Are you ready to take control of your financial future and dive into the world of investing? As a Canadian resident, you have access to Questrade, a leading discount brokerage that empowers individuals to build and manage their investment portfolios with ease. In this comprehensive guide, we’ll walk you through the process of opening a Questrade account, explore the benefits of using this platform, and provide valuable tips to help you maximize your investment potential.

Why Invest with Questrade?

Questrade has revolutionized the Canadian investment landscape by offering a compelling combination of features and benefits that cater to both novice and experienced investors:

1. Competitive Trading Commissions

One of the standout features of Questrade is its low trading commissions. By keeping costs down, Questrade allows you to retain more of your investment returns, which can make a significant difference in the long run.

2. Diverse Investment Options

Questrade offers a wide array of investment vehicles, including stocks, exchange-traded funds (ETFs), options, and even precious metals. This diversity enables you to construct a well-rounded portfolio that aligns with your financial goals and risk tolerance.

3. Powerful Trading Tools and Resources

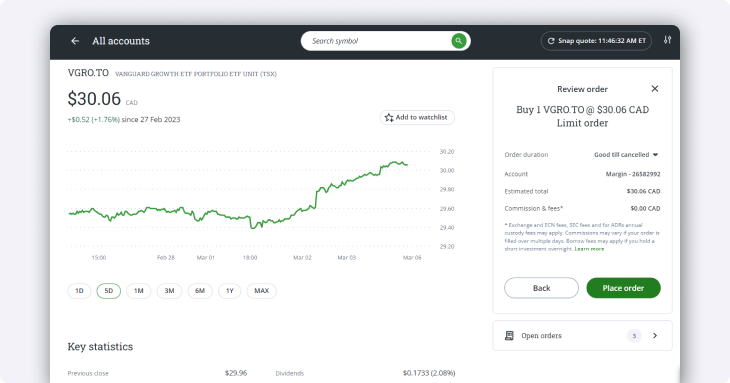

To make informed investment decisions, you need access to reliable data and analysis. Questrade provides advanced charting tools, market research, and educational resources to help you stay on top of market trends and make well-informed trades.

4. User-Friendly Platform

Whether you’re a seasoned investor or just starting out, Questrade’s intuitive web platform and mobile app make it easy to navigate the world of investing. The user-friendly interface allows you to place trades, monitor your portfolio, and access valuable insights with just a few clicks.

5. Exceptional Customer Support

Investing can be complex, and having reliable support is crucial. Questrade prides itself on providing exceptional customer service, with a dedicated team ready to assist you via phone, email, or live chat whenever you need help.

Is Questrade Right for You?

Before opening a Questrade account, it’s essential to determine whether this platform aligns with your investment goals and experience level:

- Beginner Investors: If you’re new to investing, Questrade’s user-friendly interface, educational resources, and low commissions make it an attractive choice. You can start with a small investment and gradually build your knowledge and portfolio.

- Active Traders: For those who frequently buy and sell securities, Questrade’s competitive commissions and powerful trading tools can help you execute your strategies efficiently and cost-effectively.

- Long-Term Investors: If you prefer a buy-and-hold approach, Questrade’s diverse investment options and low fees make it a suitable platform for building a long-term portfolio.

Regardless of your investment style, Questrade offers a range of account types to suit your needs, including Tax-Free Savings Accounts (TFSAs), Registered Retirement Savings Plans (RRSPs), and margin accounts.

Opening Your Questrade Account

Now that you understand the benefits of Questrade and have determined that it’s the right fit for your investment goals, let’s dive into the account opening process:

- Visit the Questrade Website: Start by navigating to the official Questrade website at https://www.questrade.com/. Click on the prominent “Open an Account” button to begin the application process.

- Provide Personal Information: Fill out the online application form with your personal details, including your full name, date of birth, email address, and phone number. Double-check the information for accuracy to ensure a smooth verification process.

- Create Your Login Credentials: Choose a strong and unique password for your Questrade account. Keeping your login information secure is crucial to protect your investments and personal data.

- Select Your Account Type: Questrade offers several account types to cater to different investment goals and tax considerations. Choose from the following options:

- TFSA: Invest with tax-free growth, subject to annual contribution limits.

- RRSP: Save for retirement with tax-deductible contributions and tax-deferred growth.

- Margin Account: Access additional buying power by borrowing funds from Questrade, but be aware of the associated risks.

- Joint Account: Invest alongside a partner or family member, sharing ownership and responsibilities.

- Provide Employment and Financial Information: Questrade is required to collect information about your employment status, annual income, net worth, and investment experience. This helps the platform assess your suitability for certain investment products and comply with regulatory requirements.

- Confirm Your Citizenship and Residency: As a Canadian brokerage, Questrade needs to verify your citizenship and residency status. Provide the necessary details and documentation as requested.

- Review and Submit Your Application: Carefully review the information you’ve provided to ensure accuracy. Read and agree to Questrade’s terms and conditions, then submit your application.

Congratulations! You’ve successfully completed the Questrade account opening process. Questrade will review your application and typically provide a response within 1-3 business days.

Funding Your Questrade Account

Once your Questrade account is approved, the next step is to fund it so you can start investing. Questrade offers several convenient funding methods:

1. Electronic Funds Transfer (EFT)

You can transfer funds directly from your linked Canadian bank account to your Questrade account. This secure method is free of charge, although processing times may vary depending on your bank.

2. Bill Payment

Initiate a bill payment from your online banking platform to fund your Questrade account. Similar to EFT, this method is free, but processing times may apply.

3. Cheque

If you prefer a more traditional approach, you can send a cheque from your Canadian bank account, payable to Questrade. Keep in mind that this method has the longest processing time, as the cheque needs to clear before the funds become available.

Minimum deposit requirements vary depending on the account type. TFSAs and RRSPs have no minimum deposit, while margin accounts require a minimum of $1,000. Joint accounts follow the requirements of the underlying account type.

Maximizing Your Questrade Experience

Now that your Questrade account is up and running, here are some tips to help you make the most of your investment journey:

1. Educate Yourself

Take advantage of Questrade’s educational resources, including webinars, tutorials, and market insights. The more you understand about investing, the better equipped you’ll be to make informed decisions.

2. Develop a Strategy

Define your investment goals, risk tolerance, and time horizon. Use this information to create a diversified portfolio that aligns with your objectives. Remember to regularly review and rebalance your portfolio as needed.

3. Utilize Questrade’s Tools

Explore Questrade’s powerful trading platforms, charting tools, and research resources. These tools can help you analyze market trends, identify opportunities, and make well-informed investment decisions.

4. Stay Disciplined

Investing can be emotional, but it’s essential to stay disciplined and stick to your strategy. Avoid making impulsive decisions based on short-term market fluctuations, and focus on your long-term goals.

5. Consider Professional Advice

If you’re unsure about your investment strategy or have complex financial needs, consider seeking guidance from a qualified financial advisor. They can provide personalized advice and help you navigate the investment landscape.

Frequently Asked Questions

1. Is Questrade safe and secure?

Yes, Questrade is a member of the Canadian Investor Protection Fund (CIPF), which protects your eligible investments up to $1 million in case of insolvency. Additionally, Questrade employs industry-standard security measures to safeguard your personal and financial information.

2. How long does it take to open a Questrade account?

The online application process typically takes less than 15 minutes to complete. However, the verification and approval process may take 1-3 business days, depending on the completeness and accuracy of your application.

3. What documents do I need to open a Questrade account?

To verify your identity and residency, you’ll need to provide a valid government-issued ID (e.g., passport or driver’s license) and proof of address (e.g., utility bill or bank statement). Questrade may request additional documents based on your specific circumstances.

4. Are there any fees associated with opening a Questrade account?

No, there are no fees for opening a Questrade account. However, standard trading commissions and fees apply when you buy or sell securities.

5. How do I contact Questrade customer support?

Questrade offers multiple channels for customer support, including phone, email, and live chat. You can find the contact details on their website or within the Questrade platform.

Conclusion

Opening a Questrade account is a significant step towards taking control of your financial future. By leveraging Questrade’s user-friendly platform, competitive fees, and extensive investment options, you can build a diversified portfolio that aligns with your goals and risk tolerance.

Remember, investing involves risks, and it’s crucial to educate yourself, develop a solid strategy, and stay disciplined. Utilize Questrade’s educational resources and tools to make informed decisions, and don’t hesitate to seek professional advice when needed.

With dedication and a well-thought-out approach, you can harness the power of investing to grow your wealth and achieve your financial aspirations. Take the first step today by opening your Questrade account and embarking on your investment journey.

Add Comment