The BNPL Boom: More Options, More Control

Buy Now, Pay Later has taken the e-commerce world by storm, offering consumers the ability to spread the cost of their purchases over time. Recognizing the growing demand for this payment method, particularly among younger generations, Google Pay is making a strategic move to expand its BNPL offerings.

The platform is partnering with established BNPL providers like Affirm and Zip, allowing users to access these services seamlessly within the Google Pay app. This integration eliminates the need to switch between multiple apps or websites during checkout, creating a more streamlined and user-friendly payment process.

But Google isn’t stopping there. The company has hinted at the possibility of launching its own BNPL service in the future, which could potentially offer users competitive interest rates, exclusive rewards, and even tighter integration with other Google products and services.

For consumers, the expansion of BNPL options within Google Pay means greater flexibility and control over their spending. Imagine being able to purchase a high-ticket item and spread the cost over several manageable installments, all without leaving the Google Pay app. This level of convenience could be a game-changer for those looking to better manage their cash flow and make larger purchases more accessible.

Biometric Authentication: The Future of Secure Transactions

While the BNPL integration addresses the demand for flexibility, Google Pay’s second major update tackles a critical issue in online transactions: security. The traditional CVV code, a three-digit number printed on the back of credit cards, has long been a weak point in the payment process. It’s relatively easy for fraudsters to obtain this information, making it a common target for unauthorized transactions.

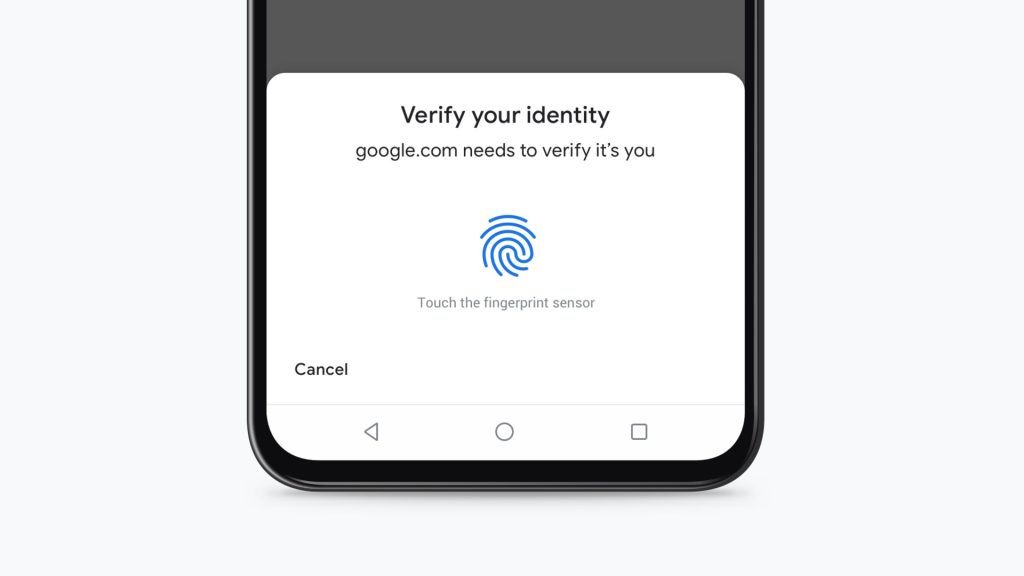

Google Pay’s solution? Replace the CVV code with biometric authentication. Instead of manually entering a code, users can now verify their identity using their fingerprint, face scan, or a secure PIN. This shift leverages the advanced security features already built into modern smartphones, creating a more seamless and secure checkout experience.

The benefits of biometric authentication are twofold. First, it offers a significant boost in security compared to the CVV code. Biometric data, such as fingerprints and facial features, are unique to each individual and nearly impossible to replicate. This makes it much harder for fraudsters to gain unauthorized access to your payment information.

Second, biometric authentication is incredibly convenient. No more fumbling for your credit card or struggling to remember the CVV code. With a simple tap of your phone or a quick face scan, you can complete your transaction securely and effortlessly. This frictionless experience could be particularly appealing for users who frequently make online purchases.

The Synergy of Convenience and Security

By combining the expansion of BNPL options with the introduction of biometric authentication, Google Pay is creating a powerful synergy that addresses two of the most pressing concerns for digital wallet users.

On the convenience front, the integration of BNPL services offers users greater flexibility and control over their spending. The ability to spread costs over time, directly within the Google Pay app, could make larger purchases more manageable and accessible. This is particularly relevant in an era where e-commerce is booming and consumers are seeking more ways to budget their expenses.

On the security side, the shift to biometric authentication represents a major leap forward in protecting users’ payment information. By replacing the vulnerable CVV code with unique biometric data, Google Pay is making it significantly harder for fraudsters to commit unauthorized transactions. This enhanced security could give users greater peace of mind when shopping online, knowing that their financial information is protected by cutting-edge technology.

The Evolving Landscape of Mobile Wallets

Google Pay‘s latest updates are not happening in a vacuum; they are part of a broader shift in the mobile wallet industry towards greater convenience, flexibility, and security. As digital payment platforms continue to evolve, we can expect to see more innovations that cater to changing consumer preferences and address emerging security threats.

One trend that’s likely to gain momentum is the rise of BNPL services. As more consumers, particularly younger generations, embrace the concept of spreading costs over time, we can expect to see BNPL options become a standard feature in mobile wallets. This could lead to increased competition among BNPL providers, potentially driving down interest rates and offering users even more favorable terms.

Another area of focus will undoubtedly be security. As hackers and fraudsters become more sophisticated, mobile wallet providers will need to stay one step ahead by continually enhancing their security measures. Biometric authentication is likely to become the norm, with the potential for even more advanced methods like iris scanning or voice recognition to add extra layers of protection.

Beyond BNPL and security, we can also anticipate a future where mobile wallets evolve into all-encompassing digital assistants. Imagine a single app that not only facilitates payments but also stores your loyalty cards, digital receipts, and even travel documents like boarding passes. This level of integration could make mobile wallets an indispensable tool for managing various aspects of our digital lives.

Embracing the Future of Mobile Payments

Google Pay’s double upgrade is a significant milestone in the evolution of mobile wallets. By integrating BNPL services and introducing biometric authentication, the platform is setting a new standard for convenience and security in digital payments.

For users, these updates represent a major step forward in how they interact with their mobile wallets. The ability to access flexible payment options and enjoy frictionless, secure transactions could transform the way we shop online. As more platforms follow suit and introduce similar features, we can expect to see a surge in adoption of mobile wallets as the preferred method of payment.

Of course, with innovation comes responsibility. As mobile wallets become more feature-rich and integral to our daily lives, it’s crucial that providers prioritize user education and transparency. Clear communication about how personal and financial data is collected, stored, and used will be essential in building trust and fostering long-term loyalty.

The Bottom Line: Embracing the Mobile Payment Revolution

Google Pay’s latest updates are a testament to the rapid evolution of mobile payments. By integrating BNPL services and biometric authentication, the platform is not only addressing key user concerns but also setting the stage for a future where mobile wallets are the norm.

As a user, embracing these new features could lead to a more convenient, flexible, and secure payment experience. And as the mobile wallet landscape continues to evolve, we can look forward to even more innovations that will redefine how we manage our finances and interact with the digital world.

In the end, the success of mobile wallets will depend on their ability to keep pace with changing consumer preferences, technological advancements, and emerging security threats. If Google Pay’s recent upgrades are any indication, we’re well on our way to a future where our smartphones are not just tools for communication, but also powerful financial companions.

Add Comment