Feeling the weight of managing multiple financial accounts? Perhaps you’ve discovered a new budgeting app or simply no longer require Mint’s services. Regardless of your reason, deleting your Mint.com account is a straightforward process. This comprehensive guide will equip you with the knowledge and steps required to delete your Mint account, whether you’re a seasoned budgeter or a casual Mint user.

Parting Ways with Mint: Considering Your Options

Before diving into account deletion, let’s explore some crucial points to consider:

- Understanding the Impact: Deleting your Mint account signifies the removal of all associated information. This includes your linked financial accounts, budget data, transaction history, and any financial goals you might have set within the platform.

- Alternatives to Deletion: Not quite ready for a complete goodbye? Here are some options:

- Stop Using the App: You can simply stop using the Mint app and website to manage your finances. Your account remains inactive but can be reactivated later if needed.

- Export Your Data (if applicable): While Mint doesn’t offer direct data export functionality, you can manually download your transaction history in a CSV format (comma-separated values) for import into another budgeting app. Explore the “Transactions” section within Mint and locate options for downloading transaction data.

Ready to proceed with deletion? Let’s get started!

How to Delete Your Mint Account (Two Methods)

There are two primary methods for deleting your Mint account:

Method 1: Utilizing the Mint Website

- Access the Mint website: Open your favorite web browser and navigate to the Mint website.

- Sign In to Your Account: Enter your Mint login credentials (email address and password) and sign in to your account. Remember: You’ll need your master password to proceed with deletion.

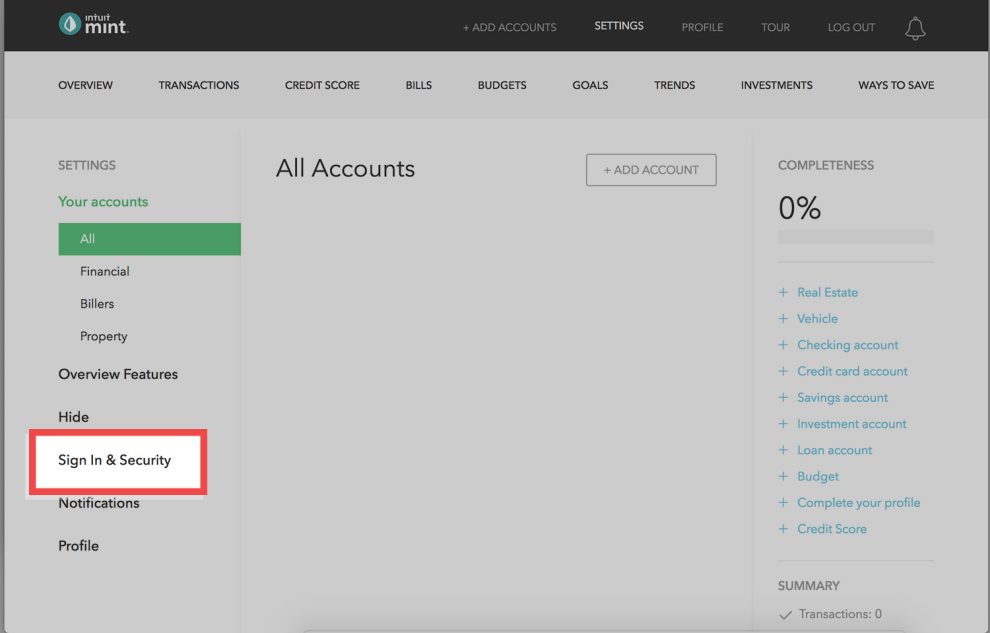

- Access Settings: Locate and click on the “Settings” option within your Mint account dashboard. This might be represented by a gear icon or a profile menu depending on the website layout.

- Find “Delete Account” Option: Carefully scan through the settings menu. You should find a section labeled “Delete Account” or something similar.

- Confirm Deletion: A confirmation pop-up will likely appear, outlining the consequences of account deletion. Read this information thoroughly before proceeding.

- Finalize Deletion: If you’re certain about your decision, click the “Delete Account” button or follow the on-screen prompts to confirm your request and delete your Mint account.

Method 2: Contacting Mint Support

If you’re unable to locate the “Delete Account” option within the website settings, or prefer a more personalized approach, you can contact Mint support for assistance with account deletion:

- Email Support: While Mint doesn’t offer traditional phone support, they do have an email support system. The email address for support should ideally be found within the Mint app itself or on the Mint website’s Help Center.

- Social Media: Mint maintains a social media presence on platforms like Twitter. While not the most secure method for account-related matters, you can try sending a direct message inquiring about account deletion.

Important Note: Regardless of the chosen method, ensure you have access to any recovery email addresses or phone numbers linked to your Mint account in case verification is required during the deletion process.

Frequently Asked Questions (FAQs) About Deleting Your Mint Account

- What happens to my linked financial accounts and transaction history?

Once your Mint account is deleted, all your linked financial accounts will be disconnected, and your historical transaction data will be erased from Mint’s servers. - Can I recover my deleted account?

Unfortunately, no. Deleting your Mint account is a permanent action. If you decide you want to use Mint again in the future, you’ll need to create a new account. - Will I receive confirmation once my account is deleted?

Ideally, Mint should send you a confirmation email notification once your account deletion is complete. The timeframe for receiving this notification might vary. - Can I keep my Mint account inactive instead of deleting it (refer back to Alternatives to Deletion)?

As mentioned earlier, you can simply stop using the Mint app and website to manage your finances. Your account remains inactive but can be reactivated later if needed. Additionally, while Mint doesn’t offer a direct data export function, you can download your transaction history in CSV format for import into another budgeting app.

What are some alternative budgeting apps to consider?

The world of personal finance management is vast! Here are a few alternatives to Mint that you might find helpful:

- YNAB (You Need a Budget): This app focuses on a unique budgeting method based on assigning every dollar a job. It requires a subscription fee but offers a robust system for proactive budgeting.

- Personal Capital: This platform offers a comprehensive suite of financial tools, including budgeting, investment tracking, and net worth monitoring. It caters well to users seeking a holistic view of their finances.

- Mvelopes: This app utilizes a digital envelope system for budgeting, mimicking the traditional cash envelope budgeting method. It can be a good option for those who prefer a visual budgeting approach.

- Simple: Simple offers a streamlined budgeting and banking experience. It combines budgeting tools with a checking account, making it suitable for users seeking an all-in-one solution.

Remember, the best budgeting app is the one that aligns with your financial goals and personal preferences. Explore available options, consider free trials if offered, and find the tool that empowers you to take control of your finances!

Beyond Deletion: Securing Your Financial Information

Deleting your Mint account signifies a step towards data privacy. Here are some additional security tips to consider:

- Unlink Your Financial Accounts: Even if you delete your Mint account, it’s recommended to manually unlink your financial accounts from Mint’s servers within the settings before complete deletion. This ensures no residual access remains.

- Enable Two-Factor Authentication: Many financial institutions offer two-factor authentication (2FA) for added security when logging into your accounts. This typically involves a secondary verification code sent via text message or generated by an authentication app in addition to your password.

- Practice Safe Online Habits: Be cautious about the financial information you share online. Avoid clicking on suspicious links or responding to emails requesting sensitive financial details. Legitimate financial institutions will never ask for your password or login credentials via email.

- Monitor Your Accounts Regularly: Regularly review your financial account statements and transaction history for any unauthorized activity. Early detection of suspicious transactions can help minimize potential financial damage.

The Power of Choice: Managing Your Financial Wellbeing

Ultimately, the decision to delete your Mint account rests with you. This guide has equipped you with the knowledge to navigate the deletion process, explore alternative options, and understand the security implications. Remember, informed financial management is key to achieving your financial goals.

So, take control of your financial data, explore alternative tools, and prioritize online security practices! We hope this comprehensive guide has empowered you to make informed decisions regarding your Mint account and your overall financial well-being.

Additional Resources:

- Mint Support Website: While Mint is currently undergoing closure processes, you might find some residual resources on the support page until it’s fully decommissioned.

- Consumer Financial Protection Bureau (CFPB): The CFPB is a valuable resource for financial education and consumer protection.

We hope this comprehensive guide has been a valuable resource in your quest to manage your Mint account and financial information. For further information, feel free to explore the additional resources provided. Happy budgeting (with or without Mint) and best of luck on your financial journey!

Add Comment