure and tax-efficient way to save for the long term.

Here are some of the key features of PPF accounts:

- Competitive Interest Rates: PPF accounts offer attractive interest rates that are set by the government on a quarterly basis.

- Tax Benefits: Contributions to PPF accounts are eligible for tax deductions under Section 80C of the Income Tax Act. Moreover, the interest earned and the maturity amount are tax-exempt.

- Long-Term Investment Horizon: PPF accounts have a maturity period of 15 years, which can be extended in blocks of 5 years. This encourages individuals to save for the long term.

- Government-Backed Security: PPF accounts are backed by the Government of India, providing a high level of safety for your investments.

Benefits of Opening a PPF Account Online with HDFC Bank

Opening a PPF account online with HDFC Bank offers several advantages over the traditional branch-based approach:

- Convenience: With online account opening, you can bid farewell to the hassle of visiting a bank branch. You can open your PPF account from anywhere, at any time, using your computer or mobile device.

- Quick and Efficient: The online process is designed to be swift and streamlined, saving you valuable time and effort.

- Paperless Process: Embrace the eco-friendly approach! Online account opening eliminates the need for physical forms and documents, making it a paperless experience.

- 24/7 Account Access: With HDFC Bank’s online banking platform, you can manage your PPF account round the clock. Check your balance, view transaction history, and make contributions at your convenience.’

Eligibility Criteria for Opening a PPF Account Online with HDFC Bank

To be eligible for opening a PPF account online with HDFC Bank, you must meet the following criteria:

- Indian Residency: Only Indian residents can open a PPF account.

- Existing HDFC Bank Savings Account: You must have an active HDFC Bank savings account with internet banking or mobile banking enabled.

- Aadhaar Card Linking: Your Aadhaar card must be linked to your HDFC Bank savings account for online verification purposes.

- Active Mobile Number: You should have an active mobile number linked to your Aadhaar card to receive One Time Passwords (OTPs) for online verification and e-signing.

Step-by-Step Guide: Opening a PPF Account Online with HDFC Bank

Follow these simple steps to open your PPF account online with HDFC Bank:

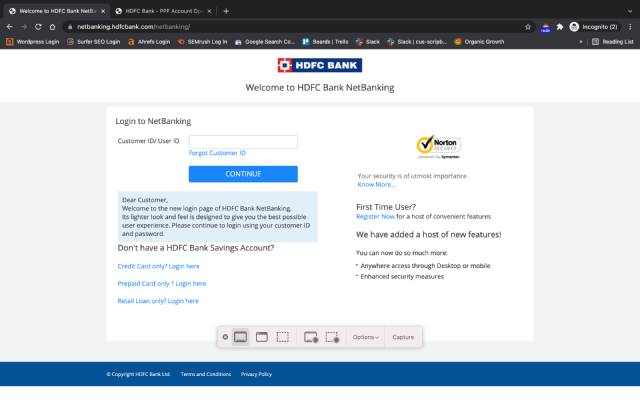

- Log in to HDFC Bank NetBanking or Mobile Banking: Access your HDFC Bank online banking account using your login credentials.

- Navigate to the PPF Account Section: Look for the “Public Provident Fund” or “PPF Account” option within the online banking platform. It may be located under the “Investments” or “Savings” section.

- Initiate the Application Process: Click on the “Open Now” or similar button to start the PPF account opening process.

- Select Your Linked Savings Account: Choose the HDFC Bank savings account that you want to link to your PPF account. This account will be used for making future contributions to your PPF.

- Provide PAN Details: Enter your Permanent Account Number (PAN) for tax purposes.

- Nominate a Beneficiary (Optional): You have the option to nominate a beneficiary who will receive the PPF account balance in the event of your unfortunate demise. While optional, it is highly recommended to add a nominee.

- Verify with Aadhaar OTP: An OTP will be sent to your mobile number registered with your Aadhaar card. Enter the OTP in the designated field to verify your identity and e-sign the application form.

- Account Activation: Once your verification is successful, your PPF account will be activated within one business day. You will receive a confirmation via email or SMS, along with your PPF account number.

Making Contributions to Your HDFC Bank Online PPF Account

After your PPF account is activated, you need to make an initial deposit to start your investment journey. The minimum initial deposit amount is typically around Rs. 500.

There are two convenient ways to contribute to your PPF account:

- Online Transfer: You can easily transfer funds from your linked HDFC Bank savings account to your PPF account using internet banking or mobile banking.

- Branch Deposit: If you prefer the traditional method, you can visit an HDFC Bank branch and make a cash deposit using a PPF-specific challan form.

Keep in mind the following points regarding PPF contributions:

- Contribution Limits: There is a minimum annual contribution requirement (usually Rs. 500) and a maximum limit (currently Rs. 1.5 lakh) for PPF accounts.

- Investment Tenure: PPF accounts have a maturity period of 15 years, which can be extended in blocks of 5 years.

- Partial Withdrawals: Partial withdrawals are allowed from the sixth financial year, subject to certain conditions and restrictions.

Managing Your HDFC Bank Online PPF Account

HDFC Bank’s online banking platform provides a seamless experience for managing your PPF account:

- Track Your Balance: Stay updated on your PPF account balance by logging into your online banking account.

- View Transaction History: Keep a record of your contributions and withdrawals by accessing your PPF account’s transaction history.

- Download Account Statements: Generate and download PPF account statements for your reference and record-keeping purposes.

- Claim Tax Benefits: Remember to claim the tax deductions for your PPF contributions under Section 80C of the Income Tax Act when filing your tax returns.

Frequently Asked Questions (FAQs) about HDFC Bank Online PPF Accounts

1. What documents are required to open a PPF account online with HDFC Bank?

The online application process doesn’t require any physical documents. However, ensure that your Aadhaar card is linked to your HDFC Bank savings account for verification purposes.

2. Can I open a PPF account for a minor online with HDFC Bank?

Currently, HDFC Bank does not offer the option to open a PPF account online for a minor. You may need to visit a branch to open a PPF account for a minor.

3. Are there any fees associated with opening a PPF account online with HDFC Bank?

Generally, there are no fees for opening a PPF account online with HDFC Bank. However, standard transaction charges may apply when transferring funds from your linked savings account to your PPF account.

4. What should I do if I forget my PPF account number?

You can easily retrieve your PPF account number by logging into your HDFC Bank online banking account and navigating to the PPF account section.

Conclusion

Opening a PPF account online with HDFC Bank is a smart and convenient way to secure your long-term financial future. With its attractive interest rates, tax benefits, and government-backed security, a PPF account is an excellent investment option for individuals looking to save for the long haul.

By following the step-by-step guide provided in this article and considering the additional information, you can confidently open your PPF account online with HDFC Bank and embark on a journey towards financial success. Remember to regularly contribute to your PPF account, track your investments, and claim the tax benefits to make the most of this powerful savings tool.

Take control of your financial future today by opening a PPF account online with HDFC Bank and watch your savings grow steadily over time!

Add Comment