YONO SBI, the official mobile banking app from State Bank of India (SBI). YONO SBI empowers you to bank on the go, offering a convenient and secure platform for all your financial needs.

New to SBI? No Problem!

The beauty of YONO SBI is that you can open a new savings account directly through the app, eliminating the need to visit a physical branch. Here’s what you’ll need to have on hand:

- Valid PAN Card: Your Permanent Account Number (PAN) is crucial for verification purposes.

- Aadhaar Card: This multi-purpose identification document is essential for opening a new account in India.

- Registered Mobile Number: Ensure you have a valid mobile number linked to your Aadhaar card for receiving OTPs (One-Time Passwords).

Ready to get started? Let’s dive in!

Opening a New Savings Account on YONO SBI: Step-by-Step

-

Download the YONO SBI App

Head to the Google Play Store (Android) or App Store (iOS) and search for “YONO SBI.” Download and install the app on your smartphone or tablet.

-

Select “New to SBI”

Upon launching the app for the first time, you’ll be presented with a login screen. Since you’re a new customer, tap on the option “New to SBI.”

-

Choose Your Account Type

YONO SBI offers various savings account options. Familiarize yourself with the features and benefits of each account type before selecting the one that best suits your requirements.

-

Enter Your Details

Carefully fill out the registration form with your personal information, including your full name, date of birth, mobile number, and email address (optional).

-

Aadhaar Verification

The app will initiate Aadhaar verification using a process called e-KYC (electronic Know Your Customer). Ensure you have a good internet connection to proceed smoothly.

-

Set Up Your Login Credentials

Create a strong and unique username and password for secure access to your YONO SBI account.

-

PAN Verification

Enter your PAN card details for further verification.

-

Review and Submit

Carefully review all the information you’ve entered before submitting the application.

-

Video KYC (Optional)

In some cases, YONO SBI might require a video call for additional verification. The app will guide you through this process if necessary.

Congratulations! Once your application is processed and approved, you’ll receive a confirmation notification, and your new YONO SBI account will be activated.

Existing SBI Customer? Here’s How to Link Your Account

If you’re already a proud SBI customer with an existing account, linking it to your YONO SBI app is a breeze:

-

Download and Launch the YONO SBI App

Download and launch the YONO SBI app as mentioned earlier.

-

Select “Existing Customer”

On the login screen, choose the option “Existing Customer.”

-

Login with Your Credentials

Enter your existing SBI account number, debit card details, or customer ID along with your MPIN (Mobile Banking Personal Identification Number) to log in.

Congratulations! Your existing SBI account will be successfully linked to your YONO SBI app. Now you can manage both your existing SBI account and any new accounts you open through YONO SBI, all from the convenience of your mobile device!

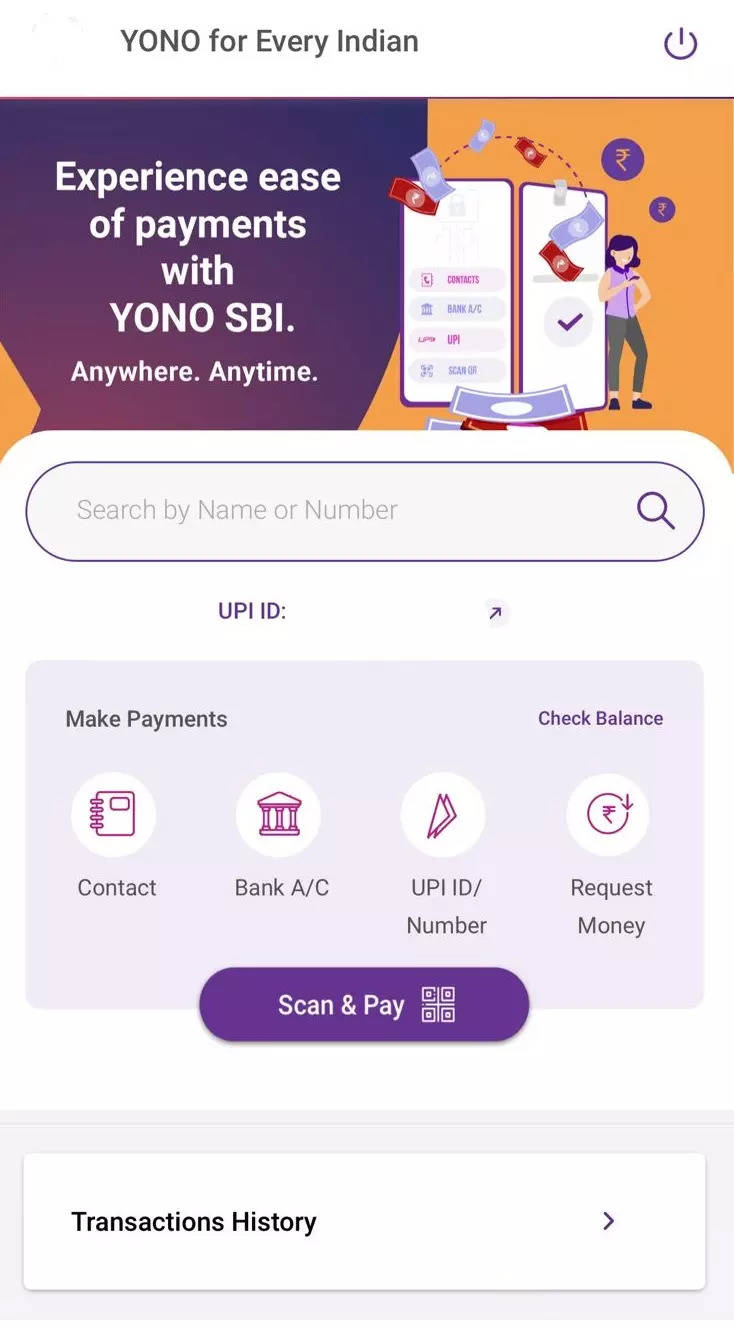

Exploring the Features of YONO SBI

YONO SBI goes beyond just opening new accounts. Here are some of the exciting features you can enjoy:

- Account Management: View your account balance, track transactions, download account statements, and manage beneficiaries – all at your fingertips.

- Fund Transfers: Effortlessly transfer funds between your SBI accounts, send money to other banks (NEFT and IMPS), and recharge your mobile phone or pay bills directly through the app.

- Investment Options: Explore various investment options like mutual funds, fixed deposits, and bonds directly through YONO SBI.

- Loan Applications: Apply for various loans, including personal loans, car loans, and home loans, conveniently through the app.

- UPI Payments: Leverage the Unified Payments Interface (UPI) for seamless and instant online and in-store payments using your YONO SBI app.

- QR Code Payments: Scan QR codes at merchants to make quick and secure payments using your YONO SBI app.

- Digital Locker: Store your important documents like PAN card, Aadhaar card, and driving license securely within the app’s digital locker.

- Bharat QR Code Scanning: Scan and pay bills at various merchants displaying the Bharat QR code.

- Pay Government Fees: Conveniently pay government challans and other fees directly through the app.

- Book Tickets: Book movie tickets, bus tickets, and flight tickets directly through YONO SBI, saving you time and effort.

- Shop Online: Enjoy exclusive deals and discounts on various online shopping platforms through YONO SBI.

- Customer Support: Access YONO SBI’s customer support through the app for any assistance you may need.

YONO SBI offers a comprehensive suite of features, transforming your smartphone into a one-stop shop for all your banking needs.

Security and Privacy with YONO SBI

Security is paramount when it comes to mobile banking. Here’s how YONO SBI prioritizes your financial well-being:

- Multi-Factor Authentication: YONO SBI utilizes multi-factor authentication for secure logins, requiring both your username/password and a one-time password (OTP) received on your registered mobile number.

- Secure Transactions: All transactions are encrypted to safeguard your sensitive financial information.

- App Lock: Enable the app lock feature to add an extra layer of security and prevent unauthorized access even if your phone is misplaced.

- Regular Updates: YONO SBI releases regular updates to address potential security vulnerabilities and enhance overall app security.

Remember, staying vigilant about online security is crucial. Be cautious of phishing attempts and never share your login credentials with anyone.

Beyond the Basics: Getting the Most Out of YONO SBI

Here are some tips to maximize your YONO SBI experience:

- Personalize Your Dashboard: Customize your YONO SBI dashboard to prioritize the features you use most frequently.

- Set Up Bill Reminders: Enable bill payment reminders to ensure you never miss a due date.

- Explore Investment Options: YONO SBI provides access to various investment options. Do your research and consider consulting a financial advisor before making any investment decisions.

- Go Paperless: Opt for e-statements and other paperless options to minimize clutter and contribute to a greener environment.

- Keep the App Updated: Ensure you have the latest version of the YONO SBI app installed for optimal functionality and security.

By following these tips and exploring the vast features offered by YONO SBI, you’ll transform your mobile device into a powerful and convenient banking tool.

Conclusion: Banking at Your Fingertips

YONO SBI revolutionizes the way you manage your finances. From opening new accounts to managing existing ones, making payments, and exploring investment options, YONO SBI empowers you to bank on the go, anytime, anywhere.

With its user-friendly interface, robust security features, and comprehensive suite of financial services, YONO SBI is your one-stop shop for all your banking needs. So, download the YONO SBI app today and experience the convenience and efficiency of mobile banking with SBI!

This guide has equipped you with the knowledge and confidence to navigate opening an account on YONO SBI and unlock a world of financial possibilities at your fingertips. Embrace the future of banking and take control of your finances with YONO SBI!

Add Comment