Indeed Flex has announced a strategic partnership with workforce payments company Branch. This collaboration introduces Same Day Pay, a feature that promises to address one of the most pressing concerns in the gig economy: timely access to earnings.

As the sun rose over Indeed Flex’s headquarters in Austin, Texas, this morning, the atmosphere was electric. Employees bustled about, preparing for the official announcement that would change the lives of thousands of temp workers across the nation.

Sarah Johnson, Indeed Flex’s Head of Product Innovation, stood before a crowd of eager journalists and industry analysts. “Today marks a new era for temporary workers,” she declared, her voice filled with enthusiasm. “Our partnership with Branch isn’t just about faster payments – it’s about empowering our workforce with financial flexibility and peace of mind.”

Indeed Flex’s decision to introduce Same Day Pay comes at a crucial time. Recent studies have shown that approximately 75% of contingent workers desire daily payment options. This statistic underscores a growing frustration with traditional pay periods, especially in an economy where many live paycheck to paycheck.

Mark Davis, a longtime temp worker I spoke with outside the event, shared his perspective. There’ve been times when I’ve finished a week of hard work, only to wait another week or more to get paid,” he said, shaking his head. “It’s tough when you’ve got bills due and groceries to buy. This Same Day Pay option? It’s a game-changer.”

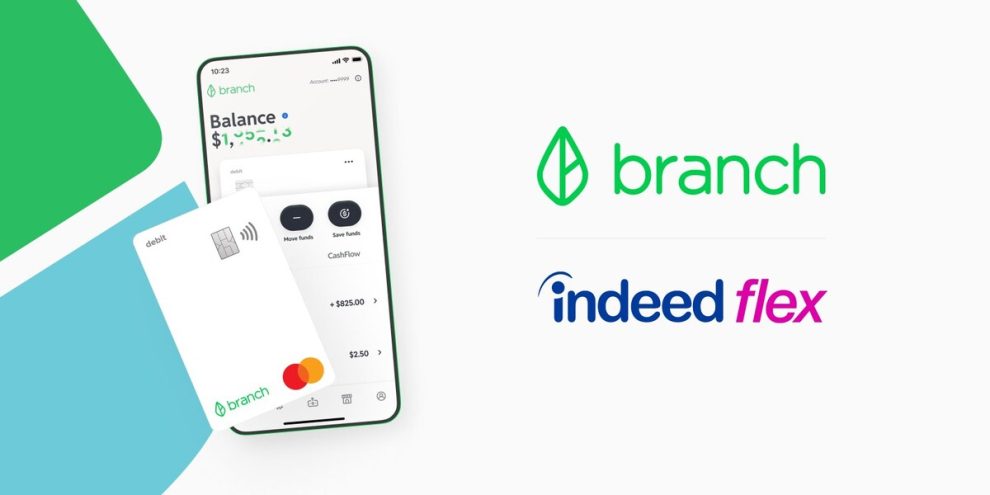

The new feature, accessible through the Branch app, allows Flex users to access up to 50% of their earnings within just one hour of completing a shift. This system is supported by a digital wallet backed by a bank account and a Mastercard debit card, all provided at no cost to the worker.

Emily Chen, Branch’s Chief Technology Officer, demonstrated the app’s functionality during the press conference. It’s as simple as tapping a button,” she explained, her fingers moving swiftly across a smartphone screen. “Workers can choose to receive their pay daily or stick with the traditional weekly schedule. The power is in their hands.”

Financial experts at the event were quick to point out the potential impact of this initiative on worker well-being. Dr. Alicia Ramirez, an economist specializing in labor markets, shared her insights with me during a coffee break.

“For gig workers, freelancers, and contractors, the wait for payment can be excruciating,” she explained, stirring her latte thoughtfully. “Payday delays can have devastating consequences if unexpected expenses arise between pay periods. This Same Day Pay option could be a lifeline for many.”

Indeed Flex and Branch’s solution goes beyond mere convenience. By offering instant, on-demand payroll, they’re providing a safety net that could help workers avoid financial hardships and reduce stress.

While the focus of the announcement was on worker benefits, the potential advantages for employers didn’t go unnoticed. Industry analysts at the event were buzzing about the implications for employee retention and satisfaction.

John Thompson, a human resources consultant, shared his perspective. “Companies that offer flexible payment options like this tend to see reduced turnover,” he noted. “Lower turnover means lower onboarding and training costs. It’s a win-win situation.”

This point was echoed by Indeed Flex’s CEO, Lisa Patel. “Happy workers are productive workers,” she stated during the Q&A session. “By addressing one of the most significant pain points in temporary work, we’re not just helping our Flex users – we’re providing value to the businesses that rely on their skills.”

The move by Indeed Flex and Branch is part of a larger trend in workforce management. Other industries, facing similar challenges, have started to adopt comparable strategies.

For instance, the trucking industry, grappling with a projected driver shortage of 160,000 by 2030, has begun introducing instant payments. The results have been promising, with an Intelligence study finding that 91% of truckers receiving instant payments appreciate the speed and peace of mind they provide.

“It’s not just about the money,” explained Mike Rodgers, a truck driver I interviewed via phone after the event. “It’s about feeling valued. When companies trust us with quick access to our earnings, it shows they respect our work.”

As the press conference wound down, the excitement in the room was palpable. Journalists huddled in corners, furiously typing on laptops, while industry representatives engaged in animated discussions about the implications of this new payment model.

Sarah Johnson of Indeed Flex took the stage one last time to address questions about the future. “This is just the beginning,” she assured the audience. “We’re committed to continuously innovating and finding new ways to support our temp workforce.”

The partnership between Indeed Flex and Branch represents a significant step forward in addressing the financial needs of temporary workers. By offering Same Day Pay, they’re not just changing payment schedules – they’re potentially reshaping the entire landscape of gig work.

As I packed up my notepad and headed out into the Austin afternoon, the buzz of excitement followed me. It was clear that this announcement wasn’t just a corporate partnership – it was the start of a revolution in how we think about work, pay, and financial well-being in the gig economy.

Add Comment