The European payments landscape is set to transform as the European Payment Initiative announces the integration of its innovative Wero digital payments app with Postbank, marking a significant step toward a unified European payment system. Starting November 25, Postbank customers will gain access to this groundbreaking service, enabling seamless account-to-account transfers across European borders.

The launch represents a strategic move in Europe’s quest for payment sovereignty and digital innovation. The application facilitates direct account-to-account transactions between users whose banks participate in the initiative, streamlining cross-border payments within the European economic zone. This development signals a significant shift in how Europeans conduct financial transactions, moving away from traditional payment methods toward more integrated digital solutions.

Dominik Hennen, Head of Personal Banking Germany at Deutsche Bank, emphasizes that Wero transcends the typical functionality of a payment app, representing a crucial advancement toward European financial sovereignty and a unified payment landscape. The initiative aligns with the bank’s broader strategy of digitizing banking services for both personal and corporate customers, particularly those in the retail sector.

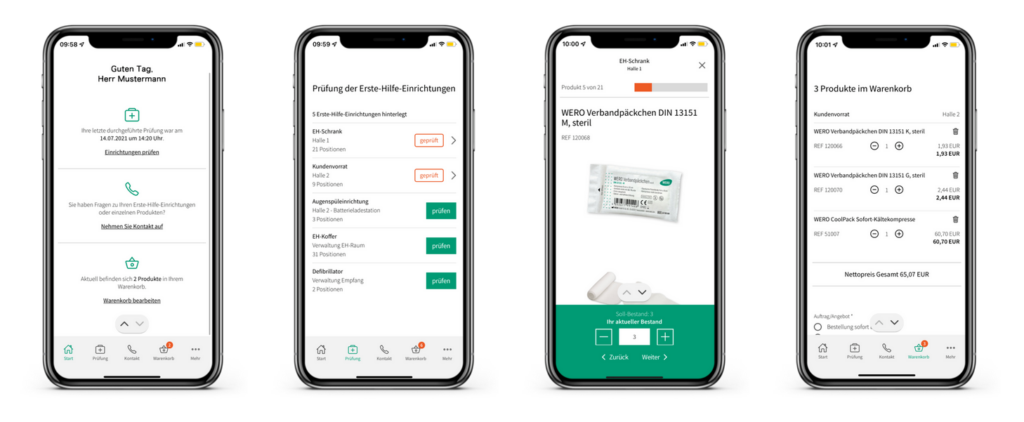

The European Payment Initiative has outlined an ambitious roadmap for Wero’s feature expansion. Future developments include implementing payments at small retailers through the Wero wallet, enabling online transactions on merchant websites, and managing subscription-based recurring payments. The platform also plans to incorporate point-of-sale payments at major retailers and introduce various value-added services such as Buy Now-Pay Later options, merchant loyalty program integration, and shared spending features.

For Postbank customers, the integration process has been designed for simplicity. Users can link their bank accounts directly to the Wero app, allowing for straightforward payment processing where transactions are directly debited from their Postbank accounts. This streamlined approach removes many of the traditional friction points associated with digital payments and cross-border transactions.

The initiative’s phased rollout strategy includes plans to extend the service to Deutsche Bank clients in the coming year, demonstrating a measured approach to expansion. Future developments will see the integration of Wero functionality directly into the banking apps of both Postbank and Deutsche Bank, creating a more cohesive digital banking experience for customers.

This development comes at a crucial time in the evolution of European financial services, as institutions seek to compete with established global payment solutions while maintaining European economic sovereignty. The initiative represents a collaborative effort to create a competitive, continent-wide payment solution that can rival existing international payment systems.

The launch of Wero through Postbank marks just the beginning of what promises to be a transformative period in European payments. The planned feature expansions indicate a comprehensive vision for the future of digital payments, encompassing everything from everyday retail transactions to sophisticated financial services.

The introduction of Wero also reflects the growing importance of digital payment solutions in the post-pandemic economy, where consumers increasingly expect seamless, contactless payment options. By incorporating features like merchant loyalty programs and shared spending capabilities, the platform aims to address evolving consumer needs while promoting European financial integration.

For retailers and businesses, the gradual expansion of Wero’s capabilities promises new opportunities for customer engagement and streamlined payment processing. The planned integration of loyalty programs and various payment options suggests a platform that could become a comprehensive solution for both merchants and consumers.

The initiative’s success could have far-reaching implications for the European financial sector, potentially establishing a new standard for digital payments while strengthening the continent’s financial independence. As the platform evolves and expands its feature set, it could play a crucial role in shaping the future of European financial transactions.

As Wero begins its journey with Postbank customers, the financial industry will be watching closely to see how this ambitious project develops and whether it can achieve its goal of creating a truly unified European payment landscape. The success of this initiative could set important precedents for future financial integration efforts across the continent.

Add Comment