PayPal Holdings announced today that U.S. merchants can now buy, hold, and sell cryptocurrency directly from their PayPal business accounts. This groundbreaking expansion of crypto services, which excludes New York State, marks a significant milestone in the mainstreaming of digital currencies for everyday business transactions.

As I stood in the bustling financial district of San Francisco, just steps away from PayPal’s headquarters, the excitement was palpable. Business owners and crypto enthusiasts alike were gathering to discuss the implications of this game-changing announcement.

This is what we’ve been waiting for,” exclaimed Sarah Chen, owner of a local tech startup. Finally, we can seamlessly integrate crypto into our business operations without jumping through hoops.

Indeed, PayPal’s latest move isn’t just about adding a new feature – it’s about fundamentally changing how businesses interact with digital currencies.

Expanding Crypto Capabilities for Business Accounts

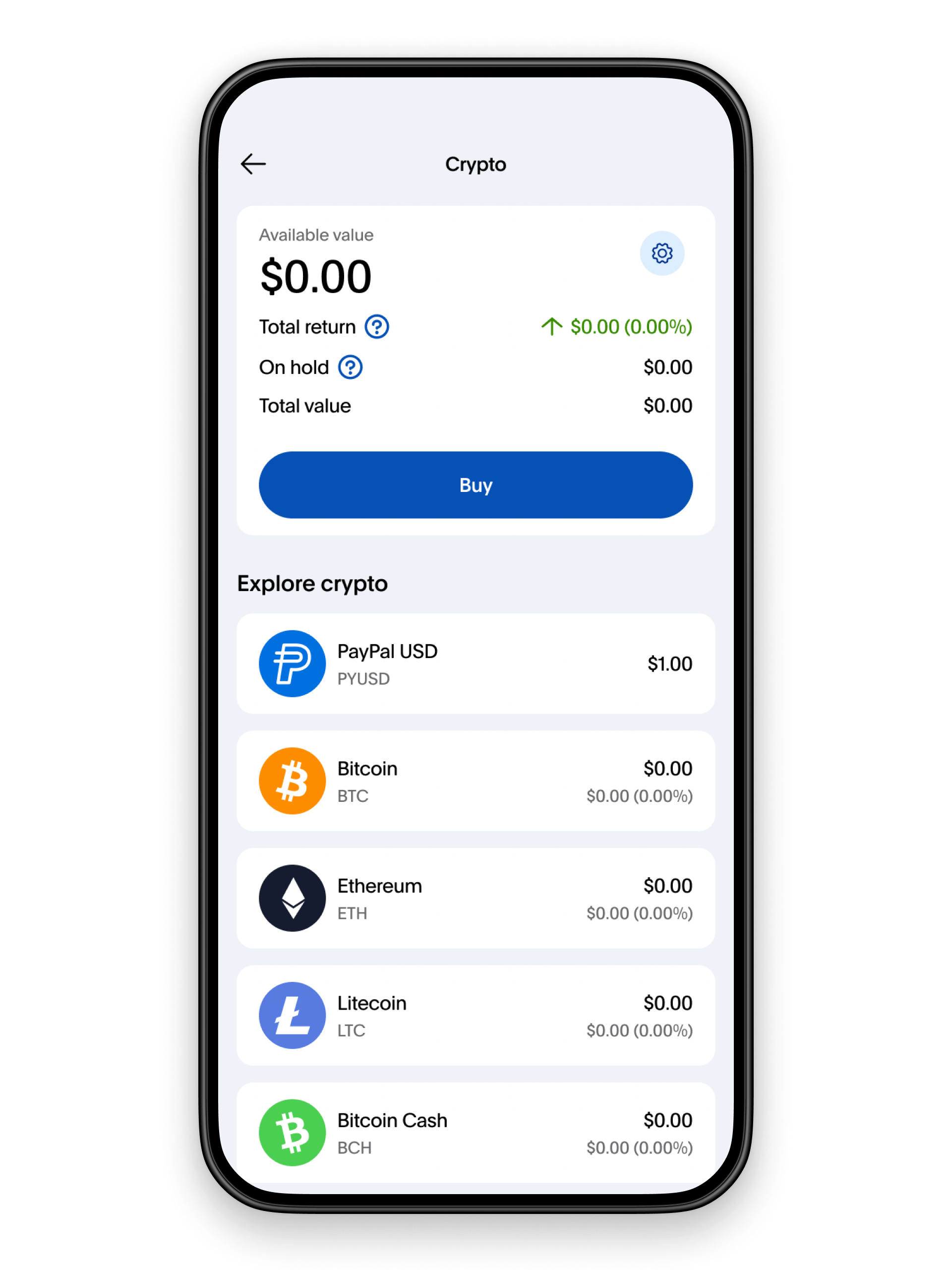

The new capabilities extend beyond mere buying and selling. PayPal business account holders can now:

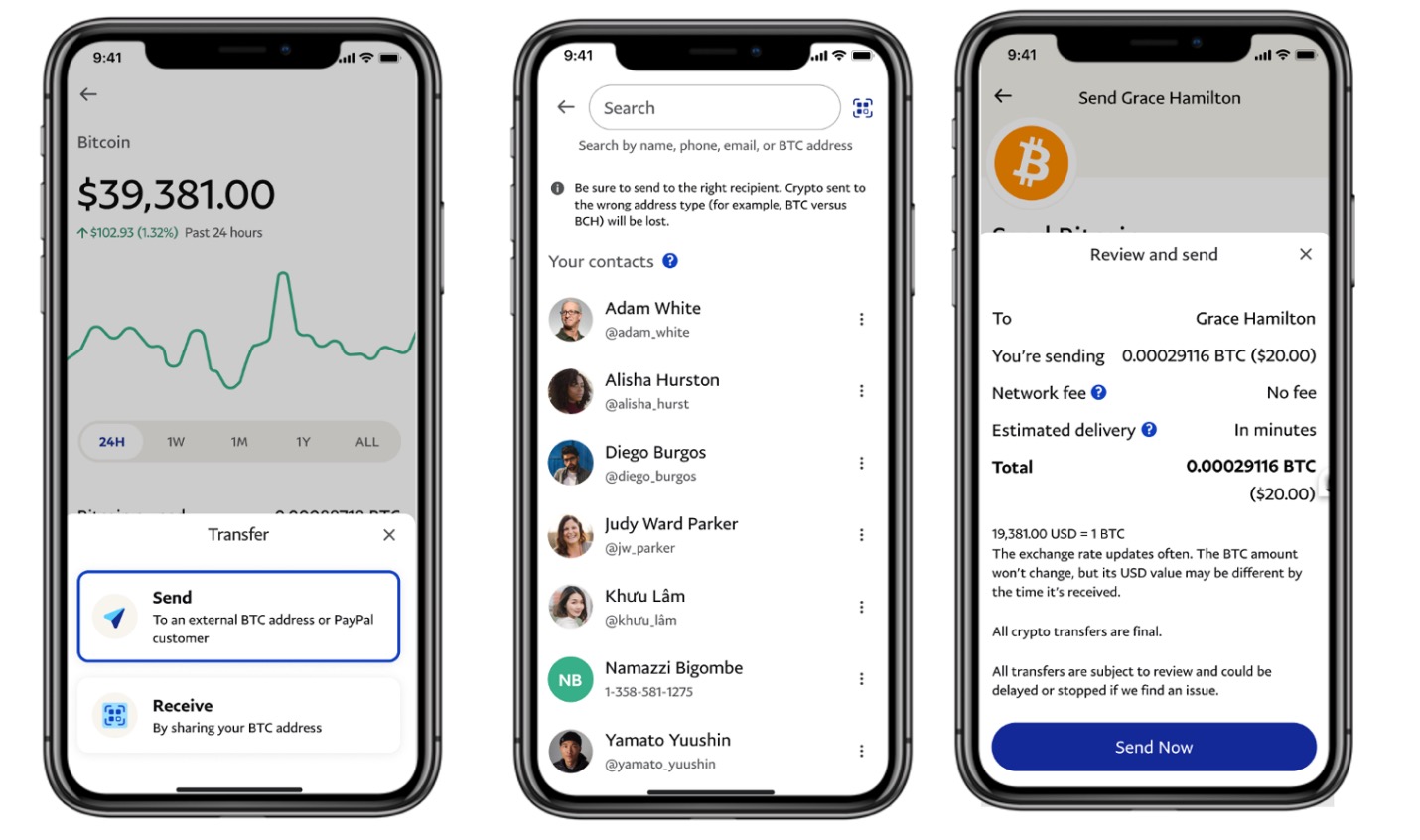

1. Send and receive supported cryptocurrency tokens to and from external blockchain accounts

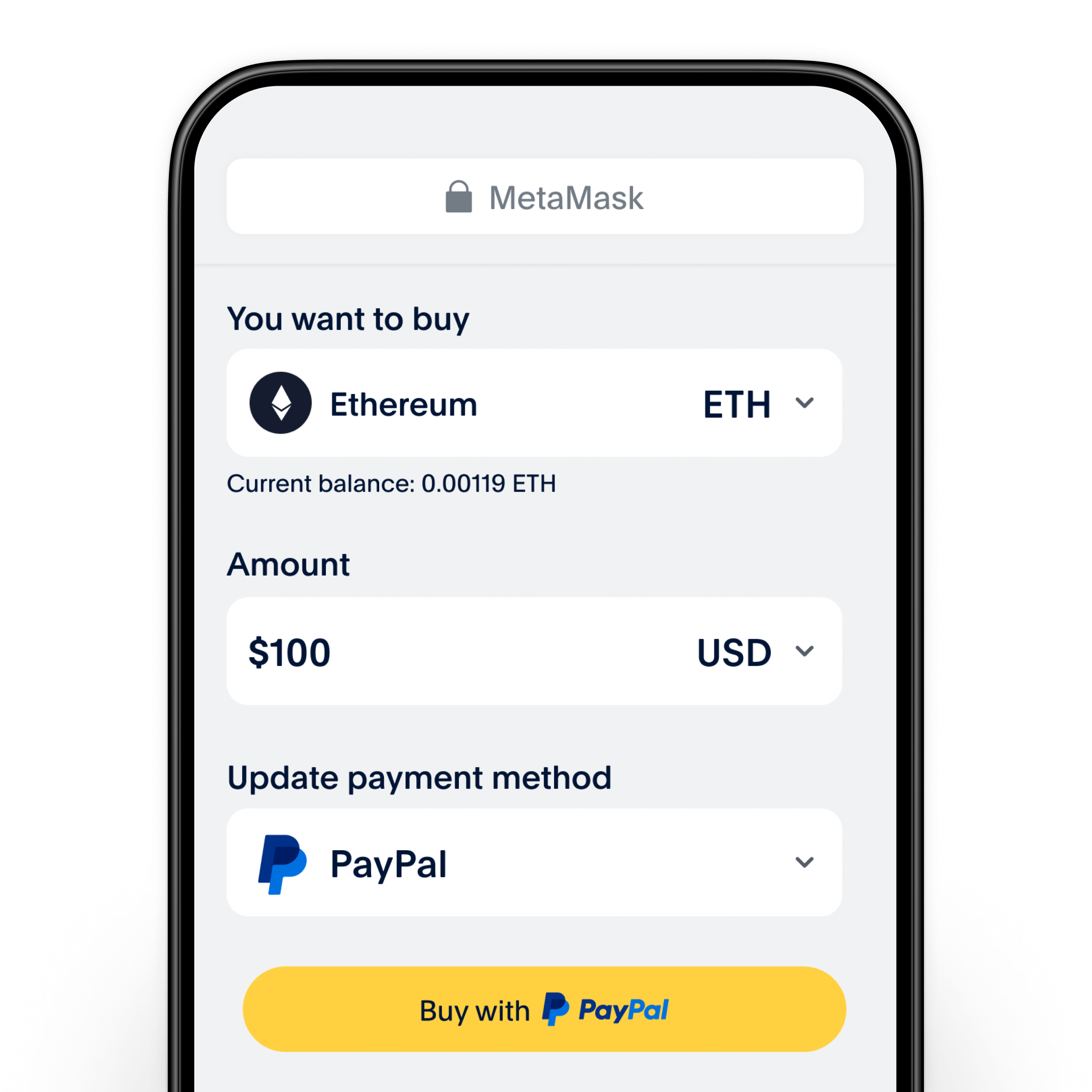

2. Integrate crypto transactions directly into their existing PayPal workflows

3. Access the same user-friendly interface for crypto that consumers have enjoyed since 2020

Jose Fernandez da Ponte, senior vice president of blockchain, cryptocurrency and digital currencies at PayPal, emphasized the demand-driven nature of this expansion. “Business owners have increasingly expressed a desire for the same cryptocurrency capabilities available to consumers,” he stated in the press release. We’re excited to meet that demand by delivering this new offering, empowering them to engage with digital currencies effortlessly.

To truly appreciate the significance of today’s announcement, it’s worth looking back at PayPal’s crypto journey. In October 2020, the company made waves by allowing consumers to buy, hold, and sell crypto through their PayPal and Venmo accounts.

At the time, then-CEO Dan Schulman prophetically stated, “The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system.”

Fast forward to today, and Schulman’s vision is becoming a reality not just for consumers, but for businesses as well.

In August 2023, PayPal took another significant step by introducing PayPal USD (PYUSD), a U.S. dollar-pegged stablecoin. This move provided users with a seamless way to fund purchases and convert between cryptocurrencies supported by PayPal.

“PayPal USD is more than just another stablecoin,” explained Dr. Maria Rodriguez, a fintech analyst I spoke with at a nearby café. “It’s a bridge between traditional finance and the crypto world, making it easier for businesses to dip their toes into digital currencies without fully leaving the comfort of fiat.”

The expansion of PayPal USD to the Solana blockchain in May further enhanced its utility, offering users faster and cheaper transactions across multiple blockchains.

As I walked through San Francisco’s vibrant small business district, I couldn’t help but wonder how this new feature would impact local merchants. Tom Nguyen, owner of a trendy coffee shop, shared his thoughts:

“We’ve been accepting crypto payments for a while now, but it’s always been a hassle to manage. With PayPal integrating it directly into our business account, it’s going to streamline everything. Plus, the ability to hold and sell crypto right there in the app? That’s a game-changer for managing our digital assets.”

While the excitement is palpable, it’s important to note that this new feature isn’t without its challenges. The exclusion of New York State, likely due to regulatory hurdles, highlights the ongoing complexities in the crypto space.

Additionally, businesses will need to navigate the volatile nature of cryptocurrencies and understand the tax implications of holding and transacting in digital assets.

“It’s crucial for business owners to educate themselves about the risks and responsibilities that come with crypto,” cautioned Lisa Park, a certified public accountant specializing in digital currencies. “PayPal’s user-friendly interface is great, but it doesn’t absolve users from due diligence.”

As the sun sets over the San Francisco Bay, casting a golden glow on the city’s iconic skyline, it’s clear that we’re witnessing a pivotal moment in the evolution of digital commerce.

PayPal’s expansion of crypto services to business accounts is more than just a new feature – it’s a glimpse into a future where digital and traditional currencies coexist seamlessly in the world of commerce.

While challenges remain, the potential for increased financial inclusion, efficiency, and innovation is immense. As businesses begin to explore these new capabilities, we may well be looking at the early days of a new era in merchant finance.

For PayPal, this move reinforces its position at the forefront of the digital payment revolution. For businesses, it opens up a world of new possibilities. And for the rest of us, it’s a clear signal that the future of money is digital, decentralized, and closer than we might think.

Add Comment