Are you considering opening a bank account with a trusted and established UK financial institution? Look no further than Royal Bank of Scotland (RBS). With a history spanning nearly three centuries, RBS offers a wide range of account options, cutting-edge digital banking services, and a commitment to customer satisfaction. In this ultimate guide, we’ll walk you through the process of opening an account with RBS, ensuring a seamless and informed experience.

Why Choose RBS for Your Banking Needs?

Before we dive into the account opening process, let’s explore the key reasons why RBS stands out as a top choice for your banking needs:

- Comprehensive Account Options: RBS offers a diverse selection of current accounts, savings accounts, and investment products tailored to various financial goals and lifestyles.

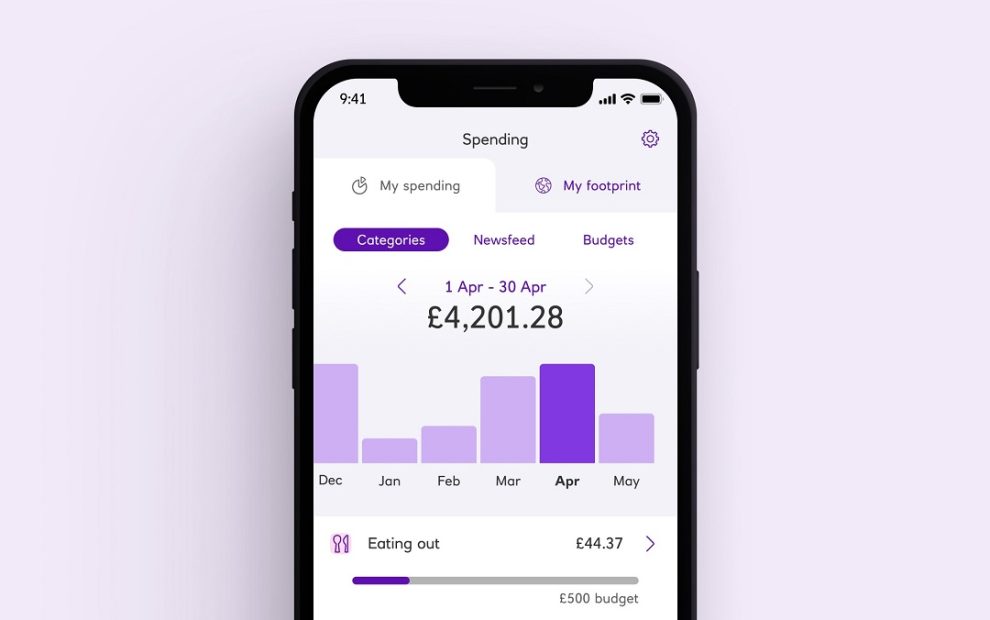

- Cutting-Edge Digital Banking: With a user-friendly online banking platform and a feature-rich mobile app, RBS prioritizes convenience and accessibility for its customers.

- Extensive Branch Network: Despite its focus on digital banking, RBS maintains a network of branches across the UK, providing in-person support when needed.

- Strong Security Measures: RBS employs robust security protocols and adheres to stringent regulatory standards to safeguard your financial information and transactions.

- Rich History and Reputation: Founded in 1727, RBS boasts a long-standing reputation for financial stability and trust within the UK banking sector.

Step-by-Step Guide: Opening an RBS Account Online

Opening an account with RBS is a straightforward process that can be completed entirely online. Follow these steps to get started:

Step 1: Visit the RBS Website

Navigate to the RBS Current Accounts page on their official website.

Step 2: Choose Your Account Type

Review the different account options offered by RBS and select the one that best aligns with your financial needs and preferences. Some popular choices include:

- Select Account

- Reward Account

- Student Account

- Foundation Account

Step 3: Click “Apply Now”

Once you’ve chosen your desired account type, click on the “Apply Now” button to initiate the online application process.

Step 4: Complete the Application Form

Fill out the online application form with accurate personal information, including your full name, date of birth, contact details, and employment status.

Step 5: Provide Proof of Identity and Address

As part of the application process, you’ll need to submit proof of your identity and address. This typically involves uploading scanned copies or photos of documents such as:

- Passport or driver’s license (for identity verification)

- Utility bill or bank statement (for address verification)

Step 6: Submit Your Application

Carefully review your application details for accuracy, then submit your application by following the on-screen prompts. RBS will process your application and notify you of the outcome within a few business days.

Once your application is approved, RBS will provide you with your new account details, including your account number and sort code. Your debit card and any relevant account materials will be mailed to your registered address.

Alternative Methods for Opening an RBS Account

While opening an account online is the most convenient option, RBS also offers alternative methods to cater to different preferences:

1. Opening an Account via the RBS Mobile App

If you prefer banking on the go, you can download the RBS Mobile Banking app from the App Store (for iOS devices) or Google Play Store (for Android devices). The app allows you to open an account by following similar steps as the online application process.

2. Opening an Account at an RBS Branch

For those who value face-to-face interaction, you can visit your nearest RBS branch to open an account. Locate your closest branch using the RBS Branch Locator on their website. Bring along the necessary identification and address verification documents, and a customer service representative will guide you through the account opening process.

Eligibility and Requirements for Opening an RBS Account

To open an account with RBS, you generally need to meet the following eligibility criteria:

- Be at least 18 years old (16 for certain account types, such as the Student Account)

- Be a UK resident

- Provide proof of identity and address

- Meet any specific requirements for the chosen account type (e.g., student status for the Student Account)

Frequently Asked Questions (FAQs)

1. How long does it take to open an account with RBS?

The online application process itself usually takes around 10-15 minutes. However, the time for RBS to review and approve your application may vary, typically ranging from a few hours to a few business days.

2. Can I open an RBS account if I have a poor credit history?

RBS may conduct a credit check as part of the application process. While a poor credit history doesn’t necessarily disqualify you from opening an account, it may affect your eligibility for certain account types or features, such as overdrafts.

3. Is there a minimum deposit required to open an RBS account?

The minimum deposit requirement varies depending on the account type. Some accounts, like the Select Account, have no minimum deposit requirement. Others may require a specific initial deposit, which will be clearly stated during the application process.

4. How do I access my RBS account once it’s open?

You can access your RBS account through various channels:

- Online Banking: Log in to your account via the RBS website using your unique username and password.

- Mobile Banking: Download the RBS Mobile Banking app and log in using your online banking credentials or biometric authentication (if available on your device).

- Branch Visit: Visit any RBS branch to conduct transactions or seek assistance from a customer service representative.

- Telephone Banking: Contact RBS’s telephone banking service for account inquiries and transactions.

5. What if I need help during the account opening process or have additional questions?

RBS provides several ways to get support:

- Online Help Center: Visit the RBS Help Center on their website for FAQs, guides, and troubleshooting tips.

- Customer Support: Contact RBS customer support via phone, email, or live chat for assistance with account opening or general inquiries.

- Branch Support: Visit your local RBS branch to speak with a customer service representative face-to-face.

Take the First Step Towards Banking with RBS Today

Opening an account with RBS is a smart choice for anyone seeking a reliable, feature-rich, and customer-centric banking experience in the UK. By following the steps outlined in this guide and carefully considering your financial needs, you can seamlessly join the millions of satisfied RBS customers.

Remember, RBS offers a range of account options to suit various lifestyles and financial goals. Whether you’re a student, a professional, or a senior, there’s an RBS account tailored to your needs. Plus, with their commitment to digital innovation and strong security measures, you can enjoy the convenience of modern banking while having peace of mind about the safety of your funds.

So why wait? Take the first step towards a rewarding banking experience and open your RBS account today!

Add Comment