Are you tired of traditional banking with its high fees and limited features? It’s time to embrace the future of finance with Revolut. This innovative financial app offers a seamless way to manage your money across borders, with a range of features designed to simplify your financial life. In this comprehensive guide, we’ll walk you through the process of opening a Revolut account and explore the benefits that await you.

Why Choose Revolut? Discovering the Benefits

Before we dive into the account opening process, let’s take a closer look at why Revolut is a game-changer for your finances:

- Borderless Banking: Revolut allows you to hold and exchange multiple currencies at interbank rates, saving you money on foreign transactions and making international travel a breeze.

- Effortless Budgeting: Take control of your spending with Revolut’s budgeting tools. Set spending limits, categorize transactions, and gain valuable insights into your financial habits.

- Transparent Fees: Say goodbye to hidden charges. Revolut boasts transparent fees, ensuring you know exactly what you’re paying for.

- Instant Transfers: Send and receive money internationally at lightning speed with Revolut’s peer-to-peer transfer system. Split bills with friends or send money back home effortlessly.

- Investment Opportunities: Grow your wealth by rounding up your everyday purchases and investing the spare change in stocks and fractional shares (subject to regulations).

Whether you’re a frequent traveler, a savvy budgeter, or simply looking for a more convenient way to manage your money, Revolut has something to offer.

Eligibility Criteria: Who Can Open a Revolut Account?

Before you start the account opening process, it’s important to understand the eligibility requirements. Here’s what you need to know:

- Residency: You must be a resident of a country where Revolut operates. Check their website for a list of supported countries.

- Age: The minimum age requirement varies by country but is typically 18 years old. Confirm the specific age requirement for your location on the Revolut website.

- Identification: You’ll need a valid government-issued ID, such as a passport or national ID card, to verify your identity during the application process.

Keep in mind that eligibility criteria may change over time, so always refer to the latest information provided by Revolut.

Step-by-Step Guide: How to Open a Revolut Account

Now that you know the benefits and eligibility requirements, let’s walk through the account opening process:

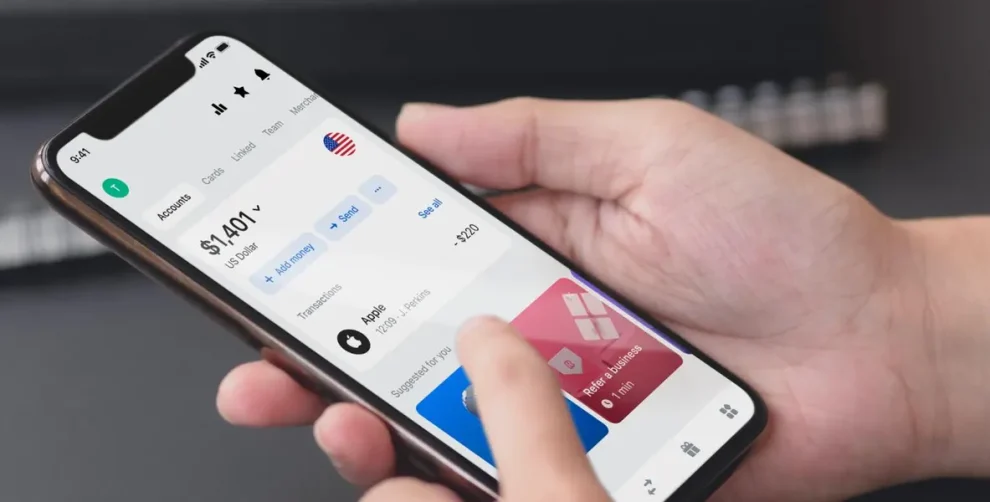

Step 1: Download the Revolut App

Start by downloading the Revolut app from the Apple App Store (for iOS devices) or the Google Play Store (for Android devices).

Step 2: Sign Up and Provide Your Information

Open the app and begin the sign-up process. You’ll need to provide your phone number, email address, and create a secure password. Ensure that you enter accurate information to avoid any delays in the verification process.

Step 3: Verify Your Identity

Revolut takes security seriously and requires identity verification. You’ll need to take a clear photo of your valid government-issued ID (passport or national ID card) and a selfie to complete the verification process. Follow the in-app instructions carefully to ensure a smooth verification.

Step 4: Select Your Account Type

Revolut offers several account types with different features and benefits:

- Standard: The free basic account with core features like currency exchange, international transfers, and debit card payments.

- Plus: A paid plan with additional benefits like weekend currency exchange, travel insurance, and priority customer support (availability may vary by country).

- Premium: The premium tier offers perks such as airport lounge access, disposable virtual cards, and higher currency exchange limits (availability may vary by country).

- Metal: The exclusive tier with a premium metal debit card, cashback rewards on purchases, and concierge services (availability may vary by country).

Choose the account type that best suits your needs and budget.

Step 5: Fund Your Account

To activate your Revolut account, you’ll need to make an initial deposit. Revolut offers various funding methods, which may include bank transfers, debit card top-ups, and Apple Pay or Google Pay (availability may vary by country). Follow the in-app instructions to add funds to your account.

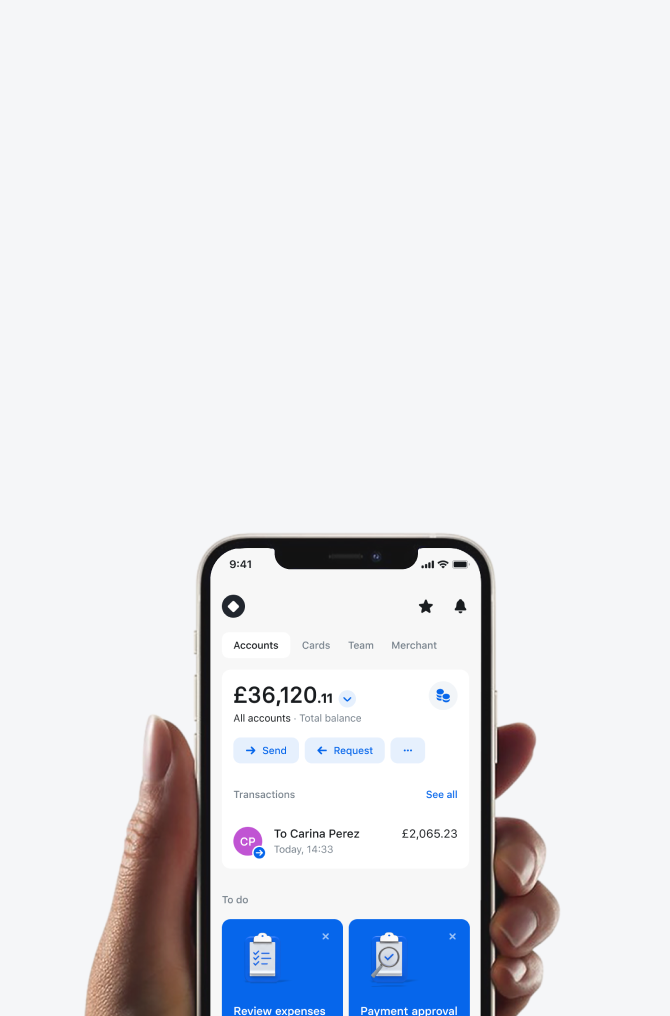

Step 6: Start Using Your Revolut Account

Once your account is verified and funded, you’re ready to start using Revolut! You’ll receive a virtual debit card instantly, which you can use for online transactions. Depending on your account type and country, you may also receive a physical debit card in the mail.

Exploring Revolut’s Key Features

With your Revolut account up and running, it’s time to dive into the exciting features that await you:

- Seamless Currency Exchange: Exchange currencies at interbank rates directly within the app, saving you money on foreign transactions.

- International Transfers: Send and receive money internationally with speed and low fees compared to traditional banks.

- Budgeting Tools: Set spending limits, categorize transactions, and gain insights into your spending habits to stay on top of your finances.

- Peer-to-Peer Payments: Split bills, send money to friends, or transfer funds internationally with ease using Revolut’s peer-to-peer system.

- Investment Options: Round up your purchases and invest the spare change in stocks and fractional shares to grow your wealth over time (subject to regulations).

These are just a few of the many features Revolut offers to simplify your financial life. As you explore the app, you’ll discover even more ways to manage your money efficiently.

Advanced Features for Maximum Convenience

As you become more familiar with Revolut, you can unlock advanced features to take your banking experience to the next level:

- Travel Insurance: Enjoy peace of mind while traveling with Revolut’s insurance plans (available with Plus and Premium accounts, subject to country availability).

- Disposable Virtual Cards: Generate single-use virtual cards for secure online shopping (availability may vary by country and account type).

- Currency Vaults: Lock in exchange rates for future transactions using Revolut’s currency vaults (availability subject to regulations).

- Bill Payments: In some countries, Revolut allows you to pay bills directly through the app, streamlining your financial management (availability subject to local regulations).

Keep in mind that the availability of these advanced features may depend on your location, account type, and local regulations. Always check the Revolut website or app for the most up-to-date information on available services in your region.

Security and Support: Banking with Peace of Mind

When it comes to your finances, security is paramount. Revolut prioritizes the safety of your money and personal information:

- Two-Factor Authentication: Enable two-factor authentication for an extra layer of security when accessing your account.

- Biometric Login: Use fingerprint or facial recognition technology for convenient and secure app access (subject to device compatibility).

- Real-Time Notifications: Stay informed about your account activity with instant transaction notifications.

- Customer Support: Revolut offers dedicated customer support through live chat, email, and in-app assistance to address any questions or concerns you may have.

With these security measures and responsive customer support, you can manage your finances with confidence using Revolut.

Conclusion

Opening a Revolut account is a smart choice for anyone seeking a modern, flexible, and cost-effective way to manage their money. With its user-friendly interface, wide range of features, and commitment to security, Revolut empowers you to take control of your finances like never before.

By following the step-by-step guide outlined in this article, you can easily open a Revolut account and start enjoying the benefits of borderless banking, effortless budgeting, and seamless money transfers. Whether you’re a global traveler, a savvy investor, or simply looking for a better way to manage your money, Revolut has you covered.

So why wait? Download the Revolut app today and embark on a journey towards financial freedom and convenience. With Revolut by your side, you’ll wonder how you ever managed your money without it!

Add Comment