Embracing Digital Convenience with Easypaisa

In today’s fast-paced world, convenience is paramount, and the ability to manage our finances seamlessly is a game-changer. Enter Easypaisa, Pakistan’s leading mobile wallet service, empowering individuals to embrace a convenient and secure way to handle their financial transactions. Whether you’re a tech-savvy trailblazer or just venturing into the digital realm, opening an Easypaisa account is a breeze, unlocking a world of possibilities right at your fingertips.

Why Open an Easypaisa Account? Unleashing a World of Convenience

Easypaisa transcends the boundaries of a mere mobile wallet; it’s a gateway to a world of financial convenience that simplifies your life in numerous ways:

- Seamless Payments: Say goodbye to cash on delivery! With Easypaisa, you can pay bills, recharge your phone, and send or receive money instantly using your mobile device.

- Online Shopping Simplified: Easypaisa integrates seamlessly with various online shopping platforms, allowing you to make secure and convenient online purchases without the hassle of entering card details.

- Easy Bill Payments: Skip the queues and pay utility bills, top up your internet data, or clear traffic challans directly through your Easypaisa account.

- Instant Money Transfers: Send and receive money instantly to any mobile number in Pakistan with Easypaisa, making it a breeze to split bills with friends or send money back home.

- Convenient Top-Ups and Cash Outs: Reload your Easypaisa account through various channels, including Easypaisa shops, ATMs, or bank deposits, and withdraw cash from Easypaisa partner ATMs or designated shops.

How to Open an Easypaisa Account: Step-by-Step Guide

Opening an Easypaisa account is a quick and straightforward process that can be completed in just a few minutes. Here’s how to get started:

Option 1: Using the Easypaisa App

- Download the App: Head over to the Google Play Store or App Store and download the Easypaisa app.

- Enter Your Mobile Number: Launch the app and enter your valid Pakistani mobile number in the designated field.

- CNIC Verification: Provide your Computerized National Identity Card (CNIC) number and the date of issuance.

- Create a Secure PIN: Choose a strong and memorable 5-digit PIN for secure access to your Easypaisa account.

- Confirm Your PIN: Re-enter your chosen PIN for confirmation.

Congratulations! Your Easypaisa account is now created, and you’ll receive a confirmation SMS with your account details.

Option 2: Opening an Account Through a Telenor SIM Card (For Telenor Users Only)

- Dial *786#: If you’re a Telenor subscriber, simply dial *786# on your mobile phone.

- Follow the Prompts: The Easypaisa menu will appear on your screen. Follow the on-screen instructions, entering your CNIC information and creating a secure PIN.

- Account Verification: You might receive a call from an Easypaisa representative for verification purposes.

Congratulations! Your Easypaisa account is now active and ready to use.

Pro Tip: Ensure you have a valid Pakistani mobile number and your CNIC readily available before starting the account opening process.

Exploring Easypaisa Account Types

Easypaisa offers different account types catering to various needs. Here’s a breakdown of the two main account types:

- Easypaisa Mobile Account: This is the basic account type, ideal for most users. It allows you to perform essential transactions like sending and receiving money, making bill payments, and mobile top-ups.

- Easypaisa Savings Account (Optional): This account offers additional benefits like earning interest on your Easypaisa balance and the ability to set savings goals. It requires linking your CNIC with a valid bank account.

Pro Tip: Choose the Easypaisa account type that best suits your financial needs and goals. You can always upgrade your account later if your requirements change.

Unlocking the Full Potential of Your Easypaisa Account

Now that you’ve opened your Easypaisa account, it’s time to explore its full potential and unlock a world of convenience.

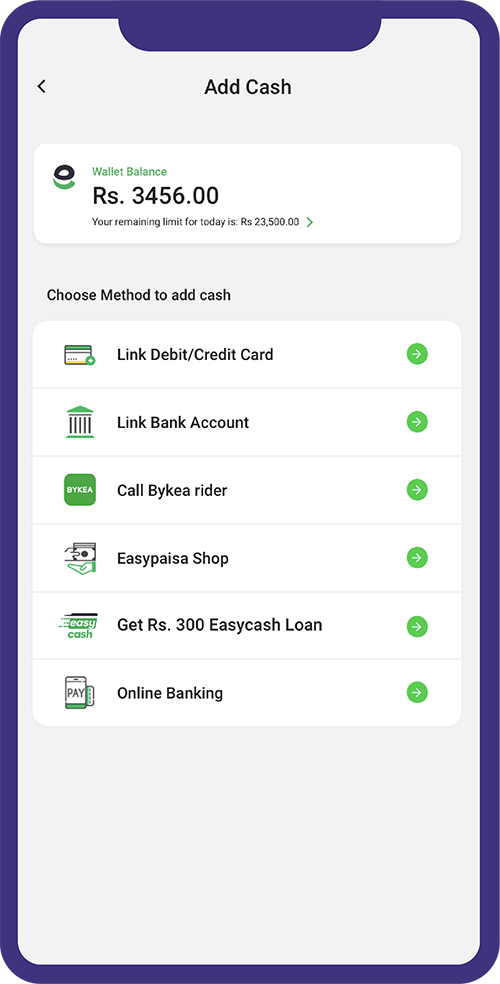

Adding Funds to Your Easypaisa Account

Before you start transacting, you’ll need to add funds to your Easypaisa account. Here are the convenient ways to reload your Easypaisa wallet:

- Easypaisa Shops: Locate a nearby Easypaisa shop and inform the shop assistant of the amount you want to deposit. They’ll credit your Easypaisa account instantly.

- ATMs: Look for ATMs displaying the Easypaisa logo. Insert your ATM card, select “Easypaisa Top Up,” enter your Easypaisa account number, and enter the desired top-up amount.

- Online Banking (if applicable): If you have a linked bank account with Easypaisa Savings Account, you might be able to transfer funds directly from your bank account to your Easypaisa wallet through online banking.

- Mobile Top-Up (Telenor Users Only): Telenor subscribers can conveniently top up their Easypaisa account directly by dialing a specific code and following the on-screen prompts (check the Easypaisa app for details).

Pro Tip: Easypaisa charges minimal fees for certain top-up methods. Be sure to review the Easypaisa fee structure for a clear understanding of associated costs.

Sending and Receiving Money with Easypaisa: Going Digital with Friends and Family

Easypaisa makes sending and receiving money a breeze. Here’s how to utilize these features:

- Sending Money: From the Easypaisa app, select “Send Money.” Enter the recipient’s mobile number, amount, and a brief description (optional). Confirm the transaction using your Easypaisa PIN. The recipient will receive the funds instantly in their Easypaisa account.

- Receiving Money: You don’t need to do anything to receive money! Anyone with an Easypaisa account can send money to your mobile number linked to your Easypaisa account. You’ll receive a notification upon receiving funds.

Pro Tip: Ensure you have the correct recipient’s mobile number before sending money to avoid any mishaps. Easypaisa also offers a transaction history feature to track your past transactions.

Making Bill Payments with Easypaisa: Ditch the Queues and Pay on the Go

Say goodbye to long lines and missed bill payments! Here’s how to leverage Easypaisa for convenient bill payments:

- Select “Bill Payment” from the Easypaisa app.

- Choose the biller category (e.g., Utility Bill, Internet, Traffic Challan).

- Select the specific biller (e.g., Electricity Company, Internet Service Provider).

- Enter your account details or reference number.

- Review the bill amount and confirm the payment using your Easypaisa PIN.

Pro Tip: Easypaisa allows you to schedule bill payments in advance, ensuring you never miss a due date. You can also save frequently paid bills for quicker access in the future.

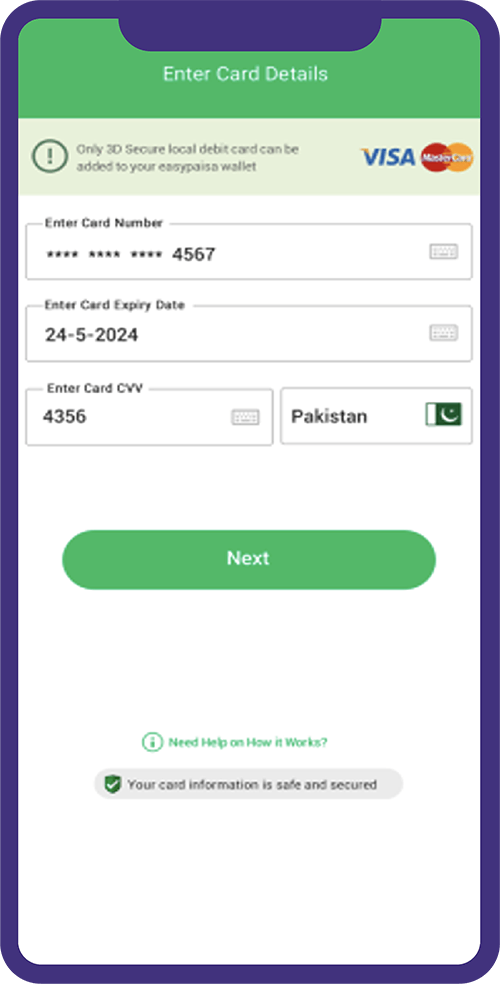

Easypaisa for Online Shopping: Secure Transactions at Your Fingertips

Forget the hassle of entering card details every time you shop online! Here’s how Easypaisa simplifies online transactions:

- Look for the Easypaisa payment option at participating online stores.

- Select Easypaisa as your payment method and enter your registered mobile number.

- You’ll be redirected to the Easypaisa app for secure verification.

- Confirm the payment using your Easypaisa PIN.

- Your order will be processed once payment is successful.

Pro Tip: Many online stores in Pakistan offer exclusive discounts or cashback rewards for using Easypaisa as a payment method. Be sure to explore these additional benefits!

Security and Support: Keeping Your Easypaisa Account Safe

Easypaisa prioritizes security to ensure your financial transactions remain secure. Here are some tips to keep your Easypaisa account safe:

- Never share your Easypaisa PIN with anyone.

- Beware of phishing scams. Easypaisa will never ask for your PIN via SMS or phone calls.

- Enable additional security features like fingerprint or facial recognition login (if available on your device).

- Report any suspicious activity to Easypaisa customer support immediately.

Easypaisa offers comprehensive customer support through various channels, including a dedicated helpline, email support, and an in-app chat function. Don’t hesitate to reach out if you have any questions or encounter any issues with your Easypaisa account.

Add Comment