Say goodbye to the hassles of traditional banking and embrace the ease of digital banking with Jio Payment Bank. As a subsidiary of Reliance Industries, Jio Payment Bank offers a paperless, secure, and accessible banking solution tailored to the evolving needs of Indian citizens. In this comprehensive guide, we’ll walk you through the process of opening a Jio Payment Bank account, highlighting the benefits and features that make it a game-changer in the world of personal finance.

Why Choose Jio Payment Bank?

Before diving into the account opening process, let’s explore what sets Jio Payment Bank apart from traditional banking options:

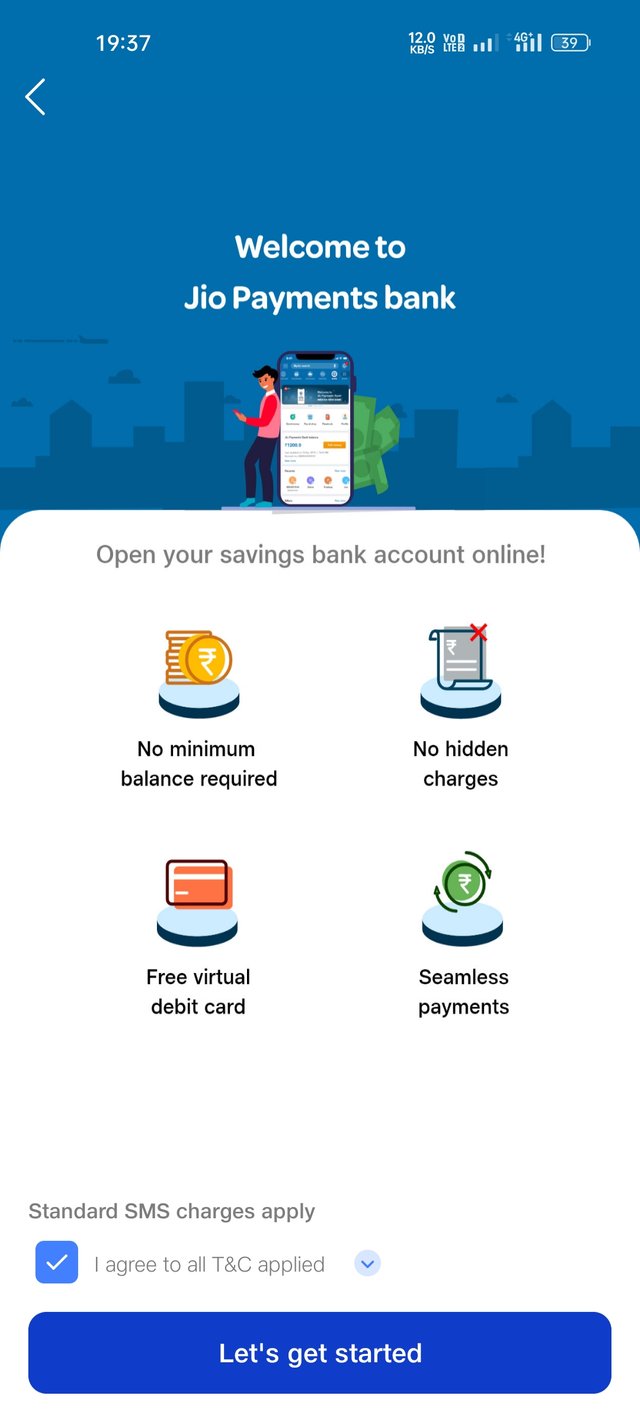

- Digital-First Approach: Jio Payment Bank prioritizes a paperless banking experience, allowing you to open and manage your account entirely online, without the need for physical paperwork.

- Zero Minimum Balance: Unlike many traditional banks that require maintaining a minimum balance, Jio Payment Bank offers the flexibility of a zero-balance account, making it accessible to a wider range of customers.

- Extensive Network: With a vast network of Jio partnered outlets across India, you can easily deposit and withdraw cash, even in remote locations, ensuring convenient access to your funds.

- Seamless Mobile Banking: The user-friendly Jio Payment Bank mobile app enables you to manage your account on the go, check balances, transfer funds, pay bills, and more, all from the palm of your hand.

- Simplified Transactions: Jio Payment Bank simplifies everyday transactions, allowing you to effortlessly pay bills, recharge your mobile, make DTH payments, and transfer money directly from your account.

Eligibility Criteria for Opening a Jio Payment Bank Account

To open a Jio Payment Bank account, you must meet the following requirements:

- Be a resident of India

- Be at least 18 years old

- Possess a valid Aadhaar card for KYC (Know Your Customer) verification

- Have a PAN card (Permanent Account Number) for certain account features and transactions (optional)

Step-by-Step Guide: How to Open a Jio Payment Bank Account

Jio Payment Bank offers two convenient methods to open an account: through the MyJio app or by visiting a Jio partnered outlet. Let’s explore both options in detail.

Method 1: Opening an Account via the MyJio App

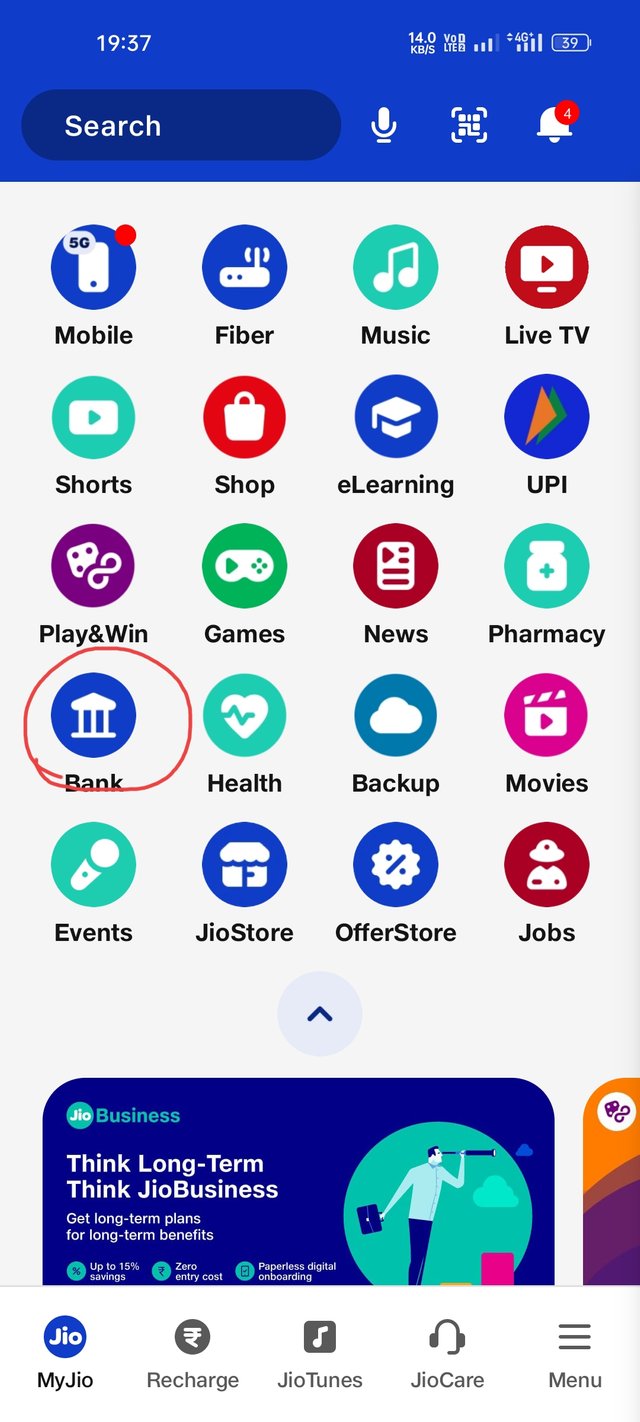

- Download the MyJio App: If you haven’t already, download the MyJio app from the Google Play Store (for Android devices) or the App Store (for iOS devices).

- Access the Banking Section: Launch the MyJio app and navigate to the “Bank” or “Services” section, where you’ll find the option to open a new account.

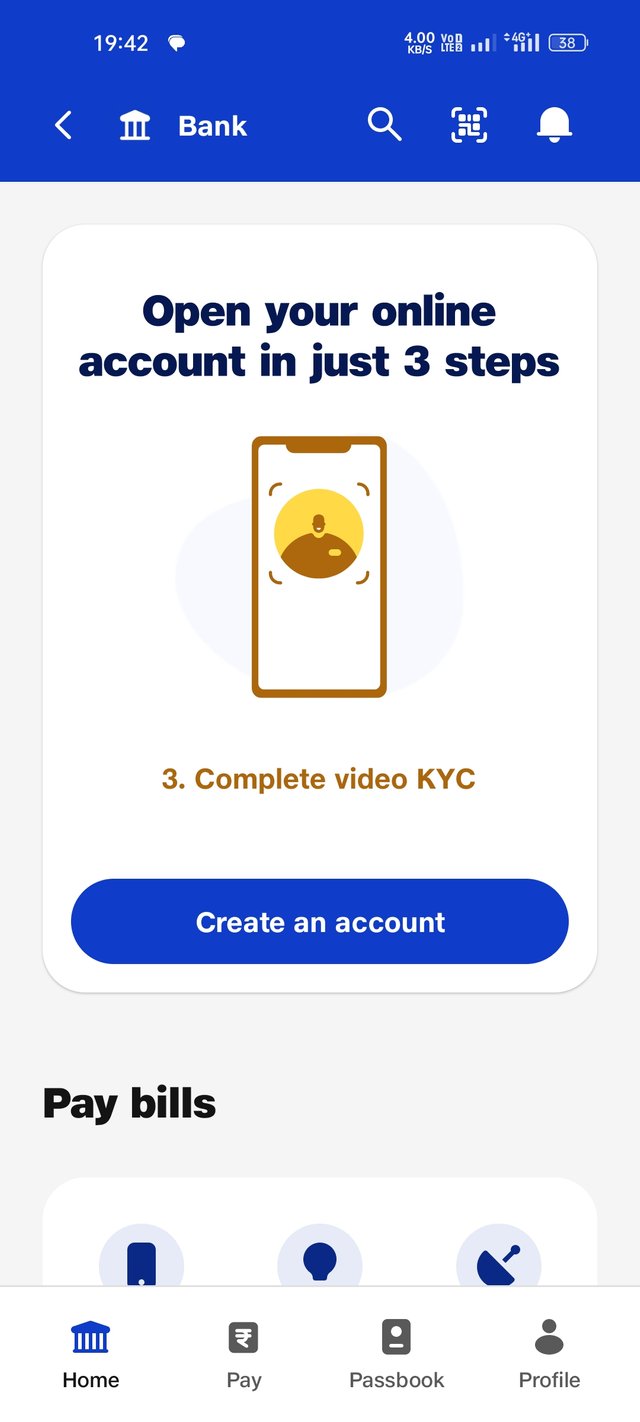

- Select Savings Account: Choose the “Savings Account” option from the available account types.

- Enter Aadhaar Details: Provide your valid Aadhaar card number for e-KYC (electronic Know Your Customer) verification.

- Complete e-KYC: Follow the on-screen instructions to complete the e-KYC process, which may involve facial recognition or OTP (One-Time Password) verification sent to your Aadhaar-linked mobile number.

- Set MPIN: Create a secure MPIN (Mobile Banking Personal Identification Number) to access your account through the app.

- Verify Contact Information: Ensure that your registered mobile number and email address are accurate for receiving account-related notifications.

- Account Activation: Once the verification process is complete, your Jio Payment Bank account will be activated, and you will receive a confirmation message.

Method 2: Opening an Account at a Jio Partnered Outlet

- Find a Jio Partnered Outlet: Locate a nearby Jio partnered outlet using the Jio website or app.

- Visit the Outlet: Go to the outlet and inform the customer service representative of your intention to open a Jio Payment Bank account.

- Present KYC Documents: Provide your valid Aadhaar card and PAN card (if applicable) for KYC verification.

- Complete the Account Opening Form: Fill out the account opening form accurately, ensuring all details are correct.

- Biometric Verification (if required): In some cases, biometric verification using your fingerprint or iris scan may be necessary for additional security.

- Initial Deposit (optional): While there is no minimum balance requirement, you may choose to make an initial deposit during account opening.

- Receive Account Details: After successful verification and account creation, you will receive your Jio Payment Bank account details, including your account number and MPIN.

Documents Required for Opening a Jio Payment Bank Account

Jio Payment Bank aims to provide a paperless banking experience. The primary documents required for account opening are:

- Aadhaar Card: A valid Aadhaar card is mandatory for opening a Jio Payment Bank account, serving as the primary identification and address proof.

- PAN Card (optional): While not always mandatory, linking a valid PAN card to your Aadhaar can streamline the verification process and unlock additional account features.

- Alternative ID Proofs (rare cases): In the absence of an Aadhaar card, Jio Payment Bank may accept alternative government-issued ID proofs such as a Voter ID card, Passport, or Driving License. However, it’s best to confirm the acceptability of alternative documents with a Jio representative beforehand.

Benefits of a Jio Payment Bank Account

Opening a Jio Payment Bank account comes with a host of advantages:

- Convenience: Manage your finances anytime, anywhere using the user-friendly Jio Payment Bank mobile app.

- Accessibility: With a wide network of Jio partnered outlets, cash deposits and withdrawals are convenient, even in remote areas.

- Cost-Effective: Enjoy the benefits of a zero-balance account, eliminating the need to maintain a minimum balance.

- Enhanced Security: Jio Payment Bank employs robust security measures to safeguard your financial information and transactions.

- Rewards and Offers: As a Jio Payment Bank account holder, you may be eligible for exclusive deals and discounts on various services, such as mobile recharges and bill payments.

Limitations of Jio Payment Bank Accounts

While Jio Payment Bank offers numerous benefits, it’s important to be aware of certain limitations compared to traditional banks:

- Transaction Limits: Jio Payment Bank accounts have restrictions on daily and monthly transaction amounts, which may not be suitable for individuals with high-volume transactions.

- Limited Product Portfolio: Compared to traditional banks, Jio Payment Bank offers a more focused range of financial products, primarily centered around savings accounts and money transfers. Complex financial instruments like loans or fixed deposits may not be available.

Is a Jio Payment Bank Account Right for You?

A Jio Payment Bank account is an excellent choice for individuals who prioritize convenience, accessibility, and a digital-first approach to banking. It is particularly well-suited for:

- Young Adults: For young individuals just starting to manage their finances independently, Jio Payment Bank offers a user-friendly platform without the burden of maintaining a minimum balance.

- Residents in Remote Locations: The extensive network of Jio partnered outlets ensures easy access to cash deposits and withdrawals, even in remote areas.

- Tech-Savvy Users: If you are comfortable managing your finances through a mobile app, Jio Payment Bank’s digital-first approach provides a seamless banking experience.

Customer Support and Assistance

Jio Payment Bank offers multiple channels for customer support and assistance:

- Jio Payment Bank Website: Visit the Jio Payment Bank website to access a comprehensive FAQ section addressing common queries and concerns.

- JioCare App: Download the JioCare app on your smartphone to get customer support through chat or phone calls.

- Toll-Free Number: Jio Payment Bank provides a dedicated toll-free customer care number for inquiries, which can be found on the Jio Payment Bank website or app.

Frequently Asked Questions (FAQs)

1. Is there a cost to open a Jio Payment Bank account?

No, opening a Jio Payment Bank account is completely free, with no account opening charges.

2. Does Jio Payment Bank offer internet banking?

While Jio Payment Bank does not provide traditional web-based internet banking, the Jio Payment Bank mobile app offers a comprehensive range of account management features.

3. Can I pay bills using my Jio Payment Bank account?

Yes, you can easily pay various bills, including mobile recharges, DTH recharges, and utility bills, directly through the Jio Payment Bank mobile app.

4. What should I do if I forget my Jio Payment Bank mobile banking MPIN?

If you forget your MPIN, you can easily reset it through the Jio Payment Bank app using your registered mobile number and completing the necessary identity verification steps.

5. Is Jio Payment Bank secure?

Yes, Jio Payment Bank implements industry-standard security measures to protect your financial information and transactions, including secure login protocols, data encryption, and transaction monitoring systems. However, it is also crucial for users to practice safe online banking habits, such as keeping their MPIN confidential and avoiding suspicious links.

Embrace the Future of Banking with Jio Payment Bank

Opening a Jio Payment Bank account is your gateway to a world of convenient, secure, and accessible banking. With its digital-first approach, extensive network of partnered outlets, and user-friendly mobile app, Jio Payment Bank empowers you to take control of your finances like never before.

Whether you are a young adult embarking on your financial journey, a resident in a remote location seeking accessible banking solutions, or a tech-savvy individual who values the ease of digital banking, Jio Payment Bank has you covered.

So why wait? Download the MyJio app or visit your nearest Jio partnered outlet today and experience the future of banking with Jio Payment Bank. Embrace the convenience, security, and accessibility that Jio Payment Bank offers and revolutionize the way you manage your money.

For more information and updates, visit the official Jio Payment Bank website or download the MyJio app from the Google Play Store or App Store.

Add Comment