Engaging in international financial transactions has become increasingly common. However, navigating the complexities of cross-border money transfers and currency exchanges can be a daunting task. Enter Wise, a game-changing financial service that simplifies international money transfers while offering competitive exchange rates. In this comprehensive guide, we’ll walk you through the process of opening a Wise account, unlocking a world of seamless and cost-effective international transactions.

Why Choose Wise? The Benefits of Opening a Wise Account

Before we delve into the specifics of creating a Wise account, let’s explore the compelling reasons why millions of individuals trust Wise for their international financial needs:

- Transparent and Competitive Exchange Rates: Wise prides itself on offering mid-market exchange rates, eliminating hidden fees and ensuring you get the most value for your money when converting currencies.

- Low Transfer Fees: Say goodbye to exorbitant bank transfer fees. Wise charges transparent, upfront fees that are significantly lower than those of traditional banks.

- Fast and Efficient Transfers: Wise facilitates speedy international money transfers, often delivering funds to recipients within a day or two, eliminating the long wait times associated with traditional bank transfers.

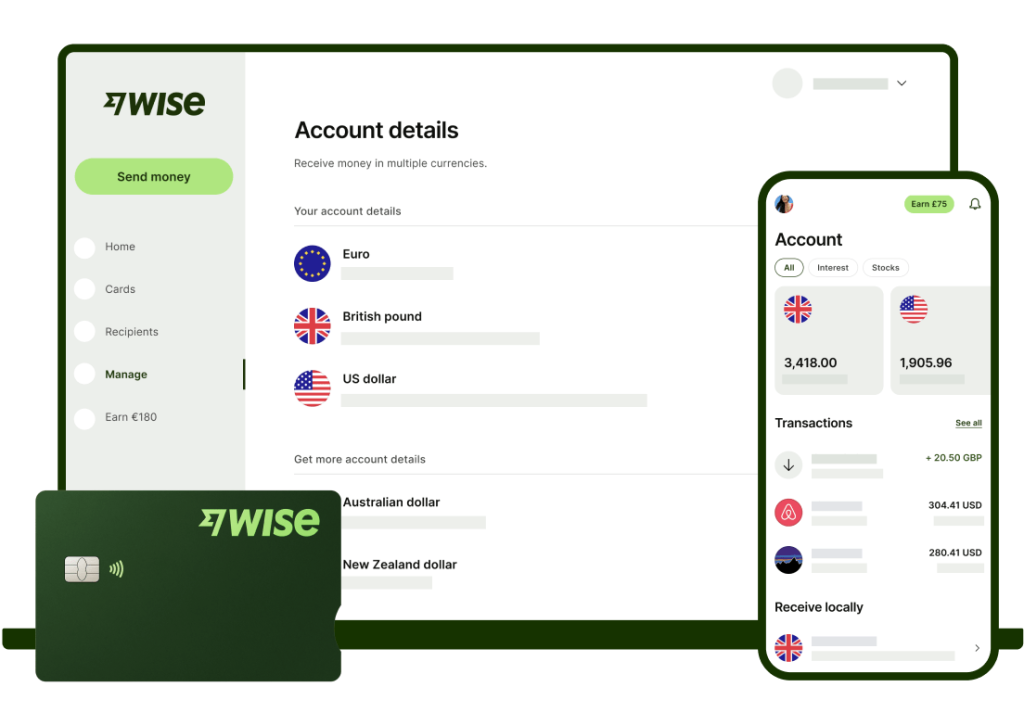

- Multi-Currency Management: With Wise, you can hold and manage over 50 different currencies within a single account, providing flexibility and convenience for your international transactions.

- Borderless Banking Features: Wise goes beyond simple money transfers. You can receive international payments, such as salary deposits, directly into your Wise account and even obtain a debit card linked to your account for seamless spending abroad.

Eligibility Requirements for Opening a Wise Account

Before you embark on your Wise journey, ensure that you meet the following eligibility criteria:

- Age Requirement: You must be at least 18 years old to open a Wise account.

- Valid Identification: Wise requires a government-issued photo ID, such as a driver’s license or passport, for identity verification purposes.

- Email Address: You’ll need a valid email address to register and manage your Wise account.

How to Open a Wise Account

Ready to unlock the benefits of simplified international money transfers? Follow these step-by-step instructions to open your Wise account:

- Visit the Wise Website: Navigate to the official Wise website at https://wise.com/.

- Create Your Account: Click on the “Sign Up” button and select your preferred registration method (email address, Google account, or Facebook account).

- Provide Personal Information: Fill in the registration form with your personal details, including your name, address, and contact information.

- Verify Your Identity: To ensure the security of your account, Wise requires identity verification. Upload a clear photo of your government-issued ID for this purpose.

- Fund Your Account: Once your identity is verified, you can add funds to your Wise account using various methods, such as bank transfers, debit cards, or credit cards (depending on your location).

- Start Transacting: Congratulations! Your Wise account is now active. Explore the platform’s features to initiate international money transfers, manage multiple currencies, and enjoy the convenience of borderless banking.

Choosing the Right Wise Account: Personal vs. Business

Wise offers two primary account types to cater to different user needs:

- Personal Account: Ideal for individuals who need to send or receive international payments for personal reasons, such as supporting family overseas, funding international studies, or making cross-border purchases.

- Business Account: Tailored for businesses that frequently engage in international transactions, a Wise business account enables seamless management of payroll for remote employees, payments to international suppliers, and receipt of payments from clients across borders. Business accounts also offer additional features like bulk transfers and team member access.

Exploring the Powerful Features of Wise

With your Wise account up and running, it’s time to explore the features that make it an invaluable tool for managing your international finances:

- Transparent Fees: Wise displays the total cost of your transfer upfront, including the exchange rate and transfer fee, ensuring you have a clear understanding of the charges before initiating a transaction.

- Real-Time Exchange Rates: Stay informed with live exchange rate updates, enabling you to choose the optimal timing for your transfers and maximize the value of your money.

- Multi-Currency Balance: Hold and manage over 50 different currencies within your Wise account, eliminating the need for constant currency conversions.

- Wise Debit Card: Enhance your international spending experience by obtaining a Wise debit card linked to your account. Enjoy the convenience of spending abroad at the mid-market exchange rate and avoid ATM fees in many countries.

- Bill Pay Feature: Simplify your international bill payments by using Wise to pay bills directly from your account, streamlining your recurring cross-border expenses.

Wise’s Commitment to Security and Privacy

When it comes to your financial information, security is paramount. Wise employs robust measures to protect your data and ensure the safety of your transactions:

- Two-Factor Authentication: Enhance the security of your account by enabling two-factor authentication. This requires a verification code sent to your phone in addition to your password when logging in.

- Data Encryption: Wise utilizes industry-standard encryption protocols to safeguard your personal and financial information from unauthorized access.

- Regulatory Compliance: Wise operates in compliance with regulations set forth by various financial authorities worldwide, ensuring adherence to strict security and anti-fraud measures.

Tips and Tricks to Maximize Your Wise Account Benefits

To get the most out of your Wise account, consider these useful tips and tricks:

- Enable Transfer Alerts: Stay informed about the status of your transfers by setting up transfer alerts. You’ll receive notifications when your transfer is initiated, completed, or encounters any issues.

- Schedule Transfers in Advance: If you have an upcoming international payment, take advantage of Wise’s scheduling feature. You can schedule transfers for a future date, ensuring timely payments and potentially benefiting from favorable exchange rates.

- Hold Multiple Currencies: Leverage Wise’s multi-currency functionality by holding frequently used currencies in your account. This allows you to avoid conversion fees for future transactions in those currencies.

- Utilize the Wise Help Center: The Wise Help Center is a valuable resource filled with comprehensive information, FAQs, and tutorials to guide you through all aspects of using your account effectively.

- Refer Friends and Earn Rewards: Share the benefits of Wise with your friends and earn rewards through Wise’s referral programs when they open their own accounts.

Wise vs. Traditional Banks: A Comparative Analysis

While traditional banks offer international money transfer services, Wise stands out with several advantages:

- Transparency: Wise provides clear and upfront fees, unlike traditional banks that often have hidden charges embedded in their exchange rates.

- Competitive Rates: Wise consistently offers more competitive exchange rates compared to traditional banks, saving you money on currency conversions.

- Speed and Efficiency: Wise transfers are typically faster and more efficient than traditional bank transfers, ensuring your funds reach the recipient in a shorter timeframe.

- Convenience: With its user-friendly online platform and mobile app, Wise allows you to manage your account and initiate transfers on the go. Traditional banks may require in-person visits or navigate complex online interfaces for international transactions.

The Future of Wise: Continuous Innovation and Expansion

As Wise continues to revolutionize international money transfers, exciting developments lie ahead:

- Integration with Financial Platforms: Expect potential future integrations with popular financial platforms and budgeting apps, enabling seamless money management and cross-border transactions within your existing financial ecosystem.

- Expanding to Emerging Markets: Wise may expand its reach to cater to the growing needs of individuals and businesses in emerging economies, facilitating international transactions and promoting financial inclusion.

- Enhanced Security Features: As technology advances, Wise is likely to implement even more sophisticated security features to combat fraud and protect user information.

By understanding how to open a Wise account, leveraging its features effectively, and staying informed about ongoing developments, you can unlock a world of convenient, cost-effective, and secure international money transfers. With Wise, you can manage your finances across borders with transparency, efficiency, and peace of mind.

Add Comment