Payoneer is a leading digital payment platform that simplifies global transactions, making it easier to send and receive funds across countries and currencies.

If you’re considering opening a Payoneer account to streamline your international payment processes, this comprehensive guide is for you. We’ll explore the benefits of using Payoneer, walk you through the account creation process step-by-step, and share expert tips for maximizing the potential of your account.

Why Choose Payoneer for Your International Payment Needs?

Payoneer offers a range of compelling features and benefits for individuals and businesses navigating the global marketplace:

1. Seamless Cross-Border Payments

With Payoneer, you can send and receive payments internationally with ease. The platform supports transactions in over 200 countries and territories, making it a versatile solution for freelancers, remote workers, and global businesses.

2. Multi-Currency Support

Payoneer allows you to hold, manage, and transact in multiple currencies, including USD, EUR, GBP, JPY, and more. This multi-currency functionality eliminates the need for constant currency conversions and simplifies international transactions.

3. Competitive Fees and Exchange Rates

Compared to traditional banks and payment processors, Payoneer often offers more competitive fees and exchange rates for international transactions. This can result in significant savings, especially for businesses with high volumes of cross-border payments.

4. Robust Security Measures

Payoneer prioritizes the security of your funds and personal information. The platform employs advanced encryption, fraud detection, and other security measures to protect your account and transactions from unauthorized access.

5. Convenient Access to Funds

With Payoneer, you have multiple options for accessing your funds. You can withdraw money directly to your local bank account, use the Payoneer Mastercard® debit card for online and in-store purchases, or even transfer funds to other Payoneer users.

6. Integration with Popular Platforms

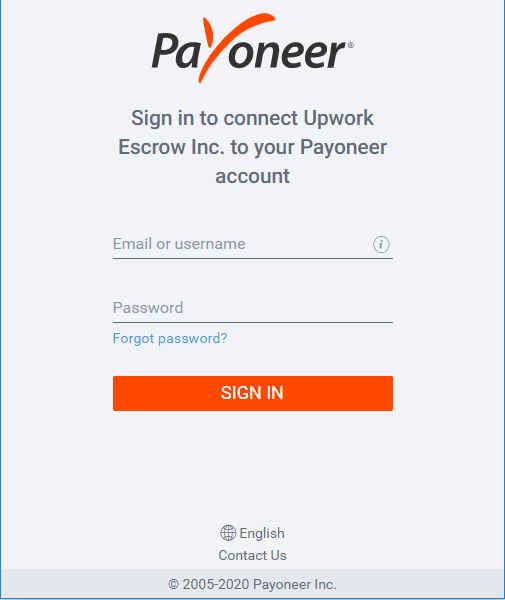

Payoneer integrates with various popular freelance marketplaces, e-commerce platforms, and payment systems, such as Upwork, Fiverr, Amazon, and Airbnb. This integration streamlines the process of receiving payments from these platforms directly into your Payoneer account.

Now that we’ve explored the key benefits of using Payoneer let’s dive into the account creation process.

Step-by-Step Guide: How to Create Your Payoneer Account

Setting up a Payoneer account is a straightforward process that can be completed in just a few steps:

- Visit the Payoneer Website: Go to Payoneer.com and click on the “Sign Up” button in the top right corner of the page.

- Choose Your Account Type: Select whether you want to create an individual account (for freelancers and sole proprietors) or a company account (for businesses and organizations).

- Provide Your Personal Information: Fill in the required details, such as your full name, date of birth, country of residence, and email address. Make sure to use a valid email address, as you’ll need to verify it later.

- Create Your Login Credentials: Choose a strong password for your Payoneer account and set up your security questions. These steps help protect your account from unauthorized access.

- Verify Your Email Address: After submitting your registration form, check your email inbox for a verification message from Payoneer. Click on the verification link to confirm your email address and activate your account.

- Provide Additional Information: Depending on your country and account type, Payoneer may require additional information, such as your business details, tax ID, or proof of identity. Follow the prompts to provide the necessary information and documentation.

- Set Up Your Payment Methods: To start receiving payments, link your local bank account to your Payoneer account. You can also order a Payoneer Mastercard® debit card for easy access to your funds.

Congratulations! You’ve now successfully created your Payoneer account and are ready to start receiving and sending payments globally.

Optimizing Your Payoneer Account for Maximum Benefit

To make the most of your Payoneer account, consider implementing these best practices and utilizing additional features:

1. Keep Your Account Information Up to Date

Ensure that your personal and business information, such as your address, contact details, and tax ID, are always accurate and current. This helps maintain the security and smooth operation of your account.

2. Utilize the Payoneer Mastercard® Debit Card

The Payoneer Mastercard® debit card allows you to access your funds instantly, make online and in-store purchases, and withdraw cash from ATMs worldwide. It’s a convenient way to use your Payoneer balance for everyday expenses and travel.

3. Take Advantage of Payoneer’s Mass Payout Feature

If your business regularly sends payments to multiple recipients, such as freelancers, contractors, or affiliates, Payoneer’s mass payout feature can save you time and effort. With mass payouts, you can send funds to multiple recipients simultaneously, streamlining your payment processes.

4. Integrate Payoneer with Your Preferred Platforms

Payoneer integrates with various popular freelance marketplaces, e-commerce platforms, and payment systems. By connecting your Payoneer account with these platforms, you can automate the process of receiving payments and reduce manual transfer steps.

5. Stay Informed About Payoneer’s Fees and Exchange Rates

While Payoneer generally offers competitive fees and exchange rates, it’s essential to stay informed about the costs associated with different types of transactions. Regularly review Payoneer’s fee schedule and exchange rates to make informed decisions about sending and receiving payments.

6. Maintain Good Account Standing

To ensure uninterrupted access to your Payoneer account and its features, maintain good account standing by following Payoneer’s terms of service, providing accurate information, and conducting legitimate business transactions. Avoid any activities that may be considered fraudulent or suspicious.

By following these best practices and leveraging Payoneer’s various features, you can optimize your account to efficiently manage your international payments and grow your business globally.

Payoneer’s Role in Your Global Business Strategy

In an increasingly globalized business landscape, having a reliable and efficient cross-border payment solution is crucial for success. Payoneer empowers freelancers, entrepreneurs, and businesses to expand their reach and tap into international markets with confidence.

By creating a Payoneer account, you gain access to a powerful tool that simplifies global transactions, reduces currency conversion costs, and provides a secure platform for sending and receiving payments worldwide. Whether you’re a freelancer working with international clients, an e-commerce business selling globally, or a company with a distributed team, Payoneer can help streamline your financial operations and support your growth.

As you embark on your global business journey, consider incorporating Payoneer into your financial strategy. With its user-friendly interface, robust features, and commitment to security, Payoneer is a trusted partner for businesses and individuals navigating the complexities of international payments.

Conclusion

Opening a Payoneer account is a simple and effective way to streamline your international payment processes and unlock new opportunities in the global marketplace. By following the step-by-step guide outlined in this article and implementing the best practices for optimizing your account, you can take full advantage of Payoneer’s features and benefits.

Whether you’re a freelancer, entrepreneur, or business owner, Payoneer provides a secure, efficient, and cost-effective solution for managing your cross-border transactions. By leveraging Payoneer’s capabilities and integrating it into your global business strategy, you can focus on growing your business and achieving your international ambitions with peace of mind.

Start your global journey today by creating your Payoneer account and experience the convenience and flexibility of seamless international payments.

Add Comment