Managing your money has never been more convenient. Say goodbye to the hassles of carrying cash and hello to the ease of mobile wallets. JazzCash, a leading digital payment platform in Pakistan, offers a seamless solution for all your financial needs. In this comprehensive guide, we’ll walk you through the process of opening a JazzCash account, highlighting the benefits and features that make it a game-changer in the world of digital finance.

What is JazzCash?

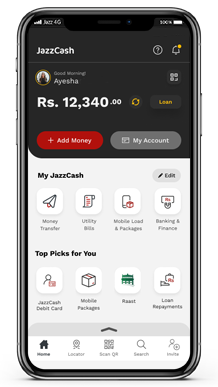

JazzCash is a revolutionary mobile wallet service provided by Jazz, one of Pakistan’s largest telecommunications companies. This innovative platform allows users to store, send, and receive money, pay bills, and conduct various financial transactions directly from their smartphones. With JazzCash, you can experience the convenience of a cashless lifestyle while enjoying top-notch security measures to protect your funds.

Why Choose JazzCash?

There are numerous compelling reasons to embrace JazzCash as your go-to digital wallet:

- Convenience: With JazzCash, you can bid farewell to the inconvenience of carrying physical cash. Manage your finances anytime, anywhere, with just a few taps on your smartphone.

- Security: JazzCash employs state-of-the-art encryption technology and robust fraud detection mechanisms to safeguard your financial information and transactions.

- Efficiency: Say goodbye to long queues and waiting times. JazzCash enables instant transfers, bill payments, and mobile top-ups, saving you valuable time and effort.

- Versatility: JazzCash offers a wide range of services beyond basic transactions. From online shopping to ticket bookings, this digital wallet has you covered.

- Accessibility: Unlike traditional bank accounts, opening a JazzCash account is a breeze. No complex paperwork or high minimum balance requirements!

Eligibility Criteria for Opening a JazzCash Account

To open a JazzCash account, you must meet the following requirements:

- Be a Pakistani citizen above 18 years of age

- Possess a valid Computerized National Identity Card (CNIC)

- Have a Pakistani mobile number (any network)

During the registration process, you will need to provide a clear photograph of your CNIC for verification purposes.

Step-by-Step Guide: How to Open a JazzCash Account

Opening a JazzCash account is a simple and straightforward process. Follow these step-by-step instructions to get started:

Option 1: Using the JazzCash Mobile App

- Download the JazzCash App: Visit the Google Play Store or Apple App Store and download the official JazzCash app on your smartphone.

- Enter Your Mobile Number: Launch the app and enter your Pakistani mobile number. You will receive a one-time password (OTP) via SMS for verification.

- Provide Personal Information: Fill in the required details, such as your full name, father’s name, and date of birth. Ensure accuracy to avoid delays in the verification process.

- CNIC Verification: Upload a clear image of your CNIC. Make sure all four corners are visible, and the information is easily readable.

- Set Your MPIN: Create a secure 4-digit Mobile Phone Identification Number (MPIN) to authorize transactions within the JazzCash app.

- Account Activation: Once the verification process is complete, your JazzCash account will be activated, granting you access to a world of digital financial services.

Option 2: Using USSD Code

If you prefer a simpler method or don’t have a smartphone, you can also open a JazzCash account using a USSD code:

- Dial *786#: From your Jazz or Warid mobile phone, dial the USSD code *786#.

- Enter CNIC Issuance Date: When prompted, enter the date your CNIC was issued, which can be found on the back of your card.

- Account Creation: JazzCash will initiate the account creation process based on the provided information.

- Set Your MPIN: Follow the instructions to create your secure 4-digit MPIN.

- Confirmation: You will receive a confirmation message once your JazzCash account is successfully created and activated.

Unleashing the Power of Your JazzCash Account

With your JazzCash account up and running, a world of financial convenience awaits you:

- Effortless Money Transfers: Send and receive money instantly between JazzCash accounts using mobile numbers or CNICs.

- Cash Deposits and Withdrawals: Deposit or withdraw cash at JazzCash retailers, partner banks, or designated ATM booths.

- Bill Payments and Mobile Top-ups: Seamlessly pay utility bills and top up your mobile balance directly through the JazzCash app.

- Secure Online Shopping: Enjoy the convenience of online shopping with JazzCash as your trusted payment method.

- QR Code Payments: Experience the speed and simplicity of QR code payments at participating merchants.

JazzCash Account Levels and Upgrade Options

JazzCash offers a tiered account system with varying transaction limits:

- Level 0: The basic account level upon registration, with limited transaction amounts.

- Level 1: Upgrade to Level 1 by visiting a JazzCash agent or Jazz Point for biometric verification using your CNIC. Enjoy higher transaction limits.

- Level 2: Achieve the highest transaction limits by visiting a Mobilink Microfinance Branch with your original CNIC and proof of income documents.

Keeping Your JazzCash Account Secure

JazzCash prioritizes the security of your financial information. Follow these best practices to ensure a safe and secure experience:

- MPIN Confidentiality: Never share your MPIN with anyone. It serves as your primary security measure for authorizing transactions.

- Phishing Awareness: Be cautious of unsolicited emails, SMS messages, or calls claiming to be from JazzCash, as they may be phishing attempts to steal your personal information.

- Official App Downloads: Always download the JazzCash app from official sources like the Google Play Store or Apple App Store to avoid potential security risks.

- Transaction Alerts: Enable transaction alerts within the app to receive real-time notifications for every transaction made on your account.

- Reporting Suspicious Activity: If you suspect any unauthorized activity on your JazzCash account, promptly report it to JazzCash customer support for immediate assistance.

Exploring Advanced Features of JazzCash

JazzCash goes beyond basic money management, offering a range of advanced features to enhance your financial experience:

- Investment Opportunities: Some JazzCash accounts allow you to explore micro-investment options, enabling you to potentially grow your savings.

- Rewards Program: Earn cashback or discounts on certain transactions through the JazzCash rewards program.

- International Money Transfers: Subject to availability, JazzCash may allow you to receive international money transfers directly into your account.

- Bill Splitting: Easily split bills among friends using the JazzCash app, simplifying group payments and settlements.

- Charitable Giving: Support your favorite causes by donating to registered charities and NGOs directly through JazzCash.

JazzCash Customer Support

If you encounter any issues or have questions regarding your JazzCash account, a dedicated customer support team is ready to assist you:

- In-App Help Center: Access the built-in help center within the JazzCash app for frequently asked questions and tutorials.

- Live Chat Support: Connect with a customer support representative in real-time using the live chat feature in the app.

- Call Center: For phone assistance, dial 111 990 000 to speak with a JazzCash customer service representative.

Embrace the Future of Finance with JazzCash

Opening a JazzCash account is your gateway to a world of financial convenience, security, and empowerment. Whether you’re looking to simplify everyday transactions, explore digital financial tools, or embrace a cashless lifestyle, JazzCash has you covered.

By following the step-by-step guide outlined in this article, you can easily open a JazzCash account and start experiencing the benefits of digital finance. With its user-friendly interface, robust security measures, and a wide range of features, JazzCash is revolutionizing the way people manage their money in Pakistan.

Don’t wait any longer. Download the JazzCash app today and take the first step towards a smarter, more convenient financial future!

Frequently Asked Questions (FAQ)

Is there a fee to open a JazzCash account?

No, opening a JazzCash account is completely free. However, certain transactions may incur charges. You can find a detailed fee schedule within the JazzCash app.

How long does it take to transfer money between JazzCash accounts?

Money transfers between JazzCash accounts are usually processed instantly, allowing for quick and seamless transactions.

Can I use JazzCash if I am not a Jazz or Warid mobile phone user?

Yes, JazzCash accounts are available to users of any mobile network in Pakistan. You can enjoy the benefits of JazzCash regardless of your mobile service provider.

What should I do if I lose my phone?

If your phone is lost or stolen, immediately contact JazzCash customer support to report the incident. They will assist you in blocking your account to prevent unauthorized access and protect your funds.

Are international transactions supported on JazzCash accounts?

The availability of international transactions on JazzCash accounts may vary. It’s recommended to check with JazzCash customer support for the most up-to-date information regarding this feature.

We hope this comprehensive guide has provided you with all the necessary information on how to open a JazzCash account and make the most of its features. Embrace the digital financial revolution and experience the convenience, security, and flexibility that JazzCash brings to your financial life.

For more information and updates, visit the official JazzCash website or download the JazzCash app from the Google Play Store or Apple App Store.

Add Comment