Habib Bank Limited (HBL) understands the importance of providing seamless and mobile-friendly banking solutions. With HBL’s mobile account opening feature, you can bid farewell to the hassle of visiting bank branches and say hello to the convenience of creating an account right from your smartphone. This comprehensive guide will walk you through the benefits of opening an HBL account on mobile, the eligibility criteria, and a step-by-step process to get you started on your mobile banking journey.

Advantages of Opening an HBL Account on Mobile

Opening an HBL account through their mobile app offers several compelling benefits:

- Convenience at Your Fingertips: With the HBL mobile app, you can open an account from the comfort of your home or on the go. Say goodbye to waiting in long queues and embrace the freedom of banking at your own pace.

- Swift and Efficient: The mobile account opening process is designed to be quick and streamlined. In just a few minutes, you can have your HBL account up and running, ready to manage your finances.

- Paperless and Eco-Friendly: HBL’s mobile account opening eliminates the need for physical forms and documents. Embrace the digital approach and contribute to a greener environment while simplifying your banking experience.

- Enhanced Security: HBL prioritizes the security of your information. The mobile app employs state-of-the-art encryption and verification measures to safeguard your data, giving you peace of mind while banking on the go.

- Instant Account Access: Once your HBL account is created, you can immediately start managing your finances through the mobile app. Check your balance, transfer funds, pay bills, and more, all at your fingertips.

Eligibility Criteria for Opening an HBL Account on Mobile

To be eligible for opening an HBL account through the mobile app, you must meet the following criteria:

- Pakistani Residency: The mobile account opening facility is available to Pakistani residents above the age of 18.

- Valid CNIC: You must possess a valid Computerized National Identity Card (CNIC) for verification purposes during the account opening process.

Step-by-Step Guide to Create an HBL Account on Mobile

Follow these simple steps to open your HBL account through the mobile app:

- Download the HBL Mobile App: Visit the Google Play Store (for Android devices) or the App Store (for iOS devices) and download the official HBL Mobile app.

- Launch the App and Select “New Account”: Open the HBL Mobile app and look for the option to create a new account. Tap on “Open New Account” or “Create Account” to initiate the process.

- Select Your Desired Account Type: HBL offers a range of account types to cater to different financial needs. Choose from options such as HBL Basic Banking Account, HBL Current Account, or HBL Savings Account, depending on your requirements.

- Provide CNIC Details: Enter your CNIC number, expiry date, and other relevant information as requested by the app. Ensure the information is accurate for a smooth verification process.

- Fill in Personal Information: Provide your full name, date of birth, contact details (phone number and email address), and occupation information as prompted by the app.

- Create Login Credentials: Set up a secure username and password for accessing your HBL mobile banking account. Choose a strong password that includes a combination of uppercase and lowercase letters, numbers, and symbols.

- Review and Accept Terms and Conditions: Carefully read through the terms and conditions associated with your selected account type. If you agree with the terms, proceed by tapping the “Accept” button.

- Complete the Verification Process: HBL may employ various methods to verify your identity, such as facial recognition through your smartphone’s camera or OTP (One Time Password) verification sent to your registered mobile number. Follow the instructions provided by the app to complete the verification process.

- Wait for Account Creation Confirmation: Once you have completed the verification process, HBL will review your application. You will receive a notification within the app or via SMS regarding the status of your account creation.

- Start Banking with HBL Mobile: Upon successful account creation, you will receive your account number and login credentials. Congratulations! You can now access your HBL mobile banking app and begin managing your finances effortlessly.

Features and Benefits of HBL Mobile Account

With your HBL mobile account, you gain access to a wide array of features and benefits:

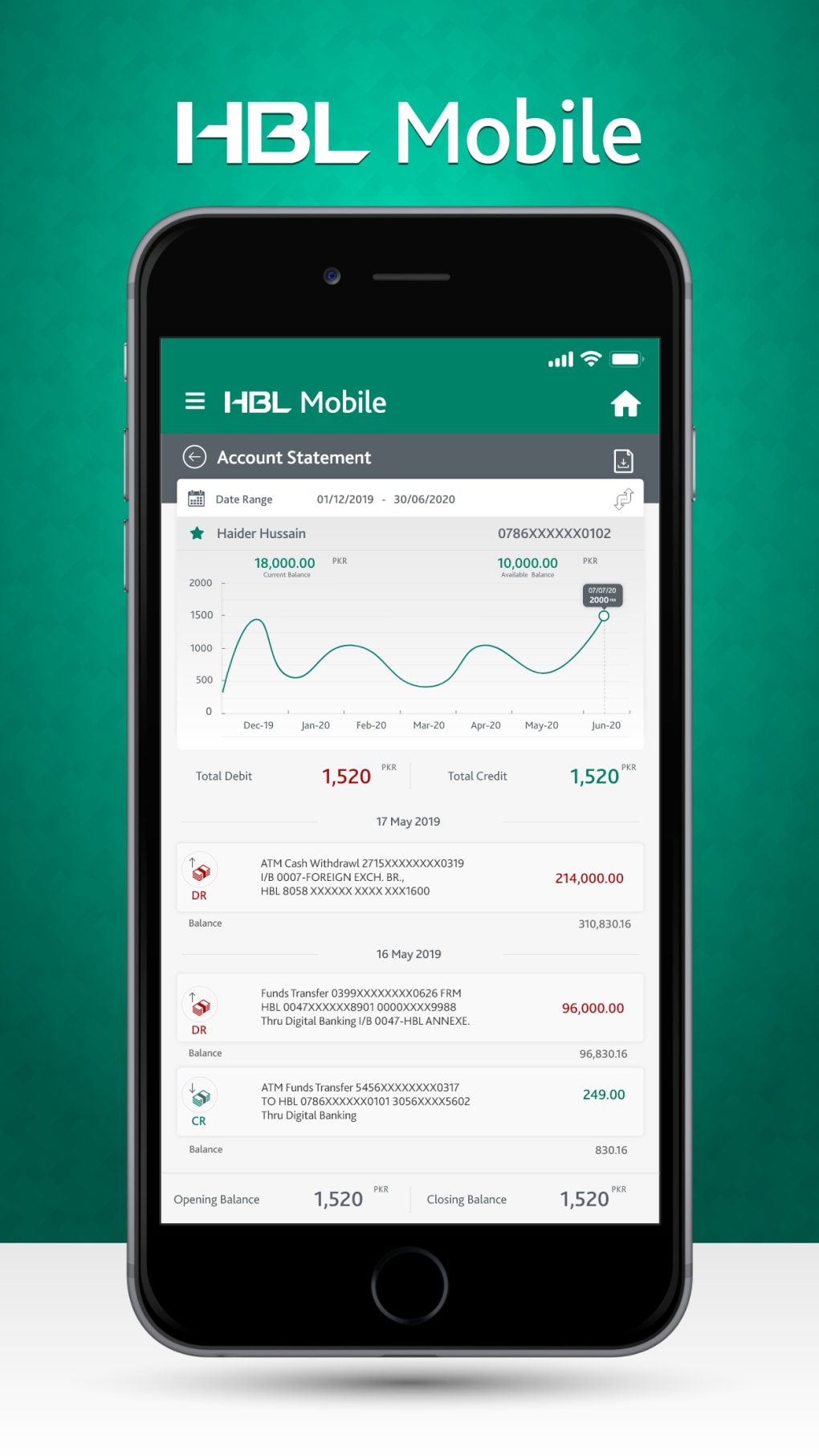

- Seamless Mobile Banking: Conduct various banking transactions, such as fund transfers, bill payments, balance inquiries, and transaction history viewing, all through the user-friendly HBL mobile app.

- Mobile Recharge: Recharge your mobile phone or data plan instantly using the HBL mobile app, eliminating the need for separate recharge platforms.

- Convenient Bill Payments: Say goodbye to standing in queues to pay your bills. With the HBL mobile app, you can easily pay utility bills, credit card bills, and other recurring payments with just a few taps.

- Investment Opportunities: Explore and manage investment options directly through the HBL mobile app. Whether you’re interested in mutual funds or fixed deposits, you can grow your wealth conveniently.

- Debit Card Management: If applicable, you can apply for an HBL debit card, activate it, and manage your PIN securely through the mobile app.

- ATM Locator: Easily locate nearby HBL ATMs or any ATMs within the 1LINK network for quick and convenient cash withdrawals.

- Customer Support: Get assistance whenever you need it. The HBL mobile app provides access to customer support, allowing you to reach out to HBL’s dedicated team for inquiries or assistance.

Additional Considerations for HBL Mobile Account Opening

When opening an HBL account through the mobile app, keep the following points in mind:

- Stable Internet Connection: Ensure you have a reliable internet connection, either through Wi-Fi or mobile data, to facilitate a smooth account opening process.

- Biometric Verification (Optional): If your smartphone supports fingerprint or facial recognition, you may have the option to enable these features for added security and convenience while using the HBL mobile app.

- Electronic Account Statements: Access and download your account statements electronically within the HBL mobile app for easy record-keeping and financial management.

Frequently Asked Questions (FAQs) about HBL Mobile Account Opening

1. What documents are required to open an HBL account on mobile?

The mobile account opening process does not require any physical documents. However, you must have a valid Computerized National Identity Card (CNIC) for verification purposes.

2. Is there a minimum balance requirement for HBL mobile accounts?

Minimum balance requirements may vary depending on the specific account type you choose. It’s recommended to check the HBL website or mobile app for detailed information on minimum balance requirements for each account type.

3. Can I open a joint account through the HBL mobile app?

Currently, the HBL mobile app does not support the opening of joint accounts. For joint account opening, you may need to visit an HBL branch.

4. What should I do if I encounter issues during the mobile account opening process?

If you face any difficulties while opening your HBL account through the mobile app, you can seek assistance through the app’s built-in customer support feature or contact HBL’s customer service hotline for guidance.

Conclusion

Opening an HBL account through the mobile app is a game-changer for individuals seeking convenience, speed, and security in their banking experience. By following the step-by-step guide provided in this article and considering the additional information, you can confidently embark on your mobile banking journey with HBL.

Once your HBL mobile account is up and running, take the time to explore the app’s features and functionalities to maximize its potential. HBL continuously strives to enhance its mobile banking platform, ensuring a seamless and user-friendly experience for its valued customers.

Embrace the future of banking with HBL’s mobile account opening and unlock a world of convenience and flexibility at your fingertips!

Add Comment