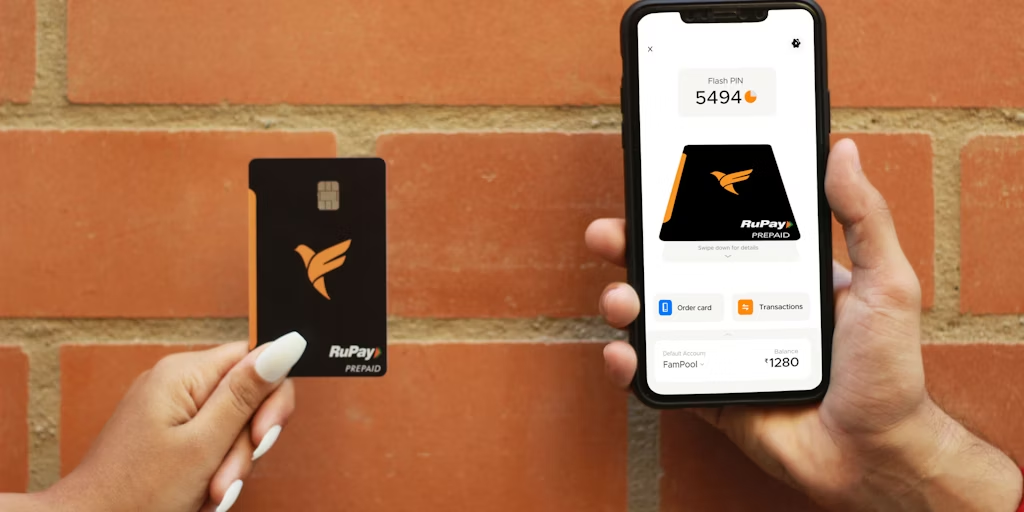

Picture this: you’re a savvy Indian teen eager to dip your toes into the world of personal finance. But traditional banks and payment apps weren’t exactly designed with your unique needs in mind. Enter FamPay, the game-changing mobile wallet that’s empowering young adults to manage their money responsibly, all with a healthy dose of parental supervision.

First Up: What Exactly is FamPay?

Before we dive into account setup, let’s clarify what sets FamPay apart from your average payment app. In a nutshell, FamPay is a secure mobile wallet designed specifically for Indian teens aged 13–18. It’s the brainchild of RBI-approved startup Eversendayi Finance Private Limited, and it’s on a mission to promote financial literacy and responsibility among young users.

Here are some of the key benefits that make FamPay a standout choice for tech-savvy teens:

- Built-in parental controls for peace of mind and safe spending

- There is no balance requirement so you can start using the app right away

- Seamless cashless transactions for online shopping, in-store purchases, and peer-to-peer payments

- Exciting rewards and offers will make your pocket money go further

Essentially, FamPay is like a virtual piggy bank that teaches you smart money habits for the digital age. And the best part? Getting started is totally free and takes just a few minutes. All you need is a smartphone, an Indian phone number, and a willing parent or guardian to link their account to yours.

How to Open Your FamPay Account

Ready to join the FamPay revolution? Follow these simple steps to get your account up and running in no time:

- Download the FamPay app from the Google Play Store or Apple App Store

- Open the app and tap “Sign Up” to begin the registration process

- Enter your Indian mobile number and wait for the verification code to arrive via SMS

- Punch in the verification code, then create a strong MPIN (Mobile PIN) to secure your account

- Now it’s your parent’s or guardian’s turn! They’ll need to download the FamPay app on their own device and create a separate account using their mobile number and MPIN

- During your signup, you’ll see a unique code to link your account to your parent’s or guardian’s. Have them enter this code in their app to establish the connection and grant them visibility over your account

- Voila! Your FamPay account is now active and ready to use. You may be prompted to complete a quick verification step, such as linking your Aadhaar card, to unlock higher transaction limits and additional features

See, we told you it was easy! In just a few taps, you’ve taken a major step towards financial independence. Now let’s talk about how to make the most of your shiny new FamPay account.

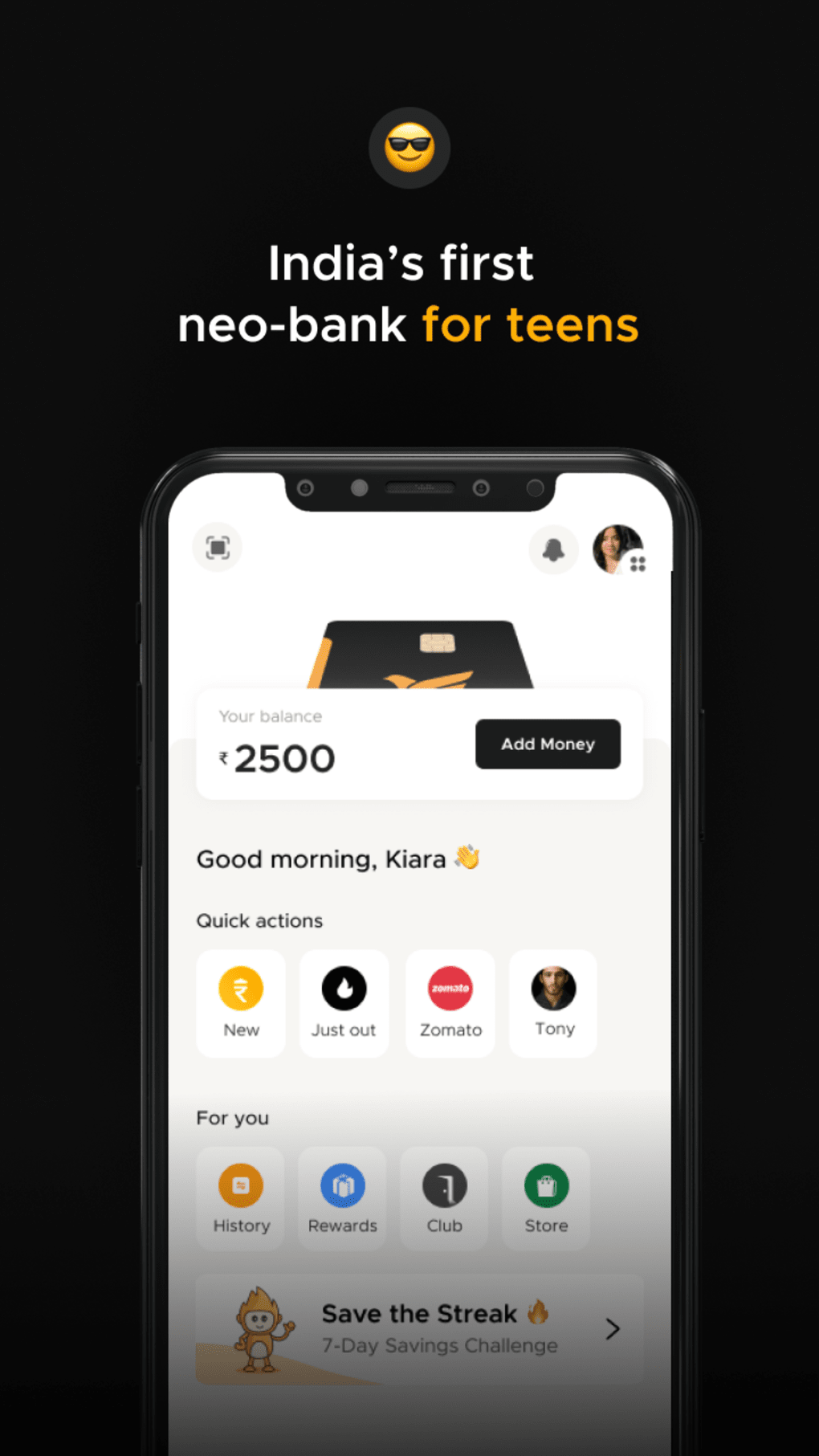

Navigating the FamPay App: A Whirlwind Tour

Congrats, You’re officially a FamPay user! Now it’s time to explore all the cool things you can do with the app. Here’s a quick rundown of the key features and how to use them like a pro:

The Home Screen

Think of the home screen as your FamPay command center. It displays your current balance, recent transactions, and handy shortcuts to all the app’s main functions.

Send & Request Money

Need to split a bill or pay back a friend? Use the “Send Money” feature to instantly transfer funds to any FamPay user using their registered mobile number. You can also “Request Money” from your contacts if they owe you.

Scan & Pay

Shopping at a store that accepts FamPay? Simply scan the merchant’s QR code at checkout to pay directly from your FamPay balance. No more fumbling for cash or cards!

Transactions

The “Transactions” tab is where you’ll find a detailed record of all your FamPay activity, including money sent, received, and spent. Use it to keep tabs on your spending and spot any unusual charges.

Profile & Settings

Tap the profile icon to view and edit your personal information, change your MPIN, set spending limits, and customize your app preferences. This is also where you’ll find the “Help & Support” section if you ever need assistance.

Of course, this is just a high-level overview; there’s plenty more to discover as you dive deeper into the FamPay experience. Don’t be afraid to tap around and explore at your own pace!

Budgeting 101: How FamPay Helps You Manage Your Money

One of the coolest things about FamPay is that it’s not just a payment app; it’s also a powerful tool for building healthy financial habits that will serve you well into adulthood. Here are some ways you can use FamPay to budget like a boss:

- Set spending limits with your parents to avoid blowing through your allowance too quickly

- Use the transaction history to track where your money is going and identify areas where you can cut back

- Take advantage of FamPay’s rewards and cashback offers to stretch your rupees further

- Talk to your parents about setting aside a portion of your FamPay balance for saving (the app doesn’t have a dedicated savings feature yet, but you can still earmark funds for future goals)

Remember, budgeting is all about finding a balance between spending and saving that works for you. FamPay gives you the tools to take control of your finances, but it’s up to you to use them wisely!

Keeping Your FamPay Account Safe & Secure

Of course, with great financial power comes great responsibility. While FamPay has robust security measures in place, it’s important to do your part to protect your account from fraud and unauthorized access. Here are some best practices to keep in mind:

- Never share your MPIN or password with anyone, not even your best friend.

- Be wary of suspicious messages or requests, especially if they ask for sensitive information like your MPIN or bank details

- If you notice any unauthorized transactions or strange activity, report it to FamPay support and your parents immediately

- Take advantage of your parent/guardian’s linked account; they have visibility into your spending and can help you spot red flags

By following these simple guidelines and trusting your instincts, you can help ensure that your FamPay experience is safe, secure, and stress-free.

The Future of FamPay: What’s Next for Teen Finance?

As impressive as FamPay is today, it’s just the beginning of a fintech revolution designed to empower the next generation. In the coming months and years, the app is poised to roll out even more game-changing features, like:

- Expanded merchant partnerships and rewards will make your FamPay balance go further

- Integration with popular online services means you can use FamPay for even more of your daily needs

- Enhanced budgeting and savings tools to help you crush your financial goals

- Educational resources and mini-games to make learning about personal finance easier, more fun and more engaging

Exciting stuff, right? By hopping on the FamPay train now, you’re not just simplifying your spending; you’re also getting a front-row seat to the future of finance. And who knows? The smart money habits you build today could be the key to unlocking a lifetime of financial freedom and success.

The Bottom Line on FamPay for Indian Teens

So there you have it—the complete lowdown on how to open a FamPay account and start your journey towards financial independence. We’ve covered everything from the basic setup process to budgeting tips, security best practices, and a sneak peek at the app’s exciting roadmap.

At the end of the day, FamPay is more than just a convenient way to spend and receive money. It’s a powerful tool for learning real-world financial skills, building trust with your parents, and laying the foundation for a bright economic future. So, what are you waiting for? Download the app, link up with your folks, and start exploring the world of mobile payments—your wallet (and your future self) will thank you!

Add Comment