The Venmo Dilemma: Exploring Alternatives in Nigeria

The convenience of peer-to-peer payment apps like Venmo has revolutionized the way we manage our finances. However, for Nigerians seeking a seamless way to split bills, send money to friends, and handle everyday transactions, the availability of such apps can be limited. While Venmo boasts a vast user base globally, its services are primarily designed and regulated for the US financial system, making it challenging to access in certain regions like Nigeria.

Embracing the Mobile Money Ecosystem in Nigeria

Thankfully, Nigeria’s vibrant mobile money landscape offers innovative solutions that fulfill functionalities similar to Venmo, empowering users to manage their finances efficiently within the local context. These platforms have emerged as game-changers, catering to the unique needs of the Nigerian market and fostering financial inclusion.

Top Mobile Money Platforms in Nigeria:

- Paycom: Backed by MTN, Nigeria’s leading mobile network operator, Paycom is widely accepted and seamlessly integrates with MTN mobile accounts.

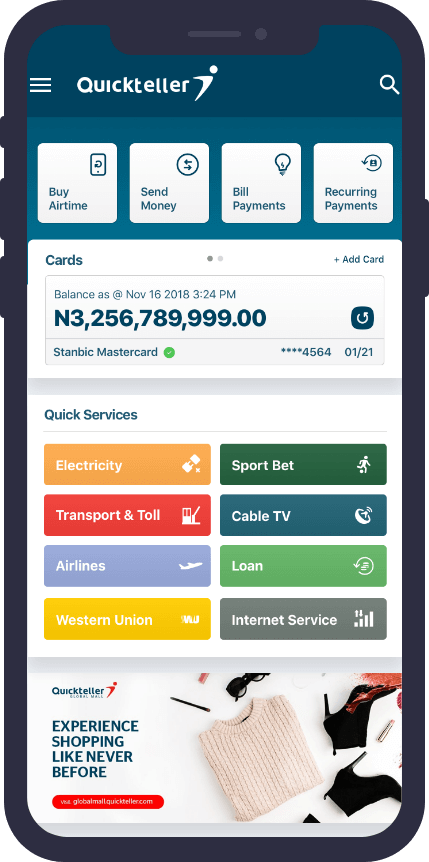

- Quickteller: A well-established online and mobile payment platform trusted by millions of Nigerians, offering money transfers, bill payments, airtime recharge, and more.

- PalmPay: Backed by tech giants Transsion Holdings and Tencent, PalmPay offers a user-friendly mobile app with rewards and cashback programs.

- Kuda bank: A digital-first bank with a mobile app that provides peer-to-peer transfers, bill payments, savings accounts, and virtual debit cards.

Choosing the Right Mobile Money Platform for You

With several mobile money solutions available, selecting the ideal platform depends on your specific needs. Consider factors such as availability, access channels, additional features, rewards programs, and integration with existing banking services. Our comprehensive comparison table can help you evaluate the options and make an informed decision.

| Feature | Paycom | Quickteller | PalmPay | Kuda Bank |

|---|---|---|---|---|

| Availability | Requires MTN mobile line | Nationwide | Nationwide | Nationwide |

| Access Channels | MyMTN app, USSD (*888#) | Website, Mobile app, USSD (322), Agent locations | Mobile app | Mobile app |

| Money Transfer | Yes | Yes | Yes | Yes |

| Bill Payment | Yes | Yes | Yes | Yes |

| Airtime Recharge | Yes | Yes | Yes | Yes |

| Online Payments | Limited | Yes | Yes | Yes |

| Rewards & Cashback | No | No | Yes | No |

| Additional Features | None | Investment options | None | Savings accounts, virtual debit cards |

Setting Up Your Mobile Money Account

Once you’ve chosen the platform that best suits your needs, the signup process is straightforward and can be completed through their respective mobile apps or websites. Here’s a general guideline:

- Download the App or Visit the Website: Locate the chosen platform’s mobile app on the app store or visit their official website.

- Register: Initiate the registration process by providing your personal details and following the on-screen instructions.

- Verify Your Identity: Most platforms require verification to comply with regulations and prevent fraud. Be prepared to provide a valid Nigerian ID, biometric data, and your Bank Verification Number (BVN).

- Fund Your Mobile Money wallet: Add funds to your wallet through bank transfers, agent networks, or mobile top-ups (where available).

Prioritizing Security and Best Practices

While mobile money offers convenience, security awareness is crucial. Follow these best practices to keep your hard-earned money safe:

- Use Strong Passwords and PINs: Choose unique and complex login credentials, avoiding easily guessable information.

- Beware of Phishing Scams: Be cautious of messages or calls claiming to be from your mobile money provider. Never share your login credentials or one-time codes with anyone.

- Enable Two-Factor Authentication (2FA): If available, activate 2FA for an extra layer of security when logging in.

- Report Suspicious Activity: If you suspect any unauthorized activity on your account, report it immediately to your mobile money provider’s customer support.

Beyond Peer-to-Peer Payments: Additional Features and Benefits

While sending and receiving money is a core functionality of mobile money platforms, they offer additional features that can enhance your financial management:

- Bill Payments: Conveniently pay your utility bills, cable subscriptions, and other recurring expenses directly through your mobile money wallet.

- Airtime Recharge: Top up your own or others’ mobile phone airtime with ease using your mobile money balance.

- Online Payments: Make online payments for various merchants and services within the app.

- Investment Options (Limited): Some platforms might offer limited investment options within their app.

- Savings Accounts (Limited): A few platforms provide built-in savings accounts to help you manage your finances effectively.

The Future of Mobile Money in Nigeria

The mobile money landscape in Nigeria is constantly evolving, offering exciting possibilities for the future:

- Increased Financial Inclusion: As mobile money penetration grows, it has the potential to bring more Nigerians into the formal financial system, promoting financial inclusion.

- Integration with Fintech Services: Expect greater integration between mobile money platforms and innovative fintech services, offering a wider range of financial products and services to users.

- Enhanced Security Measures: As technology advances, mobile money providers will likely invest in even more robust security features to safeguard user data and transactions.

Conclusion

While Venmo may not be readily available in Nigeria, the country’s vibrant mobile money ecosystem offers a wealth of feature-rich alternatives. By understanding the verification process, funding options, and security practices, you can leverage these platforms to manage your finances efficiently and enjoy a secure digital payment experience. Remember, exploring the additional functionalities offered by these platforms can unlock a whole new level of financial convenience, further empowering you to take control of your financial future.