When it comes to banking, few things are more convenient than being able to open an account entirely online. Fortunately, Federal Bank, one of India’s leading private sector banks, offers a seamless and hassle-free online account opening process for savvy customers like you.

Who Can Open a Federal Bank Account Online?

Before we dive into the nitty-gritty of online account opening, let’s clarify who is eligible to take advantage of this convenient service. To open a Federal Bank account online, you must meet the following criteria:

- Indian Residency: You must be a resident of India with a valid proof of address

- Age Requirement: You must be at least 18 years old (or a minor with a parent/guardian)

- Valid Documents: You must have a PAN (Permanent Account Number) card and Aadhaar card

If you check all these boxes, you’re good to go! Keep in mind that while you can initiate the account opening process online, you may still need to visit a branch in person to complete certain formalities, depending on your specific circumstances.

Opening Your Federal Bank Account Online

Now that we’ve covered the basics, let’s dive into the meat of the matter: the actual process of opening your Federal Bank account online. Follow these simple steps to get started:

- Visit the Federal Bank Website: Navigate to www.federalbank.co.in in your web browser

- Choose Your Account Type: Hover over the “Accounts” tab and select the type of account you’d like to open (e.g. savings, current, etc.)

- Click “Open Account Online”: Look for the “Open Account Online” button on the account type page and click it

- Fill Out the Application form. Enter your personal details, contact information, and occupation in the online application

- Upload KYC Documents: Provide scanned copies of your PAN and Aadhaar cards for identity verification

- Set Up Login Credentials: Create a unique username and strong password for your online banking access

- Review and Accept Terms: Carefully read the account terms and conditions, then accept them to proceed

- Submit Your Application: Double-check all your information, then click “Submit” to send your application to Federal Bank for review

And that’s it! The actual application process is quite intuitive and should only take a few minutes to complete. Once you’ve submitted your request, Federal Bank will review it and contact you with next steps, which may include visiting a branch to provide a wet signature or complete other formalities.

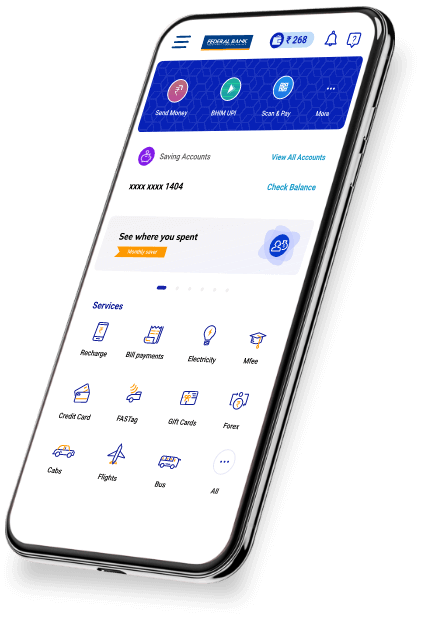

Alternative Method: Using the FedMobile App for Aadhaar eKYC

If you’re an Indian citizen with an Aadhaar card linked to your mobile number, you may be able to speed up the KYC (Know Your Customer) process by using Federal Bank’s FedMobile app. Here’s how it works:

- Download the FedMobile App: Get the app from the Google Play Store or Apple App Store

- Start Your application: Open the app and navigate to the account opening section to begin your request

- Choose Aadhaar eKYC: When prompted, select the option to complete your KYC using Aadhaar-based verification

- Enter the OTP. You’ll receive a one-time password (OTP) via SMS to the mobile number linked with your Aadhaar. Input this OTP in the app to complete the eKYC process

Using Aadhaar-based eKYC can significantly streamline your account opening journey, as it allows Federal Bank to verify your identity digitally without the need for physical document submission.

What Happens After You Apply?

Once you’ve submitted your online account application, the ball is in Federal Bank’s court. Here’s what you can expect in terms of next steps and timeframes:

- Application Acknowledgment: Federal Bank will send you an email or SMS confirming receipt of your application, typically within 1-2 business days

- Application Review: The bank’s team will review your application and supporting documents to ensure completeness and accuracy. This process can take anywhere from a few days to a couple of weeks, depending on volume and any back-and-forth required

- Follow-up Requirements: If Federal Bank needs any additional information or documentation from you, they’ll reach out via email or phone to request it. Be sure to promptly provide anything they need to keep your application moving forward

- In-Person Verification: Some customers may need to visit a Federal Bank branch in person to complete certain formalities, like providing a physical signature or showing original KYC documents. The bank will let you know if this applies to you

- Account Activation: Once your application is fully approved, Federal Bank will activate your new account and send you a welcome kit with your account details, debit card (if applicable), and online/mobile banking login credentials

All in all, the timeline from application to active account will vary, but you can generally expect the process to take anywhere from a few days to a few weeks. Stay in touch with Federal Bank and promptly respond to any requests to ensure the smoothest possible experience.

Why Choose Federal Bank for Online Account Opening?

While many Indian banks now offer online account opening, Federal Bank stands out for several reasons:

- Streamlined Process: Federal Bank’s online application is intuitive, user-friendly, and takes just minutes to complete

- Robust Security: The bank employs state-of-the-art encryption and fraud detection measures to keep your personal and financial data safe

- Wide Account Selection: Whether you need a basic savings account, a feature-rich current account, or something in between, Federal Bank has options to suit every need and lifestyle

- Extensive Branch Network: Although you’re opening your account online, it’s comforting to know that Federal Bank has a vast network of physical branches and ATMs across India if you ever need in-person support

- Top-Notch Customer Service: Federal Bank is known for its responsive and helpful customer support team, available via phone, email, and social media to assist with any questions or issues you may have

Of course, these are just a few of the many perks of banking with Federal Bank. As you explore their products and services, you’ll undoubtedly discover even more reasons to love being a part of the Federal Bank family.

5 Pro Tips for a Seamless Online Account Opening Experience

Want to make your Federal Bank online account opening journey as smooth and stress-free as possible? Keep these expert tips in mind:

- Get Your Documents in Order: Before starting your application, gather digital copies of your PAN, Aadhaar, and any other required documents. Having these ready-to-go will save you time and hassle

- Double-Check Your Details: As you fill out the online form, take a moment to review each section for accuracy. Even a small typo or mistake could delay processing, so it pays to be meticulous

- Choose a Strong Password: When setting up your online banking credentials, select a unique, complex password that includes a mix of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessed words or personal information

- Keep an Eye on Your Inbox: Throughout the application process, Federal Bank will likely send you important updates, requests, and confirmations via email. Be sure to monitor your inbox (including your spam folder!) and promptly respond to any messages from the bank

- Don’t Hesitate to Ask for help. If you have any questions or run into any roadblocks during the online account opening process, don’t be afraid to reach out to Federal Bank’s customer support team. They’re there to help you every step of the way!

By following these simple tips and staying engaged with the process from start to finish, you’ll be well on your way to a successful online account opening experience with Federal Bank.

Frequently Asked Questions About Federal Bank Online Account Opening

Still have some lingering questions about opening your Federal Bank account online? Check out these common queries:

Q: Is opening an online account safe and secure?

A: Absolutely! The Federal Bank uses cutting-edge security measures to protect your personal and financial information throughout the online application process and beyond. As long as you’re applying through the official Federal Bank website or mobile app, you can trust that your data is in good hands.

Q: Can I open a joint account online?

A: Yes, Federal Bank allows you to open certain types of joint accounts (like savings accounts) through the online application process. However, all account holders will need to provide their own KYC documents and may need to visit a branch in person to complete certain formalities.

Q: How long does it take to get approved for an account?

The timeline can vary depending on a number of factors, including the completeness of your application, the volume of applications the bank is processing, and any additional verification steps required. In general, expect the process to take anywhere from a few days to a couple of weeks from start to finish.

Q: What if I need help with my online application?

A: Federal Bank offers a variety of support options for customers who need assistance with the online account opening process. You can contact their customer care team via phone, email, or social media, or visit your nearest Federal Bank branch for in-person support.

Q: Can I apply for an account from outside India?

A: Currently, Federal Bank’s online account opening facility is only available to Indian residents. If you’re an NRI (Non-Resident Indian) or foreign national looking to open an account, you’ll need to visit a Federal Bank branch in person to discuss your options.

Remember, these are just a few of the most common questions about Federal Bank’s online account opening process. If you have any other concerns or queries, don’t hesitate to reach out to the bank directly for personalized support.

Take the Next Step in Your Financial Journey with Federal Bank

In today’s fast-paced, digital-first world, being able to open a bank account entirely online is a game-changer. With Federal Bank’s user-friendly online application process, you can take control of your financial future from the comfort of your own home in just a few quick and easy steps.

By following the guidance in this comprehensive guide, you’ll be well-equipped to breeze through the Federal Bank online account opening process and unlock a world of convenient, feature-rich banking services. So, what are you waiting for? Head over to the Federal Bank website or download the FedMobile app to get started on your online account opening journey today!

As you embark on this exciting new chapter in your financial story, remember that the Federal Bank is more than just a place to park your money; it’s a trusted partner in your success. With a wide range of products and services designed to help you save, invest, and grow your wealth, Federal Bank is committed to empowering you to achieve your short-term goals and long-term dreams.

So go ahead and take that first step towards a brighter financial future with the Federal Bank. With their cutting-edge technology, unparalleled customer service, and unwavering commitment to your success, you can trust that you’re in good hands every step of the way. Happy banking!

Add Comment