If you’re considering opening a new bank account, Citibank’s online application process makes it easier than ever to get started. In this comprehensive guide, we’ll walk you through the steps to open a Citibank account online, discuss the benefits of online banking, and help you determine if a Citibank account is the right choice for your financial needs.

Why Choose Citibank for Your Online Banking Needs?

Before diving into the account opening process, let’s explore why Citibank might be the perfect fit for your online banking needs:

Extensive Account Options

Citibank offers a wide range of checking and savings accounts designed to cater to various financial situations and goals. Whether you’re a student, a working professional, or someone looking to maximize your savings potential, Citibank has an account that can meet your needs.

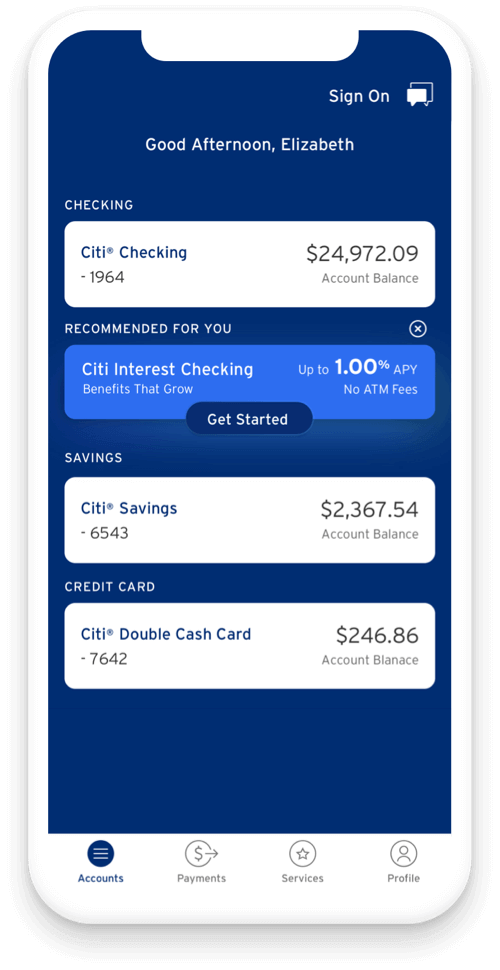

Robust Online and Mobile Banking platforms

With Citibank’s user-friendly online and mobile banking platform, you can manage your finances anytime, anywhere. From checking your account balances and transaction history to paying bills and transferring funds, Citibank’s digital tools make banking a breeze.

Nationwide Accessibility

While Citibank may not have physical branches in every location, their online banking services are accessible nationwide. This means you can enjoy the benefits of a Citibank account no matter where you reside, as long as you have internet access.

Is a Citibank Online Account Right for You?

Before proceeding with the account opening process, consider the following factors to determine if a Citibank online account aligns with your financial needs and preferences:

Comfort with Technology

If you’re comfortable managing your finances electronically and prefer the convenience of online and mobile banking, a Citibank online account could be an excellent fit for you.

ATM and Branch Accessibility

While Citibank offers a robust online banking platform, it’s important to consider your access to ATMs and physical branches. If you frequently require cash or in-person banking services, check Citibank’s ATM and branch locations in your area to ensure they meet your needs.

Account Features and Fees

Review the features and fees associated with Citibank’s various account options. Consider factors such as minimum balance requirements, monthly maintenance fees, ATM fee waivers, and interest rates to find the account that best aligns with your financial habits and goals.

Step-by-Step Guide: How to Open a Citibank Account Online

Now that you have a better understanding of what Citibank offers and whether an online account suits your needs, let’s walk through the step-by-step process of opening a Citibank account online:

Step 1: Visit the Citibank Website

Begin by navigating to the official Citibank website at https://www.citi.com/.

Step 2: Explore Account Options

Take some time to explore Citibank’s checking and savings account options. Each account page provides detailed information about features, benefits, fees, and eligibility requirements. Determine which account best fits your financial needs.

Step 3: Initiate the Online Application

Once you’ve selected your desired account, click on the “Open Account” button to start the online application process.

Step 4: Provide Personal Information

Fill out the online application form with your personal details, including your full name, date of birth, Social Security number, and contact information. Ensure that all information provided is accurate and up-to-date.

Step 5: Verify Your Identity

To comply with banking regulations and protect your security, Citibank requires identity verification. You may need to upload scanned copies or images of a valid government-issued photo ID (such as a driver’s license or passport) and proof of address (like a utility bill or bank statement).

Step 6: Fund Your Account

Choose your preferred method to fund your new Citibank account. Options may include linking an existing bank account, initiating an electronic transfer, or mailing a physical check. Be aware of any minimum opening deposit requirements for your specific account type.

Step 7: Review and Submit Your Application

Carefully review all the information you’ve provided in the application to ensure accuracy. Once you’re satisfied, submit your application electronically.

Step 8: Await Application Processing

After submitting your application, Citibank will review your information. The approval process typically takes a few business days, depending on individual circumstances. Citibank will notify you via email regarding the status of your application.

Tips for a Smooth Online Account Opening Experience

To ensure a seamless and efficient online account opening process with Citibank, keep these tips in mind:

- Have all necessary documents and information readily available before starting the application.

- Ensure scanned copies or images of your ID and proof of address are clear and legible.

- Double-check all entered information for accuracy before submitting your application.

- Be aware of any minimum opening deposit requirements for your chosen account type.

- Review Citibank’s account features, fees, and terms carefully to make an informed decision.

Maximizing the Benefits of Your Citibank Online Account

Once your Citibank online account is open, take advantage of the various features and benefits offered through their digital banking platform.

24/7 Account Access

With online banking, you can check your account balances, view transaction history, and manage your finances whenever and wherever it’s convenient for you.

Online Bill Pay

Streamline your bill payments by setting up online bill pay through your Citibank account. You can schedule one-time or recurring payments, track your payment history, and eliminate the need for paper checks and postage.

Mobile Banking App

Download the Citi Mobile app to access your accounts on the go. The app allows you to check balances, transfer funds, deposit checks, and even locate nearby ATMs or branches.

Account Alerts and Notifications

Stay informed about your account activity by setting up customizable alerts and notifications. Receive updates via email or text message for transactions, balance thresholds, or suspicious activity.

Frequently Asked Questions About Opening a Citibank Account Online

Is it safe to open a Citibank account online?

Yes, Citibank employs advanced security measures to protect your personal and financial information during the online account opening process and throughout your online banking experience.

How long does it take to open a Citibank account online?

The online application process typically takes around 15-20 minutes to complete, provided you have all the necessary information and documents readily available. The approval process usually takes a few business days, depending on individual circumstances.

What documents do I need to open a Citibank account online?

You’ll generally need a valid government-issued photo ID (such as a driver’s license or passport) and proof of address (like a utility bill or bank statement). Specific document requirements may vary depending on your individual situation.

Is there a minimum deposit required to open a Citibank account?

Minimum deposit requirements vary depending on the specific account type you choose. Some accounts may have no minimum opening deposit, while others may require a certain amount. Be sure to review the account details for your chosen account type.

Can I open a joint account online with Citibank?

Yes, Citibank allows you to open a joint account online. During the application process, you’ll need to provide personal information and identity verification for both account holders.

Conclusion

Opening a Citibank account online is a convenient and efficient way to start your banking relationship with a trusted financial institution. By following the step-by-step guide outlined in this article and considering the tips provided, you can ensure a smooth account-opening experience.

Remember to review Citibank’s account options, features, and fees carefully to select the account type that best aligns with your financial needs and goals. Once your account is open, take full advantage of Citibank’s online and mobile banking tools to streamline your financial management and make the most of your banking experience.

With the power of online banking at your fingertips, you can enjoy the flexibility and convenience of managing your finances anytime, anywhere. Start your journey with Citibank today and take control of your financial future.

Add Comment