Rocket by Dutch-Bangla Bank (DBBL) is at the forefront of this revolution. With a Rocket account, you can bid farewell to the hassles of cash transactions and embrace a world of convenient, secure, and instant digital payments. In this comprehensive guide, we’ll walk you through the process of opening a Rocket account in Bangladesh, highlighting the benefits, eligibility criteria, and step-by-step instructions.

Understanding Rocket: A Mobile Banking Solution for the Digital Age

Before we dive into the account opening process, let’s explore what makes Rocket a compelling choice for your mobile banking needs:

- Instant Mobile Payments: Send and receive money instantly using just a mobile phone number, eliminating the need for cash or bank visits.

- Convenient Bill Payments: Pay your utility bills, phone bills, internet subscriptions, and more directly through your Rocket account, saving time and effort.

- Secure Online Shopping: Make online purchases with peace of mind, as Rocket ensures secure transactions without the need to share your debit or credit card details.

- Mobile Top-up: Recharge your prepaid mobile phone directly from your Rocket account, ensuring you stay connected without interruptions.

- Cash In/Cash Out: Deposit and withdraw cash at any Dutch-Bangla Bank branch or authorized agent point, providing flexibility and accessibility.

With these benefits and more, a Rocket account simplifies your financial transactions and offers a seamless mobile banking experience in Bangladesh.

Eligibility Criteria: Who Can Open a Rocket Account?

Before embarking on your Rocket account opening journey, it’s essential to understand the eligibility criteria:

- Bangladeshi Residents: Rocket accounts are available to all Bangladeshi residents, including citizens and individuals with valid residency permits.

- Age Requirement: The minimum age to open a Rocket account is typically 18 years old. However, it’s advisable to check with Dutch-Bangla Bank for the most up-to-date eligibility criteria.

Meeting these eligibility requirements is crucial for a smooth account opening process.

Step-by-Step Guide: How to Open a Rocket Account

Now that you understand the benefits and eligibility criteria, let’s explore the various methods available for opening a Rocket account:

Method 1: Opening an Account at a Dutch-Bangla Bank Branch

- Visit a Branch: Start by visiting your nearest Dutch-Bangla Bank branch.

- Express Your Interest: Inform a customer service representative about your intention to open a Rocket account.

- Fill Out the Application Form: Obtain and fill out the Rocket account registration form, providing accurate personal information, contact details, and desired account type (individual or corporate).

- Submit Required Documents: Present your National ID Card (NID) and a recent passport-sized photograph for verification.

- Account Activation: Upon successful application processing and approval, you’ll receive a confirmation message containing your Rocket account number and a temporary PIN.

Method 2: Opening an Account via the Rocket App (if available)

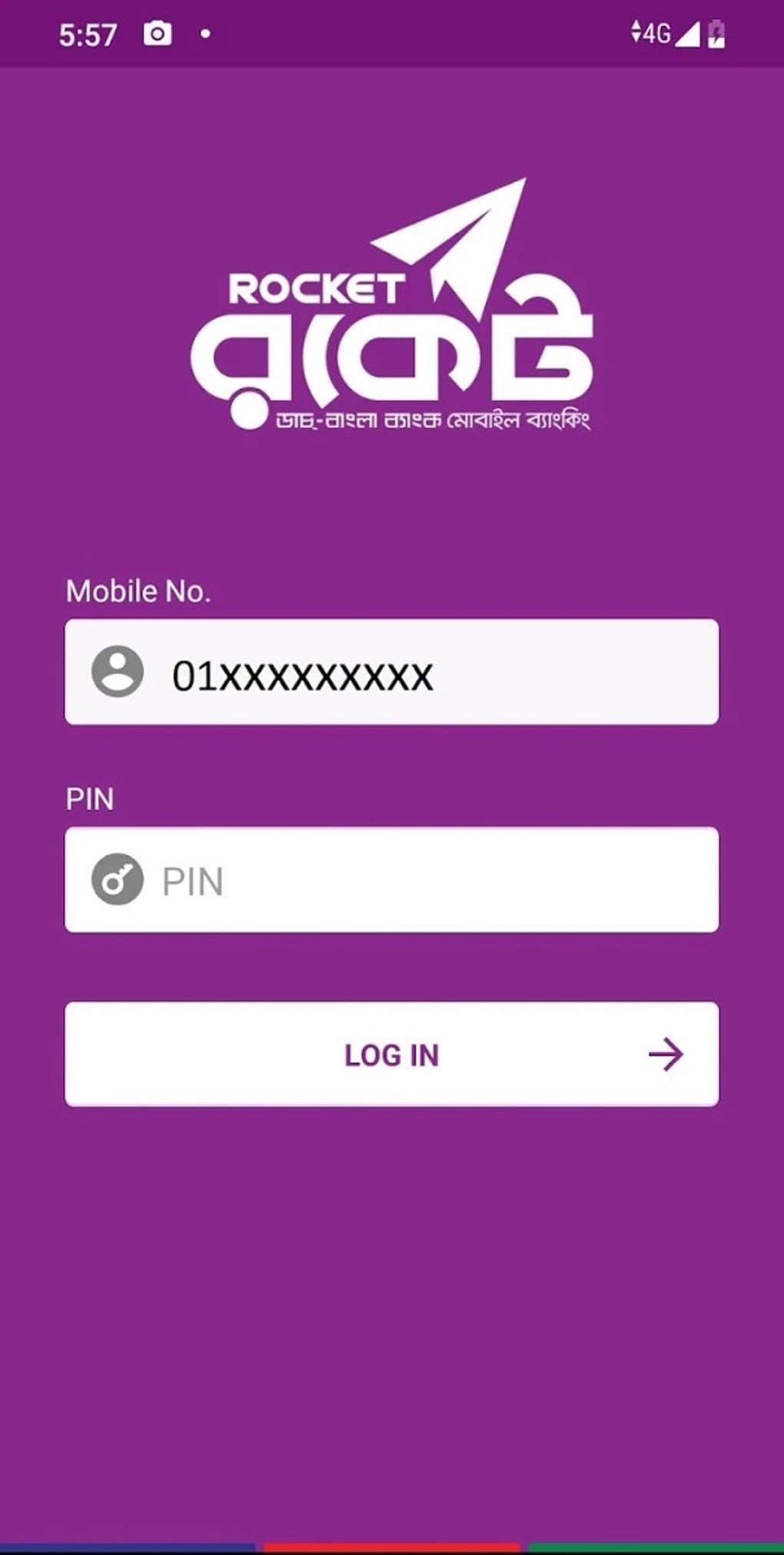

- Download the App: Search for “Rocket” on the App Store (iOS) or Google Play Store (Android) and download the official Dutch-Bangla Bank Rocket app.

- Initiate Registration: Launch the app and start the registration process.

- Provide Mobile Number: Enter your valid Bangladeshi mobile phone number that you wish to link to your Rocket account.

- Verification Code: An SMS containing a verification code will be sent to your provided mobile number. Enter this code in the app to proceed.

- Set Up PIN: Create a secure 4-digit PIN that you’ll use to access your Rocket account.

- Optional Facebook Login (if available): Some regions may offer the option to link your Facebook account for faster registration, but this feature might not be universally available.

Method 3: Opening an Account through a Dutch-Bangla Bank Agent

- Find an Agent: Locate a Dutch-Bangla Bank authorized agent point near you.

- Express Your Interest: Communicate your desire to open a Rocket account to the agent.

- Agent Assistance: The agent will guide you through the registration process, which may include filling out a form and providing your NID card and passport-sized photograph.

- Verification and Activation: The agent will assist in verifying your information and initiating account activation. You may receive a verification call or SMS during this process.

- Receive Account Details: Upon successful registration, the agent will provide you with your Rocket account number and a temporary PIN.

Regardless of the method you choose, ensure that you have your NID card and a valid Bangladeshi mobile phone number readily available to facilitate a smooth account opening experience.

Post-Account Opening Considerations

Congratulations on successfully opening your Rocket account in Bangladesh! Here are a few important points to keep in mind:

- Change Your PIN: For enhanced security, it’s highly recommended to change your temporary PIN to a personalized 4-digit PIN that you can easily remember. This can be done through the Rocket app (if available) or by visiting a Dutch-Bangla Bank branch or agent.

- Fund Your Account: Once your account is active, you can add funds to your Rocket account through various methods:

- Cash Deposit: Deposit cash at any Dutch-Bangla Bank branch or authorized agent point.

- Fund Transfer (if available): Depending on your region, you may be able to transfer funds electronically from your bank account to your Rocket account. Check with Dutch-Bangla Bank for availability.

- Mobile Recharge (available for certain mobile operators): Top up your Rocket account by recharging your mobile phone with an amount higher than your intended usage. The excess amount will be credited to your Rocket account.

By following these steps and considering these additional points, you’ll be well-prepared to navigate the process of opening a Rocket account and start enjoying the convenience of digital payments in Bangladesh.

Exploring Rocket Account Features and Benefits

With your Rocket account up and running, let’s explore the exciting features and benefits it offers:

- Real-Time Transaction Tracking: Keep track of your account activity and monitor all transactions in real-time through the Rocket app (if available) or SMS notifications.

- Transaction Limits: Set daily and monthly transaction limits to enhance security and maintain control over your spending.

- Customer Support: Dutch-Bangla Bank provides dedicated customer support for Rocket account holders. Reach out to their customer service hotline or visit a branch for any assistance you may need.

A Rocket account not only grants you access to digital payments but also unlocks a world of financial convenience and control at your fingertips.

Advanced Features of Rocket Accounts

As you become more familiar with your Rocket account, you can explore its advanced functionalities:

- Salary Account Option: Some employers in Bangladesh offer the option to disburse salaries directly through Rocket accounts. Discuss this possibility with your employer to simplify your salary receipt process.

- International Money Transfer (if available): In certain regions, Rocket accounts may offer limited international money transfer capabilities. Check with Dutch-Bangla Bank for availability and any associated fees.

- Investment Opportunities (limited): Some banks may provide limited investment options linked to your Rocket account. Explore these options if you’re interested in growing your money.

It’s important to note that features and functionalities may vary depending on your region and account type. Always consult with Dutch-Bangla Bank for the most current information on available services.

Conclusion

Opening a Rocket account in Bangladesh is more than just adopting a new payment method; it’s about embracing the growing digital financial ecosystem. With its user-friendly interface, robust security measures, and ever-expanding features, a Rocket account is an invaluable tool for managing your finances efficiently and conveniently.

By following the step-by-step guide outlined in this article and understanding the eligibility criteria, account opening methods, and post-account opening considerations, you’ll be well-equipped to embark on your mobile banking journey with Rocket.

So, why wait? Take the first step towards financial convenience and visit a Dutch-Bangla Bank branch, download the Rocket app, or locate an authorized agent today to open your Rocket account in Bangladesh. Welcome to the future of banking!

Add Comment