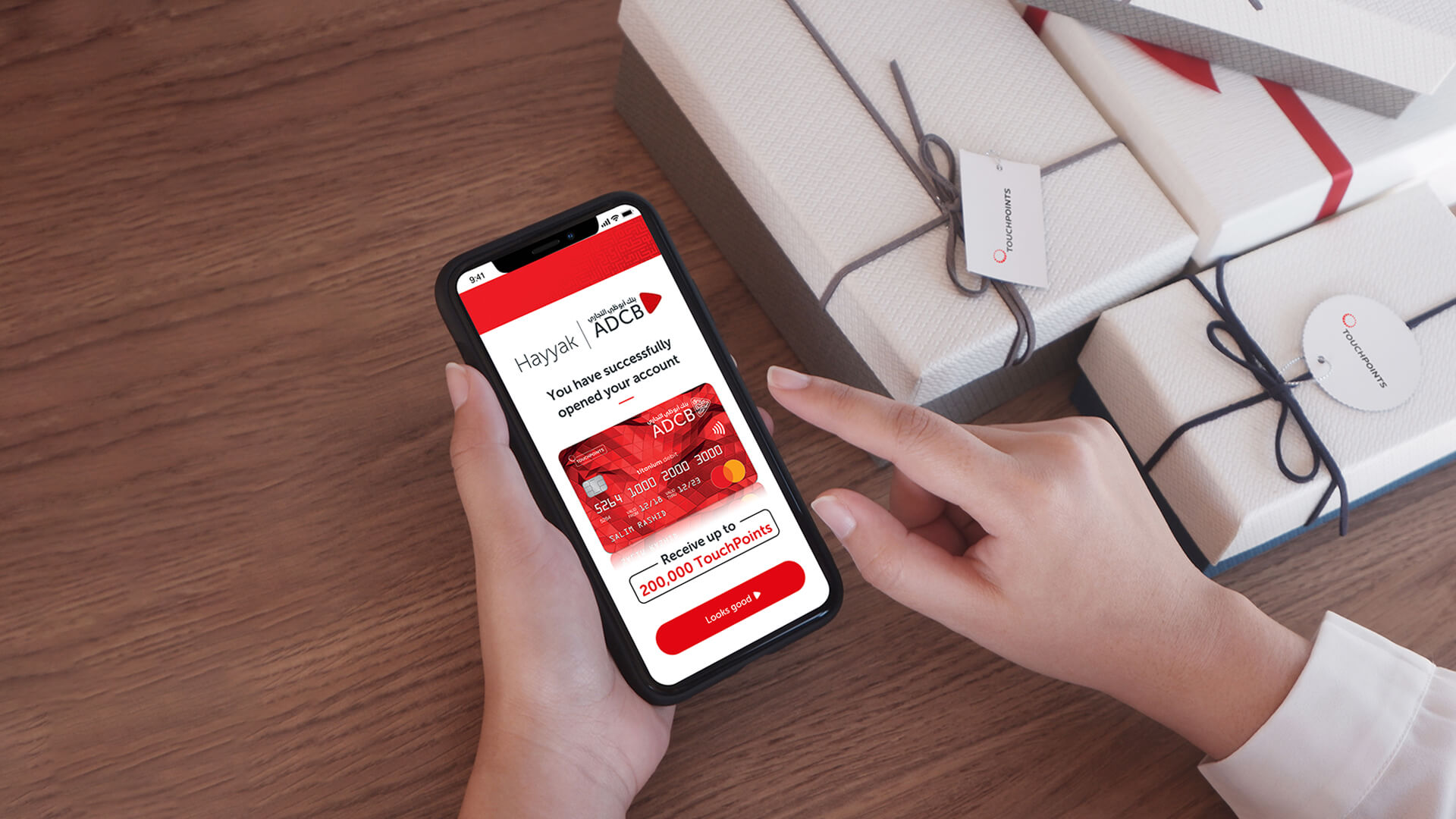

ADCB, a leading UAE bank, has revolutionized the account opening process with its groundbreaking Hayyak app. Say goodbye to lengthy branch visits and cumbersome paperwork, and embrace the convenience of managing your finances from the palm of your hand. In this comprehensive guide, we’ll walk you through the simple steps of opening an ADCB Hayyak account, ensuring a seamless and hassle-free experience.

Why Choose Hayyak for Your Banking Needs?

Before we dive into the account opening process, let’s explore the compelling reasons to choose Hayyak as your banking companion:

- Unparalleled Convenience: With Hayyak, you can open your account anytime, anywhere, using just your smartphone. No more waiting in long queues or scheduling branch appointments – banking is now at your fingertips.

- Swift and Efficient: The Hayyak app streamlines the account opening process, allowing you to complete the entire application in a matter of minutes. Time is precious, and Hayyak values yours.

- Robust Security Measures: ADCB prioritizes the safety of your personal and financial information. The Hayyak app employs state-of-the-art security protocols to protect your data throughout the online application process, giving you peace of mind.

- Transparency and Clarity: Hayyak’s user-friendly interface provides clear and concise information about account features, fees, and terms and conditions. You’ll have a thorough understanding of what to expect from your banking experience.

- 24/7 Account Management: Once your Hayyak account is active, you’ll have round-the-clock access to your online banking dashboard. Manage your finances, track transactions, and make informed decisions, all from the convenience of your smartphone.

Is Hayyak the Right Fit for You?

Opening an ADCB Hayyak account is an excellent choice for individuals who:

- Prioritize convenience and efficiency in their banking experience.

- Are comfortable navigating mobile apps and prefer digital banking solutions.

- Have the necessary documents readily available for online verification.

- Meet the minimum age requirement of 21 years.

It’s important to note that while Hayyak offers a range of account types, the online account opening process is currently available for select options, such as Current Accounts and Savings Accounts. We’ll delve into the eligibility requirements in the upcoming sections to ensure you have a clear understanding of what to expect.

Getting Started: Prerequisites for Opening a Hayyak Account

Before embarking on your Hayyak account opening journey, make sure you meet the following eligibility criteria:

- Residency Status: You must be a resident of the United Arab Emirates to open a Hayyak account.

- Age Requirement: The minimum age to open a Hayyak account is 21 years.

- Document Checklist: Keep scanned copies of your Emirates ID (or a valid passport for non-residents) and a proof of address document (such as a utility bill or residence visa) ready for upload during the application process.

Hayyak Helpful Tip: Ensure that the scanned copies of your documents are clear, legible, and within the file size limit specified by ADCB to avoid any delays in the verification process.

Depending on your chosen account type, Hayyak may request additional documents during the application. Be prepared to provide them if prompted to ensure a smooth account opening experience.

Step-by-Step Guide: Opening Your Hayyak Account

Now that you have the prerequisites in order let’s walk through the step-by-step process of opening your ADCB Hayyak account:

- Download the ADCB Hayyak app from the App Store or Google Play Store on your smartphone.

- Launch the app and select your preferred language and location (if applicable).

- On the main screen, tap the “New User” option to begin the account opening process.

- Enter your Emirates ID number accurately when prompted.

- Verify your mobile number by entering the one-time verification code (OTP) sent to your registered number.

- Choose the account type that best suits your banking needs from the list of available options.

- Fill out the application form with your personal information and employment details (if required).

- Upload scanned copies of your Emirates ID (or passport) and proof of address document in the designated section.

- Review all the entered information for accuracy and completeness before submitting your application.

- If required, take a clear selfie following the on-screen instructions for verification purposes.

- Upon submission, you’ll receive a notification acknowledging your application.

Hayyak Helpful Tip: Keep a record of your application reference number for future correspondence regarding your account opening status.

The Approval Process: What to Expect

After submitting your Hayyak account application, ADCB will review your information and documents to ensure eligibility. The approval process typically takes 24-48 hours. You’ll receive a notification via email or SMS regarding the status of your application.

If your application is approved, congratulations! Your Hayyak account is now active and ready for use. If there are any delays or additional requirements, ADCB will contact you with further instructions.

Navigating Your Hayyak Account: Getting Started

Once your Hayyak account is approved, it’s time to explore the features and benefits at your fingertips:

- Launch the Hayyak app and log in using your Emirates ID number or chosen username and password.

- Familiarize yourself with your Hayyak dashboard, which provides an overview of your account balance, recent transactions, and available features.

- Fund your account through various methods, such as bank transfers, cash deposits at ADCB ATMs, or mobile cheque deposits (subject to account type).

- If applicable, track the delivery status of your Hayyak debit card within the app.

- Start utilizing your Hayyak account for everyday banking activities, including online payments, bill settlements, and money transfers.

Hayyak Helpful Tip: Take some time to explore the Hayyak app’s features and functionalities. You can manage your debit card, set up recurring payments, and access customer support directly through the app.

Troubleshooting: Common Reasons for Application Delays or Rejection

While ADCB strives to make the Hayyak account opening process as seamless as possible, there may be instances where your application faces delays or rejection. Here are a few common reasons:

- Incomplete or Inaccurate Information: Double-check your application form to ensure all details are entered correctly and completely.

- Missing or Unclear Documents: Verify that you have uploaded all the required documents as specified by Hayyak. Ensure the scanned copies are clear, legible, and within the prescribed file size limit.

- Eligibility Criteria Not Met: Review the eligibility requirements for your chosen account type. Factors such as age, residency status, or outstanding obligations may impact your application’s approval.

- Negative Credit History: For certain account types, a soft credit check may be part of the application process. If the check reveals any negative credit history that doesn’t align with ADCB’s criteria, it may affect your application’s success.

Hayyak Help is Here: If you encounter any issues or have questions regarding your application status or the Hayyak app, ADCB’s customer support is readily available to assist you. You can reach out through the in-app chat feature or visit the ADCB website’s contact us section for alternative communication methods.

Unlocking the Full Potential of Hayyak: Features and Benefits

Beyond the seamless account opening process, Hayyak offers a range of features and benefits designed to enhance your banking experience:

- Diverse Account Options: Hayyak provides a variety of account types tailored to your specific needs, whether you’re looking for everyday banking solutions or opportunities to grow your savings.

- Instant Cash Transfers: Send and receive money instantly between Hayyak accounts or to other UAE bank accounts with enabled features, making funds transfer a breeze.

- Bill Payments Made Easy: Streamline your financial management by scheduling and paying your utility bills, mobile phone bills, and other recurring payments directly from your Hayyak account.

- Mobile Top-Ups: Recharge your mobile phone credit conveniently through the Hayyak app, eliminating the need for separate top-up procedures.

- Investment Opportunities: Explore a range of investment products offered by ADCB, all accessible through your Hayyak app (subject to eligibility and terms).

Hayyak Security Reminder: While Hayyak offers a convenient and user-friendly banking experience, it’s crucial to prioritize the security of your account. Never share your login credentials with anyone and always ensure that you’re using a secure internet connection when accessing your Hayyak account. ADCB employs robust security measures to protect your information, but practicing safe online banking habits is equally important.

Conclusion

Opening an ADCB Hayyak account is your gateway to a new era of banking convenience. With its user-friendly app, swift account opening process, and a wide range of features, Hayyak empowers you to take control of your finances like never before. By following the step-by-step guide provided in this article, you can easily open your Hayyak account and start experiencing the benefits of digital banking.

As you embark on your Hayyak journey, remember to explore the app’s features, customize your preferences, and leverage the available tools to maximize your banking efficiency. With Hayyak by your side, managing your finances becomes a seamless and enjoyable experience.

So, what are you waiting for? Download the ADCB Hayyak app today and take the first step towards revolutionizing your banking experience. Welcome to the future of banking with Hayyak!

Add Comment