Apple’s latest iOS 17.4 update introduces a game-changing feature for iPhone users who depend on budgeting apps to track their finances. The new FinanceKit API allows these apps to automatically import transactions from Apple Card, Cash, and Savings accounts, eliminating the need for tedious manual data entry. This development promises to streamline the budgeting process and enhance financial management for iPhone users.

Understanding the FinanceKit API

The FinanceKit API is a powerful new framework that debuted in iOS 17.4. It enables budgeting apps to securely access and import transaction data from Apple’s financial services, including Apple Card, Cash, and Savings accounts. By providing a standardized interface for apps to interact with these services, the FinanceKit API eliminates the need for each app developer to create custom integrations, simplifying the development process and ensuring a consistent user experience across different budgeting apps.

The Advantages of Automatic Transaction Import

Automatic transaction import powered by the FinanceKit API offers numerous benefits for iPhone users who rely on budgeting apps:

1. Improved Accuracy

Manual data entry is inherently error-prone, with users susceptible to making typos or inadvertently omitting transactions. By directly importing transaction data from the source, automatic import ensures a higher level of accuracy in tracking financial activity, reducing the likelihood of errors that could skew budgeting insights.

2. Increased Efficiency

Manually inputting transactions into a budgeting app can be a time-consuming and monotonous task. Automatic import eliminates this manual labor, saving users valuable time and effort that can be better spent on analyzing spending patterns and making informed financial decisions.

3. Enhanced User Experience

With automatic transaction import, managing finances becomes a seamless and effortless process. Users can focus on the insights provided by their budgeting app without the hassle of manual data entry, leading to a more enjoyable and efficient user experience.

Enabling Automatic Transaction Import in Your Budgeting App

While the FinanceKit API lays the foundation for automatic transaction import, it’s up to individual budgeting apps to integrate this functionality into their platforms. Here’s a general overview of the steps involved in enabling automatic transaction import:

- Ensure you have the latest version of your budgeting app installed, as an update may be required to support FinanceKit API integration.

- Navigate to the app’s settings and locate the section dedicated to account connections or integrations.

- Within the settings, look for an option related to Apple Card, Cash, and Savings accounts.

- Follow the app’s specific instructions to enable automatic transaction import for your Apple financial accounts.

It’s important to note that the exact steps may vary slightly depending on the budgeting app you’re using. Consult the app’s documentation or support resources for detailed guidance on enabling automatic transaction import.

Budgeting Apps Leading the Way with FinanceKit API Integration

Several prominent budgeting apps have already embraced the FinanceKit API to offer automatic transaction import from Apple Card, Cash, and Savings accounts. Here are a few notable examples:

1. YNAB (You Need a Budget)

YNAB, a popular envelope-based budgeting app, has integrated the FinanceKit API to enable automatic transaction import for its users. This integration streamlines the process of managing finances within the app, making it even more convenient for YNAB users to stay on top of their budgets.

2. Monarch

Monarch, known for its user-friendly interface and robust budgeting features, now supports automatic transaction import through the FinanceKit API. This enhancement allows Monarch users to effortlessly track their spending from Apple Card, Cash, and Savings accounts, simplifying their financial management experience.

3. Copilot

Copilot, a budgeting app focused on collaborative finance management, has also integrated the FinanceKit API. With automatic transaction import, Copilot users can seamlessly track shared expenses and manage joint finances using their Apple financial accounts.

These are just a few examples of budgeting apps that have embraced the FinanceKit API, and it’s expected that more apps will follow suit in the near future.

Prioritizing Security with Automatic Transaction Import

While automatic transaction import offers unparalleled convenience, it’s crucial to consider the security implications. Here are some key points to keep in mind:

1. Authorization Requirements

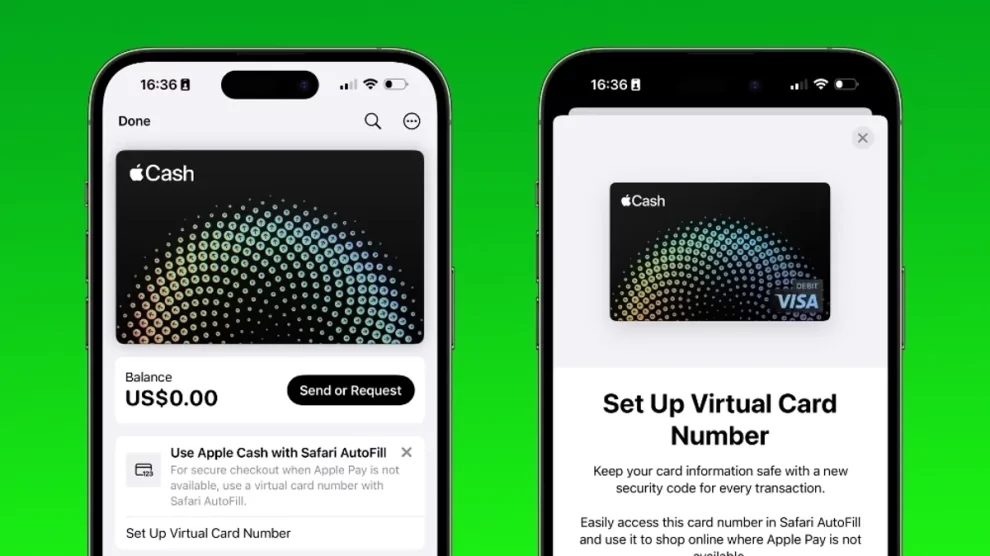

Before a budgeting app can access your Apple Card, Cash, and Savings transaction data through the FinanceKit API, you must explicitly authorize it to do so. This authorization process ensures that only apps you trust can access your financial information.

2. Apple’s Robust Encryption

Apple employs state-of-the-art encryption techniques to safeguard your financial data when using the FinanceKit API. Your transaction data is encrypted both during transmission and storage, significantly reducing the risk of unauthorized access.

3. Reviewing App Permissions

It’s always a good practice to carefully review the permissions requested by any app before granting access to your financial information. Be cautious of apps that demand excessive permissions beyond what is necessary for their core functionality.

By understanding and considering these security aspects, you can make informed decisions when enabling automatic transaction import within your budgeting apps.

Conclusion

The introduction of the FinanceKit API in iOS 17.4 represents a significant milestone for iPhone users who rely on budgeting apps to manage their finances. Automatic transaction import from Apple Card, Cash, and Savings accounts streamlines the budgeting process, improves accuracy, and enhances the overall user experience. As more budgeting apps embrace this powerful API, iPhone users can look forward to a more seamless and efficient way to track their spending and make informed financial decisions. By prioritizing security and carefully reviewing app permissions, users can confidently take advantage of this game-changing feature to revolutionize their budgeting experience on their iPhones.

Add Comment